Welcome to My Net Worth, our regular column on the lives and motivations of our country’s top business and political people, in their own words.

Bruce McLachlan became chief executive of Fisher Funds in 2017 when founder Carmel Fisher stepped back from the business. He has had a long career in banking, including heading up the Co-operative Bank for four years and, before that, spending 10 years at Westpac NZ, where his roles included leading both its business banking and retail banking operations and serving as acting chief executive of the New Zealand division.

I’m the second youngest of seven kids. I was born in Upper Hutt and raised on the Kāpiti Coast, on the beach. We were a family of modest means. I guess that keeps you really well grounded and you appreciate everything.

It can operate the other way as well – it might make you less aspirational sometimes and a little less prone to taking risks because you’ve been brought up with the idea that every dollar matters, wearing hand-me-downs and so on.

I was the only one of my siblings who went to university. I had a different career path than the rest of my family.

The Reserve Bank did intakes of school leavers in those days. I don’t know how it happened, but I ended up in the bank at the age of 17 and I was very naive. They were incredibly generous and you could go to university part-time – that’s how I did my degree.

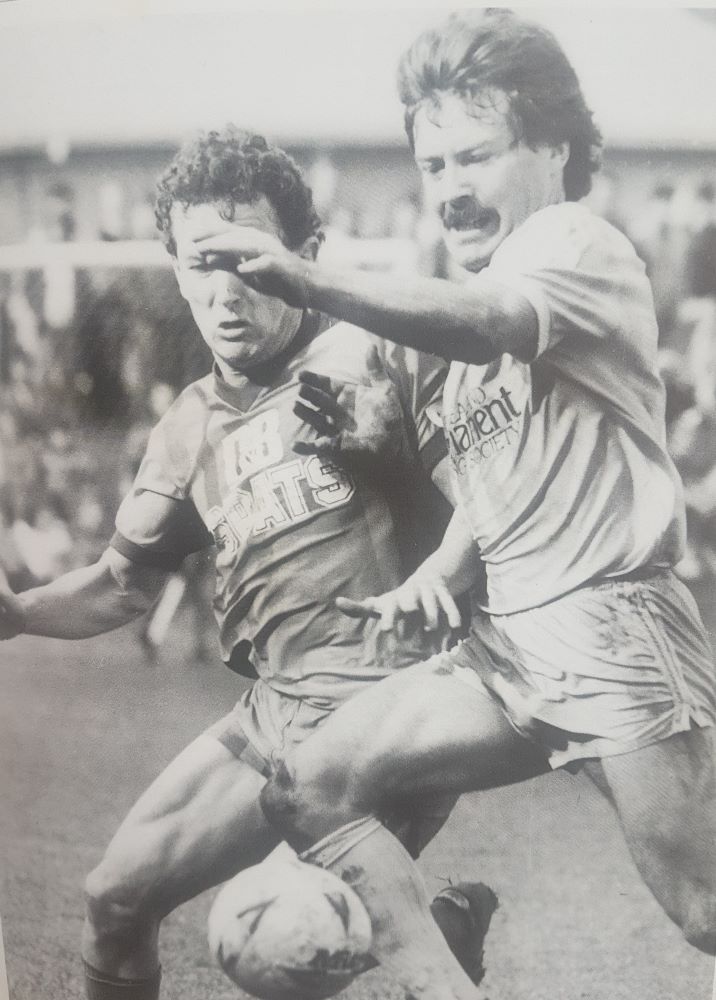

Bruce McLachlan (left) in a 1985 National League Football match - WDU vs Gisborne

Bruce McLachlan (left) in a 1985 National League Football match - WDU vs Gisborne

I became a bond trader at some ridiculous age like 23 and I knew nothing about bond trading.

I scored the global head of branches role at NAB but it was a title only. It was a farce. I hated every minute of it. It was a very political environment and, in those days, we naive Kiwis came out and called things as we saw them. We weren’t political and we weren’t part of the old boys’ network that was well established back then.

After NAB, my wife and I hired a car in Melbourne and we threw in our three kids and toured Australia and the whole east coast. We were just having fun. We did that for a couple of months and it was good. We arrived back in New Zealand just before Y2K, so I’ve been back 20 years.

We Kiwis are far too trusting of other people. Operating honestly whilst balancing really hard competing priorities is an art and a science that many Kiwis are very good at – but it is not the way much of the business world operates.

I did 10 years on the Westpac NZ executive but then one day, I rang my wife and said I just want to go and have a career break. I didn’t want to be that person to wait until they retired to do those things I wanted to do. So late in my 40s, I took what I intended to be a couple of years off. It was wonderful.

Everyone expects me to say, oh, I did all these amazing things, but guess what, I largely didn’t. After about a year, my wife said, “You need to go back to work”.

Bruce McLachlan in 1990

Bruce McLachlan in 1990

It did take a little longer than I thought it would to get a job. I believed that because I had a lot of generalist skills here and in Australia, they were adaptable to other industries. But the other industries didn’t think that!

Three times in my career I’ve changed jobs and taken a drop in income, because money’s never been my primary driver. I’m happy to go back to go forward.

One of my favourite pastimes is maintaining land; I love working outside. “Gardening” sounds way too technical a term to describe what I do; I’m a labourer on the weekends.

I bought a bach last month – that was a splurge. Over the years, I’ve spent way too much money on cars, wine and art, and socialising generally.

With art, the rule is if my wife and I agree on anything we buy it, because it’s rare that happens. I don’t buy art because of what it might be worth and who made it. I actually don’t care.

As told to Victoria Young.

The interview has been edited for clarity.