Chairs and directors of NZX-listed companies are earning more in fees than their counterparts on the boards of unlisted companies, while those in “unwoke” sectors are getting the biggest financial rewards of all.

A survey by Strategic Pay has found that non-executive chairs of boards of NZX-listed companies can expect to be paid 62% more, at the median, than the chairs of unlisted private sector organisations, with median pay for chairing a company clocking in at $75,000 a year.

For that, the average chair can expect to commit 200 hours to the task, which equates to $375 at the average, about the charge-out rate for a mid-tier partner at a corporate law firm. The median fee is $5,000 lower than in 2020, according to the executive pay research firm.

For non-executive directors, who put in an estimated 100 hours a year, the median fee was $40,000 in the 2021 survey of 1,923 such directors, down fractionally from $41,000 the year before.

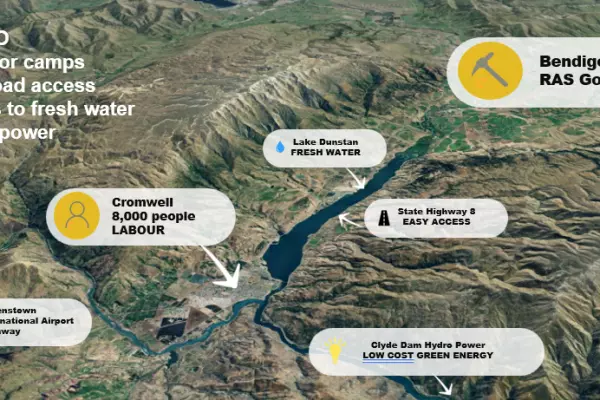

Directors looking for the highest pay should head for the somewhat ‘unwoke’ parts of the economy, with mining, petroleum and manufacturing companies offering the highest fees and, again, directors of listed entities can expect to earn 68% more than their counterparts in unlisted companies.

Covid uncertainty

The annual survey found the average board has six directors, including the chair, and 37% of directors in the survey were women, compared with 35% last year. Also, 23% of board chairs were women, up from 20% a year earlier.

The survey covered 2,554 directorships of 403 organisations spread around New Zealand.

In its survey senior executive remuneration, the report found that incentive schemes had suffered very little change despite the covid-19 pandemic.

“The majority (67%) of respondents indicated positive impacts on the organisation as a result of covid and 22% made a discretionary payment to their executives despite a less successful year than planned.”

Only 11% intended to change their incentive schemes because of the uncertainty created by covid.

CEO and managing director pay structure findings were that, on average, 54% of their packages were fixed remuneration, an average 23% of pay was composed of short term incentives and 26% was paid against long term targets.

Half of the CEOs surveyed got a car park at work, but only 28% were offered health insurance.

While half of the 751 firms surveyed for the CEO and senior executives pay research reported no change in their team in the last year, the report did note a 22% turnover in CEOs of NZX-listed companies.

Against the run of anecdotal evidence that skilled senior staff are hard to find, the survey said: “The majority of respondents have not had issues recruiting at the CEO/senior executive level in spite of ongoing border closures”.

This story has been changed to correct the introductory sentence, which incorrectly claimed that unlisted directors earn more than NZX-listed company directors in the original version.