Seequent is New Zealand’s latest billion-dollar company, with Nasdaq-listed Bentley Systems buying the geoscience software firm for US$1.05 billion (NZ$1.46b).

The deal comes just two-and-a-half years after Silicon Valley private equity firm Accel-KKR bought into the firm in a deal valuing Seequent and Geosoft at $172.6 million when they were poured into a new holding company.

Bentley will pay US$900m in cash and 3.1m class B shares – which closed at US$44.80 yesterday – for the Kiwi firm. The deal is subject to regulatory approvals.

Chief operating officer Graham Grant will take over the top job next month in the Kiwi unit, which will remain headquartered in Christchurch and keep its main research and development base in the South Island city.

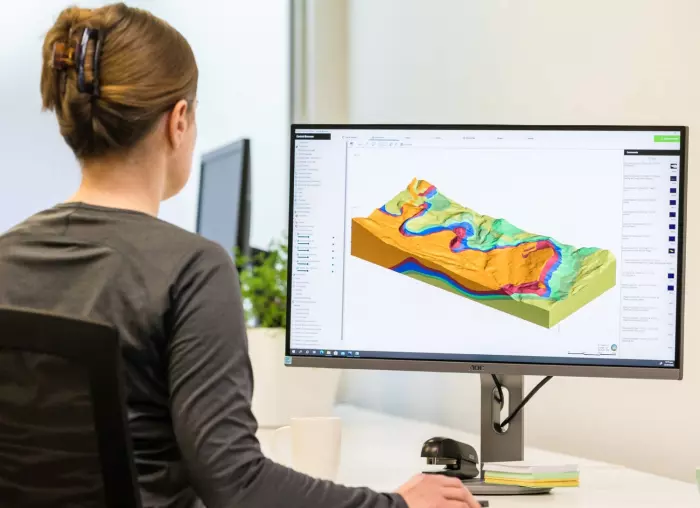

Seequent’s 3D modelling helps engineers know what’s going on underground, while Bentley’s engineering software helps projects above ground.

The companies characterise that as deepening the infrastructure digital twins' ability to help their customers better understand – and mitigate – environmental risks to make their projects more resilient and sustainable.

Adding value

Bentley expects the acquisition to add 10% to both its annual earnings of US$266.2m and US$801.5m in revenue in 2020. Its chief financial officer, David Hollister, expects Seequent to add US$80m of annualised recurring revenue this year.

The firm will also add Seequent’s 430 staff – including 173 in NZ – to 4,000 employees.

Seequent itself has been growing at a rapid pace. In the March 2020 year, its annual revenue was $108.9m, and it reported an operating profit of $22.9m and an operating cash inflow of $20.7m.

The 2019 period included the restructuring when Accel-KKR came on board, and spanned the 11 months ended March 31. During this time it reported revenue of $42.6m, an operating loss of $1.1m and an operating cash outflow of $4.1m.

Grant said Seequent’s board had multiple options on the table when considering its next step, and needed capital to keep growing as it mapped out its next three-year plan.

Director and Accel-KKR co-managing partner Tom Barnds said the board had been looking forward to an initial public offering this year but was “convinced of the logic of this combination”.

Grant said his focus will include looking at how to leverage the talent and scale of Bentley, but also to continue Seequent’s own growth aspirations. And for that, Seequent is also on the hunt for people.

“It’s a very exciting story for New Zealand – we’re another organisation creating a global opportunity and high-skilled professional careers,” he said.

The transaction will also mean the exit of chief executive Shaun Maloney, who will retire next month, something he said was already being planned for.

Accel-KKR owns 75% of the firm and local investor Pencarrow Private Equity owns 9%, while Maloney owns 3.6%.

This article has been edited to show Seequent's 2020 and 2019 financial years were different lengths and not directly comparable.