Interim Result

HALFYR

Tue, Feb 22 2022 09:43 am

NZL is pleased to announce its unaudited interim financial results for the six months ending 31 December 2021. NZL recorded a net profit after tax of $3.17M for the period and will pay an inaugural interim dividend of 2.01cps, equivalent to 95% of Adjusted Funds from Operations (AFFO).

Financial Summary for the six months ending 31 December 2021

Net Profit After Tax $ 3.17M

Total Assets $ 221.37M

Total Liabilities $ 89.62M

Net Assets $ 131.75M

Net Asset Value (NAV) Per Share $ 1.3596

Update

NZL is now into its second year as a listed company. The highlight of the year to date has been the acquisition of a further 4,000 hectares of premium rural land.

NZL has an attractive pipeline of opportunities ahead of it in the second half of the financial year across several rural sub-sectors. Due diligence is being conducted on a number of assets, by its manager New Zealand Rural Land Management Limited Partnership (the Manager).

NZL has a low risk profile and is well insulated from the ongoing COVID-19 pandemic and record inflation levels. All NZL’s tenants are categorised as essential workers, and leases incorporate regular CPI adjustments and remove direct exposure to on-farm operational risks. All NZL’s properties have 100% occupancy and an average lease term over 10 years. This creates very predictable, inflation protected and sustainable income.

NZL is managed under a management agreement with the Manager which is governed by a board comprised of a majority of independent directors. The Manager is 50% owned by NZX-listed Allied Farmers Limited (ALF).

Acquisitions

NZL completed two acquisitions in the period. Both represented quality rural land at attractive prices with new large-scale tenants.

The first, completed in August 2021, was a 493-hectare hybrid dairy farm located in Waimate, South Canterbury, for further details refer to: (https://nzrlc.co.nz/investors).

NZL’s second acquisition, completed in November 2021, was a portfolio of six large scale dairy assets in Maniototo, Central Otago, totalling approximately 3,500 hectares. The portfolio comprises a mixture of productive dairy platforms, support farms and modern infrastructure, for more details refer to: (https://nzrlc.co.nz/investors).

Operations Update

The Manager has continued to investigate further investments to increase sector and tenant diversity. NZL has an attractive acquisition pipeline, with the Manager progressing due diligence on several new opportunities across multiple sub-sectors.

Work continues measuring and articulating the sustainability pledges NZL and its tenants make when entering into a partnership.

These pledges are founded on NZL’s tenants sharing its vision of sustainability, which embraces societal progress, productivity, economic success and environmental care.

In keeping with its sustainability vision, NZL has commissioned work to understand better the opportunities for carbon sequestration and biodiversity improvement on its land. NZL is also investigating options to improve the efficiency of water and nutrient use on its properties. The realisation of efficiency gains is expected to lead to reduced nutrient leaching and improved water quality.

Addressing Market Conditions

NZL is largely insulated from the 30-year high inflation levels reported in December 2021. NZL’s leases all incorporate CPI adjustments, typically occurring every three years. Furthermore, NZL is insulated from inflation impacted (and all other operational) on-farm risks by only owning the land.

As food producers, NZL’s tenants have been classified as essential workers at all stages of the Government’s COVID-19 response. NZL considers it extremely unlikely that its tenants’ activities, and thus their ability to meet lease payment obligations, will be curtailed in any meaningful way as the result of COVID-19. NZL properties have an occupancy rate of 100%.

Dividend

NZL targets dividends equivalent to 95% of AFFO. For the six months to 31 December 2021, NZL reported an AFFO of 2.12 cps. Accordingly, an interim cash dividend of 2.01cps will be paid on Friday, 18 March 2022, with a record date of Tuesday, 1 March 2022.

Outlook

NZL expects total FY22 AFFO of $4.2M (4.38cps) and to pay a final dividend of a further 2.15cps. NZL currently forecasts FY23 AFFO of $6.3M (6.52cps) with a total dividend of 6.20cps.

NZL has long term leases in place with an average length of 10.3 years, providing certainty of income for an extended period.

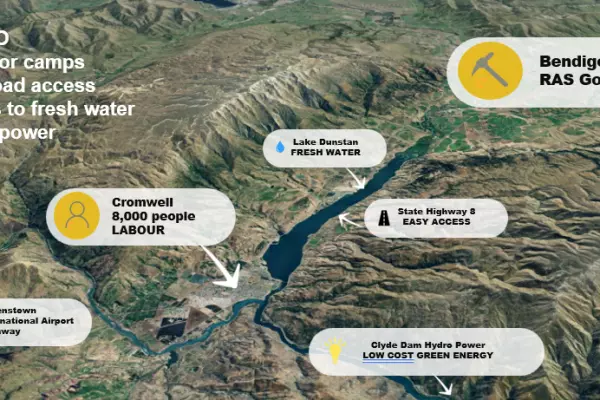

NZL enters the second half of the financial year with solid momentum and an exciting acquisition pipeline. The Company’s core aspiration remains for it to be a large-scale owner of New Zealand rural land. Acquisitions to date have been in dairy, but NZL sees opportunities in a number of sub-sectors, including green energy, poultry, viticulture and horticulture. NZL intends to remain rural sector agnostic, focusing on acquiring well and achieving attractive long-term risk-adjusted returns.

NZL’s long term tenants currently pay approximately $10.4M per annum in rental income. With the Manager currently progressing several opportunities, NZL hopes to announce further acquisitions in the second half of the year. This will grow the Company’s revenue base while also diversifying NZL’s land holdings and income streams.

For further information please contact:

Christopher Swasbrook

Mobile: 021 928 262

Email: [email protected]

Richard Milsom

Mobile: 021 274 2476

Email: [email protected]