By Rich Miller

Recessions, like unhappy families, are each painful in their own way.

And the next one – which economists see as increasingly possible by the end of next year – will probably bear that out. A US downturn may well be modest, but it might also be long.

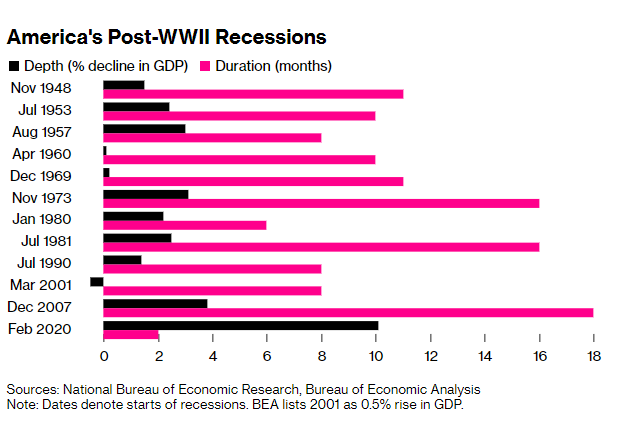

Many observers expect any decline to be a lot less wrenching than the 2007-09 global financial crisis (GFC) and the back-to-back downturns seen in the 1980s, when inflation was last this high. The economy is simply not as far out of whack as it was in those earlier periods, they say.

While the recession may be moderate, it could end up lasting longer than the abbreviated, eight-month contractions of 1990-91 and 2001. That’s because elevated inflation may hold the Federal Reserve back from rushing to reverse the downturn.

“The good news is there’s a limit to how severe it’s going to be,” said Nomura Securities senior US economist Robert Dent. “The bad news is it’s going to be prolonged.”

The former New York Fed analyst sees a roughly 2% contraction that begins in the fourth quarter and lasts through next year.

No matter what shape the pullback takes, one thing seems certain: there will be a lot of hurt when it comes.

In the dozen recessions since the second world war, on average the economy contracted by 2.5%, unemployment rose about 3.8 percentage points and corporate profits fell some 15%. The average length was 10 months.

Biden's poll ratings

Even a downturn on the shallower end of the spectrum would likely see hundreds of thousands of Americans – at least – lose their jobs. The battered stock market may suffer a further fall as earnings drop. And President Joe Biden’s already poor poll ratings could take another hit.

“This would be the sixth or seventh recession, I think, since I started doing this,” private-equity veteran Scott Sperling said. “Every one of them is somewhat different, and every one of them feels equally painful.”

Signs of economic weakness are multiplying, with personal spending falling in May for the first time this year, after accounting for inflation, and a US manufacturing gauge hitting a two-year low in June. JPMorgan Chase & Co chief US economist Michael Feroli responded to the latest data by cutting his mid-year growth forecasts “perilously close to a recession”.

The depth and length of the recession will largely be determined by how persistent inflation proves to be, and by how much pain the Fed is willing to inflict on the economy to bring it down to levels it deems acceptable.

Allianz SE chief economic adviser Mohamed El-Erian said he’s worried about a stop-go scenario akin to the 1970s, where the Fed prematurely eases policy in response to economic weakness before it has eradicated inflation from the system.

Such a strategy would set the stage for a deeper economic decline down the road, and even greater inequality, the Bloomberg Opinion columnist said. El-Erian was out front in warning last year that the Fed was making a big blunder by playing down the inflationary threat.

Anna Wong, Bloomberg's chief US economist, said: “The Fed is not going to pause until they see that inflation has convincingly come down. That means that this Fed will be hiking well into economic weakness, likely prolonging the duration of the recession.”

For his part, Fed chair Jerome Powell has argued that while there’s a risk of a recession, the economy is still in good enough shape to withstand the Fed’s interest-rate hikes and dodge a downturn.

A growing number of private economists aren’t convinced.

“A faltering economy is all but inevitable,” said Lindsey Piegza, chief economist for Stifel Nicolaus & Co. “The question has moved beyond if we are going to see a recession to what’s the depth and duration of a downturn.”

Reining in consumer prices

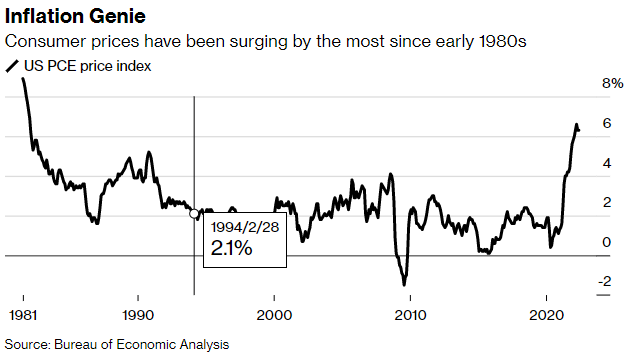

Just as happened some 40 years ago, the decline in gross domestic product (GDP) will be driven by a central bank determined to rein in runaway consumer prices. The Fed’s favourite inflation gauge is more than triple its 2% objective.

But there are good reasons to expect the outcome won’t be nearly as bad as in the early 1980s, or the 2007-09 financial crisis – episodes when unemployment soared to double-digit levels.

As Goldman Sachs Group chief economist Jan Hatzius has noted, inflation isn’t as embedded in the economy or in Americans’ psyche as it was when Paul Volcker took the helm of the Fed in 1979 after a decade of persistently powerful price pressures.

So, it won’t take nearly as big a slump for today’s Fed to bring price rises down to more acceptable levels.

Prominent academic economist Robert Gordon reckons the Fed’s task today requires about half the amount of disinflation that Volcker had to put the economy through.

Former Fed chair Paul Volcker. (Image: Getty)

Former Fed chair Paul Volcker. (Image: Getty)What’s more, consumers, banks and the housing market are all better placed to weather economic turbulence than they were ahead of the 2007-09 recession.

“Private-sector balance sheets are in good shape,” said Deutsche Bank Securities chief US economist Matthew Luzzetti. “We haven’t seen leverage taken out to the extent that we saw” ahead of the financial crisis.

Thanks in part to hefty government handouts that boosted savings, household debt obligations amounted to just 9.5% of disposable personal income in the first quarter, according to Fed data. That’s well below the 13.2% seen in late 2007.

Banks, for their part, recently aced the Fed’s latest stress test, proving they have the wherewithal to withstand a nasty combination of surging unemployment, collapsing real-estate prices and a plunge in stocks.

Housing market

And while housing has been battered of late by the Fed-engineered surge in mortgage rates, it, too, is in a better place than in 2006-07, when it was awash with supply due to a speculative building boom.

Today, the US is about two million housing units “short of what our demographic profile would suggest at this point”, said Doug Duncan, chief economist at Fannie Mae. “That puts a floor to some degree under how big a recession could be.”

Duncan’s base case is for a sharp depreciation in house-price increases, but not an outright decline.

In the labour market, an underlying shortage of workers – thanks to baby boomers retiring and immigration lagging – is likely to make companies more cautious about shedding staff in a downturn, especially if it’s a mild one.

“The story of the past two years has been businesses struggling to find workers,” said Jay Bryson, chief economist for Wells Fargo’s Corporate and Investment Bank. “We don’t think you’re going to see mass layoffs.”

Some economists say the next recession will prove long-lived, however, if the Fed holds back from riding to the economy’s rescue – as it’s signalled it might do if inflation stays stubbornly high.

Powell told a central banking conference last week that failing to restore price stability would be a “bigger mistake” than pushing the US into a recession.

Fiscal policy will also be hamstrung – and could well turn contractionary – if Republicans win back power in Congress, as looks likely in November's midterm elections.

In an echo of what happened after the financial crisis, GOP lawmakers might use debt-limit standoffs to push for cuts in government spending.

While not predicting a downturn, JPMorgan’s Feroli agreed a recession might be lengthy, if one occurred. That would particularly be true if the Fed is again hampered from providing the economy with help by not being able to cut interest rates below zero.

“We don’t think it will be a severe one, but it could be a long one,” he said.

– With assistance by Sonali Basak, and Vince Golle

For more articles like this, please visit bloomberg.com.