Each week, BusinessDesk and the NZ Herald’s Cooking the Books podcast tackles a different money problem. Today, it’s a banking expert on how safe savings are in New Zealand and Australia. Hosted by Frances Cook.

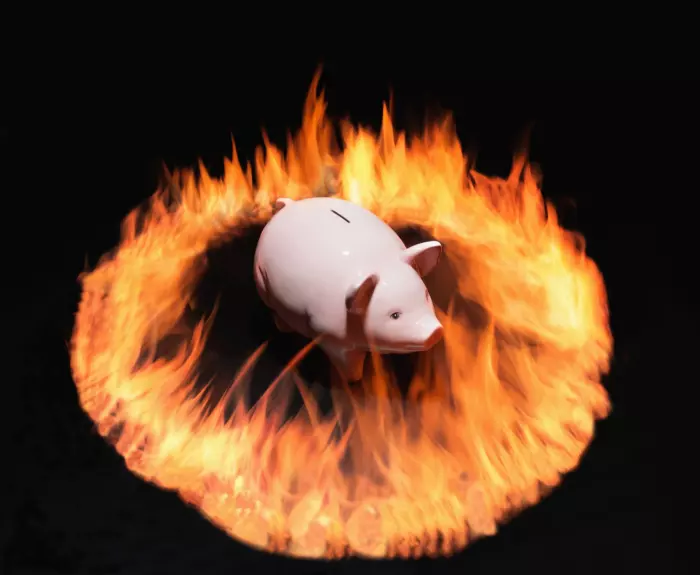

A bank collapse is the stuff of nightmares, with the potential to wipe out hard-earned savings, or a business’s ability to pay staff.

This nightmare has become reality in the United States, with a run on Silicon Valley Bank (SVB) that resulted in the bank collapsing.

It’s a big deal because SVB is, or was, the 16th largest bank in the US. It's the second biggest to fail since Washington Mutual’s collapse during the 2008 global financial crisis.

For context, it’s a bigger bank than ANZ here in New Zealand, which is our biggest bank. SVB had assets of US$209 billion (NZ$334b), while ANZ NZ has assets of US$120b.

It’s been followed by a couple of other worrying developments.

Credit Suisse was Switzerland’s second largest bank – but it’s being bought out in an emergency rescue deal by the country’s biggest bank, UBS.

UBS is snapping up their rival for a bargain 3 billion Swiss francs, which is about 60% less than Credit Suisse was supposedly worth before it hit the panic button.

Meanwhile, back in the US, Signature Bank has been shut down and is likely to have its deposits and loans bought out by Flagstar Bank.

Not great.

So, could it happen here, and should all New Zealanders be worried?

For the interview, listen to the podcast here.

If you have a question about this podcast or a question you'd like answered in the next one, come and talk to me about it. I'm on Facebook here, Instagram here, and Twitter here.

Listen to the full interview on the Cooking the Books podcast. You can follow the podcast on iHeartRadio, Apple Podcasts, or Spotify.