Welcome to My Net Worth, our regular column on the lives and motivations of our country’s top business, legal and political people, in their own words.

Rob Everett has been chief executive of the FMA since February 2014. Originally from the United Kingdom, he was previously a director in London with Promontory Financial Group, a regulatory consultancy. Before that, he spent 17 years at Bank of America Merrill Lynch in Europe, Asia and North America. He has an MA in law from St Catharine’s College, University of Cambridge, and is married to a New Zealander.

I grew up in a sleepy little village down in the west country, England. It was fantastic until I turned 16, and then it was just desperate.

It is great to grow up out in the country, with the great outdoors right over the back fence. But you get to a certain age and it becomes a little bit claustrophobic. We had people in our village who had left only half a dozen times in their lives.

Growing up, I wanted to be a footballer. I was a huge fan of Kevin Keegan, who played for Liverpool and England. Then I wanted to be in the army, because I just thought that looked a lot of fun. But once I realised what the army was really about, I decided otherwise.

Why did I study law? A lack of imagination, probably. My dad was a lawyer, I couldn’t decide what to do and law just seemed like one of those degrees that opened doors into lots of other areas.

It’s a good thing to study to train your mind around the use of words, and what words can mean. My passion was probably English literature, but I didn’t really see that leading anywhere.

James Joyce was my go-to writer when I was teenager, but I probably don’t have the intellectual bandwidth to read that stuff any more.

I went to a big law firm in the City, in London, where I ended up in the capital markets group and went on secondment to Merrill Lynch. It was supposed to be two months, then it was five months, then it was six months. Then the role I had been doing was open at Merrill and I said, “What about me doing it?” and they said okay.

At Merrill Lynch, so many doors seemed to open. You’d start on one product and in one area and, if you were minded to do so, there were almost infinite places you could go — both geographically and in terms of products.

During the global financial crisis, I was back in London as general counsel for Europe, the Middle East and Africa. When Bank of America bought Merrill, they asked me to be the chief operating officer to bind Bank of America and Merrill together.

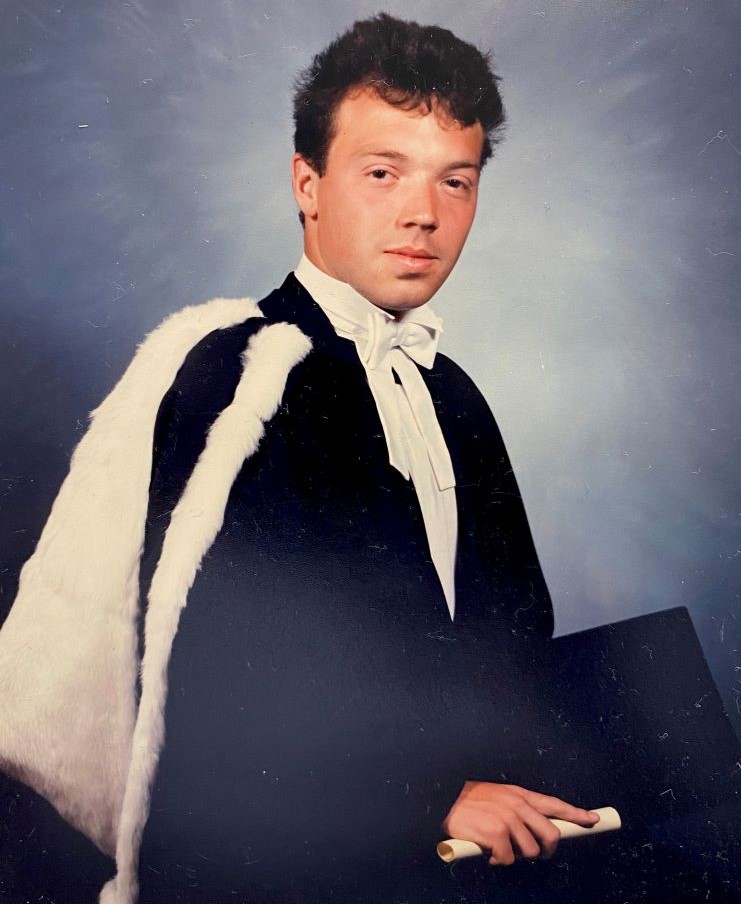

Rob Everett's graduation in 1989

Rob Everett's graduation in 1989

It is a cliché, but you learn so much more in a crisis than you learn in ordinary life.

One thing I learned is that when people make things so complex it is difficult to explain, it is often because the parts don’t fit together very well. Complexity is an enemy in financial services. The more complex something is, the less I trust it.

My wife is a Dunedin girl, so the deal when we got married was that we’d do 10 years in London and then move to New Zealand. I’m a relatively outdoorsy, rugby-loving, beer-drinking, easy-going sort of guy… It’s not Riyadh, so it wasn’t a hard sell.

In Wellington, sometimes I thought I must have missed a nuclear alarm, because there were only 20 other people on Lambton Quay. I come from the centre of London, and so I constantly thought that I was driving to the wrong place or had gone out to get my lunch at the wrong time, because there were so few people around.

Culturally, Wellington is such a small village. I’ve only been here seven years and I could not walk the length of Lambton Quay any day without someone saying, “Hey, how you doing?”

That’s been lovely for feeling part of a community. But also, it can be a little intimidating when the person you are waving to is someone you are taking to enforcement.

I do worry about the balance. I have seen regulators who have got the balance completely wrong on the enforcement side and as a result, they don’t know what is happening in the industry, because nobody wants to tell them anything.

Treat people the way you would want them to treat you, or your mother. If you treat people decently then it is more reasonable to expect to be treated decently back. That’s always been my life motto and it works out quite nicely as a financial regulator.

As told to Dan Brunskill.

This interview has been edited for clarity.