Architect’s render of completed Lambton Quay development in Wellington / Photo Supplied.

In this opinion piece, Matt McHardy, GM of Investor Relations at PMG Funds, looks at the potential opportunities for investors in commercial property.

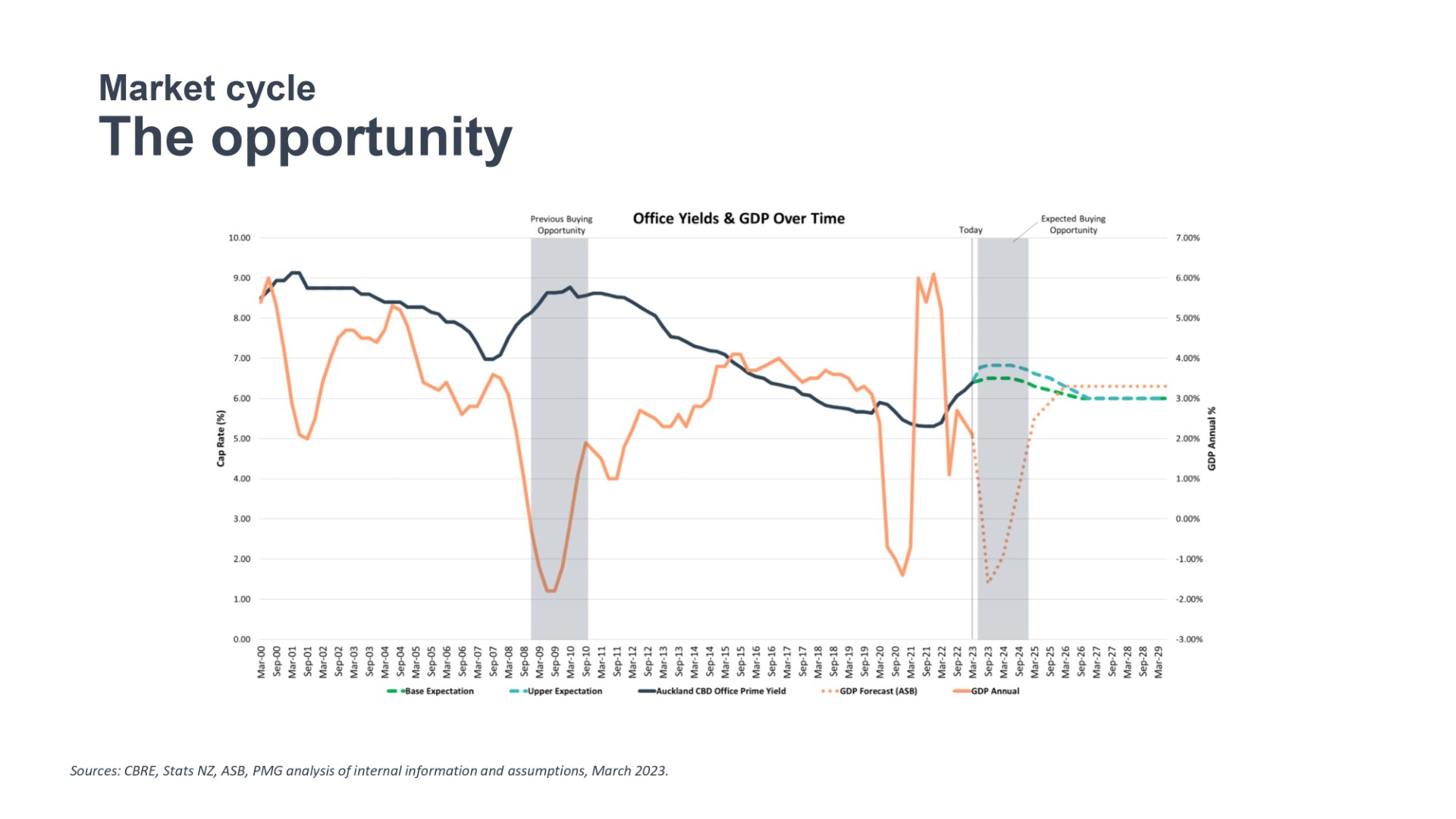

History has shown there is a clear correlation between GDP and total commercial property returns. The last decade has generally been kind to owners and investors, although rising values have continued to push up the threshold for market entry.

Tracking back a bit further, we see the last great buying opportunity of the 21st century – when values were down and capitalisation rates up – was during the GFC of 2007-2008 as GDP plummeted.

Those prescient enough to have bought assets in this window, and held them through to the present day, will have done particularly well.

Figure 1/Supplied.

Figure 1/Supplied.Now, with most economists anticipating a 2 per cent drop in GDP, history tells us we should again expect capitalisation rates to trend in the other direction, thus creating another buying window.

Until recently we’ve not had the transaction data to back up this theory. But, as activity has picked up through 2023, it’s possible to observe this counter-cyclical phenomenon gathering pace, with clear evidence of values softening.

What this tells us is that the buying window is now here. But, given today’s rapid global information flow and the responsiveness of Central Banks, we can surmise this window will remain open only for a short period of time - likely somewhere between 6 and 18 months.

Once there is more certainty that the OCR has peaked, and we have clarity around who is going to be running the country and with what priorities, then confidence will return to the market and the window to strategically deploy capital will swiftly close.

Opportunities arising

According to the most recent Knight Frank Ultra High Net Worth Report (which essentially looks at how some of the world’s wealthiest families and individuals manage their capital) almost 70 per cent expect to increase their wealth through the uncertainty of 2023. This is a clear indication this ‘elite’ group understands that we are already in a counter-cyclical environment – and there are investment opportunities to be had.

The only advantage this group has is the leverage of their wealth. While they may employ their own research teams, they don’t actually know anything we don’t – in fact they’re working off exactly the same data that we have at our disposal. It’s just they have significant capital of their own available to deploy or redeploy.

The report shows more than a quarter of those surveyed expect to increase their exposure to commercial real estate in 2023, with the office market favoured to benefit most from these capital flows. I believe this is because they recognise 2023 is a year for real asset price discovery for the sector.

We only need to look at the performance of the S&P500 and the NASDAQ to see that equities have arguably hit their bottom already and are now rebounding. With commercial real estate, there’s a bit of a lag – and as we get towards the end of the year we’re going to find out where that price discovery really sits.

This is why, through our wholesale funds strategy, PMG is making this opportunity to acquire quality assets with falling valuations available to New Zealand investors.

What about the tax policies of those jostling to govern?

While the two main protagonists are keeping much of their powder dry, tax policy has already become something of a pre-election battleground for the minor parties jostling for a seat at the top table. Given how unlikely it is that the future will be painted in undiluted shades of either red or blue, it’s worth bearing in mind what influence these lieutenants may try to bring to bear.

From stage left, Labour’s most natural allies, the Greens and Te Pāti Māori, are both advocating for a wealth tax, even though the Prime Minister has discounted the possibility under his watch. Meanwhile to the right, ACT would naturally like to lower income tax for all earners. So where does this leave Labour and National?

Inevitably somewhere closer to the middle ground - but with some important differences.

What we know is that, while National has promised to adjust tax brackets for inflation if re-elected, the Labour Government will raise the tax rate for trusts to at least 39 per cent. For many New Zealanders, this will have a significant impact on investment returns as currently structured.

With neither party having signalled any changes to the current multi-rate Portfolio Investment Entity (PIE) structure provided by some investment opportunities, this tax-efficient avenue will seemingly remain open to investors after the election.

In terms of what investors should read into tax policy conversations, it’s becoming more and more important to consider the net rather than gross returns of any investment offer.

Typically, returns from commercial property funds can benefit from not only being structured as PIEs, but from the tax depreciation on buildings - reducing the proportion of an investor's income that is taxable.

Visit pmgfunds.co.nz/investment-partner for more information on PMG’s products and investment options.

Disclaimer: The information in this article is of a general nature and was current at 10th August 2023. It is not intended to be regulated financial advice for the purpose of the Financial Markets Conduct Act 2013 and does not take your individual circumstances and financial situation into account. PMG does not provide financial advice. Please seek advice from a licenced financial advice provider before making any investment decisions.

Any wholesale investment opportunities referred to by PMG are not intended to and do not constitute an offer of a financial product, unless explicitly stated as such and supported by a current disclosure document. Any wholesale offers that are made will only be open to persons who fall within the exclusions applicable to offers made to Wholesale Investors as set out in Schedule 1, clause 3 of the Financial Markets Conduct Act 2013 (or to any other person to whom an exclusion applies under Schedule 1 of that act.