Welcome to My Net Worth, our regular column on the lives and motivations of our country’s top business, legal and political people, in their own words.

Kenyon Clarke and his wife Charlotte founded property development company Du Val Group in 2013. Their focus was on large-scale residential projects in south Auckland. Today, the firm employs 120 full-time staff and has a book of nine developments, including two purpose-built sites under its build-to-rent fund. Its purported book value is about $750 million, with a $600m pipeline of work and about 700 homes at various stages of development. Du Val is a case of second time round for Clarke, after an earlier development business in the Waikato fell over on the back of the global financial crisis in 2008. But now, Du Val has international aspirations, with offices in Singapore, London and Hong Kong. The couple are planning to build a family home in Fiji and to relocate there in the next few years.

I grew up in the UK. Dad was English but Mum was a New Zealander, and even though I did my schooling over there, I was always a Kiwi.

My claim to fame was I was asked to leave some of the better English schools, as education and I weren’t great friends. A number of my teachers told me I wouldn’t amount to much.

My parents divorced in the mid-1990s, largely because Mum had always had a desire to come back to NZ. I hung around the UK initially but wasn’t much of a fan of Dad’s cooking, so I followed Mum to NZ in 1996. I was 17 and, like a lot of young men, didn’t really know what I wanted to do with my life.

When I turned up here, I had a yellow mohawk, purple contact lenses and a great big earring. The first thing Mum did when she saw me was take out the horse clippers, and that was the end of that.

That was the time the movie Wall St was out, and I thought this was the way to go. Start in the mail room and work your way up to CEO.

My first job was as a general hand in a cheese factory at Lichfield, in south Waikato. I was working on the edge of a brine bath and my job – for nine-hour shifts – was to straighten the cheese if it came down the bath the wrong way.

I realised my future wasn’t in dairy, so I applied to do a business management degree at Waikato University. I moved into the halls of residence, got a student loan, got a V8, a leather jacket and a computer – and didn’t go to classes.

This was really at the dawn of the internet, yet marketing communications and business were being taught by people who’d never employed anyone, created anything and didn’t have the aspiration to disrupt the world.

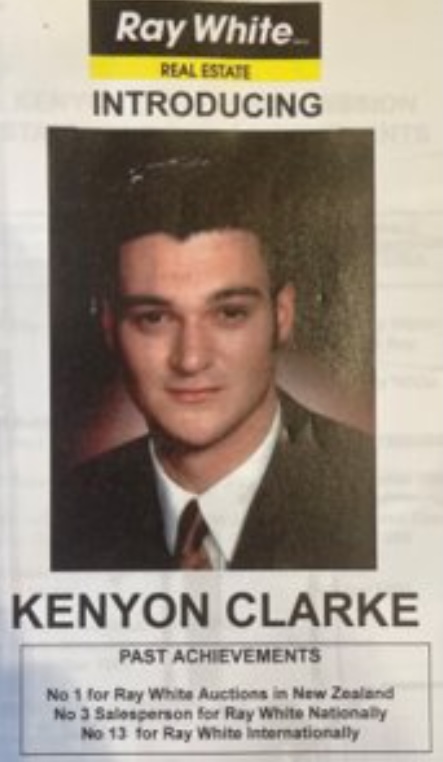

My next plan was to join the Royal Marines in the UK, but Mum managed to talk me into talking to real estate firms. When I was 18, I got a job with Ace Real Estate, which became Ray White. I spent a couple of years doing that, and when I finished, I was the number-one auction salesperson for the Ray White network in NZ, Australia and southeast Asia.

While I was selling, I started investing in property. At 18, I borrowed $20,000 from my dad and bought a leaky, five-bedroom house at 18 Livingstone Ave in Hamilton as an investment. That was my first foray into rental properties, carving sections off them and moving secondhand houses on and keeping those for investment.

A car crash in 2001 made me rethink things and I decided real estate wasn’t a long-term thing for me, so I started working with my mum as a property entrepreneur. She had some money from the divorce but had no income. I had no savings but had a little income.

We built about $200m worth of property, most of which we retained for investment. By the time I was 26, we had a portfolio of $102.5m worth of real estate.

I never really thought about property or housing as "deals". It's always been a long-term game for me, not about what I can make on a flip. I’ve only ever sold when it made sense to trade up into larger assets.

By 2006, I had this incredible bank called Halifax Bank of Scotland, who were prepared to support me into leveraged buyouts. I went around buying businesses, but during the GFC [global financial crisis], they went bust and we went bust with them.

I went back to the UK, and there spent some time with Michael O’Flynn, an Irish property developer who had a whole lot of his portfolio in Melbourne. I learned a lot from him and fell in love with property again.

That was probably the thing that galvanised me to establish the Du Val Group in 2013. We now employ 120 people in our offices in Auckland and have people in Singapore and London, and up to 700 workers who turn up on our building sites every day.

There are many New Zealanders I admire – Sir Michael Hill and Graeme Hart, to name two – but I really only know of them. I think one of the most terrible things you can do is meet your heroes, so the people who have been most inspirational for me are my mum and my wife, Charlotte.

Kenyon and Charlotte Clarke at Lakewood Plaza, a 15-storey apartment building Du Val has developed at Manukau in south Auckland. (Image: Supplied)

Kenyon and Charlotte Clarke at Lakewood Plaza, a 15-storey apartment building Du Val has developed at Manukau in south Auckland. (Image: Supplied) These days, I’m less interested in trotting around the Monopoly board, which is why we established the Du Val Foundation as a registered charity. We work with the principals of seven partner schools in south Auckland to identify families in need, to feed the children, and also to give kids access to ideas and different career opportunities.

The construction sector in NZ has the highest suicide rate among men, so we’ve also started the Solid Ground initiative, which provides counselling to every man on our sites. To date, we’ve had more than 163 sessions and the feedback is that we’ve saved some lives, so that’s something Charlotte and I have been pretty passionate about.

I think what covid has shown is that there is a failure in our building industry to properly manage risk. For Du Val, we're investing in timber, in sawmills, and have bought our own steel-manufacturing machine. We want to be entirely self-reliant.

After I made a series of poor choices in dating, a friend had said, you should write out a list of all the things you're looking for in a partner or wife. In a moment of reflection I did write that out. And it was this, slightly edited, list I gave to our recruitment consultant when we were looking for a CFO – Charlotte turned up as the first person I interviewed.

We now have four children. The eldest, a boy, is 11. We have a 10-year-old girl, a six-year-old boy and five-year-old girl.

Our aspirations these days are beyond NZ. We still hold a torch for the country and will do so no matter where we are. We are building a house in Fiji and will relocate our family there indefinitely within a few years. That also allows us to be close to our management team in NZ.

We have a tech platform launching at the end of this year. The aim is to help democratise the global property investment space, and we've partnered with some of the largest property developers in the world out of the UK and Australia. The aim is to disrupt property, put it in people's hands, so that's our big focus.

You've got to ride the lightning. At some point the things you care about, and the things you've tried to build – you're either going to be all in or you're going to be all out.