To avoid “horror stories”, selling a farm begins long before the "for sale" sign goes up. Produced in association with Craigs Investment Partners.

The sudden influx of a substantial sum – like those farmers receive when they sell the family farm – can sometimes be less of a windfall than it first appears.

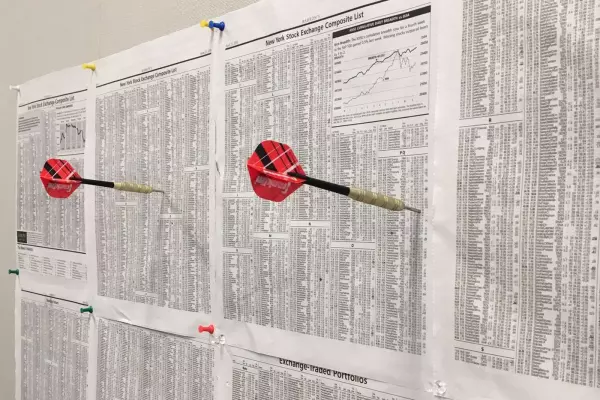

Craigs Investment Partners Investment Adviser Andrew McLean has heard plenty of those tales when the arrival of a large sum shocks the system: “Most farmers want to protect their wealth after realising the value of their assets – but doing so without the right guidance can be risky. There are horror stories of selling the farm and investing only to come unstuck.”

Farmers have, in a quite literal sense, a tough row to hoe. For starters, they operate in an industry which has historically been capital intense and cashflow poor, often with their hard work not being financially recognised until their farm asset is sold.

As a result, most farmers spend a lot of their career managing debt and dealing with a range of cyclical challenges from the weather, interest rates and fluctuating demand for produce. Along the way, the goal and immediate focus is building an asset, and that involves external capital – otherwise known as a significant mortgage and overdraft.

The odd thing, notes McLean, is that most farmers he works with are usually understated and humble, some even taking the view that they don’t have a lot of real-world skills.

Yet, he adds, nothing could be further from the truth. Successful farmers apply knowledge ranging from accounting and finance to science, geography, and meteorology. They know lots about biology, chemistry, animal science, soil science, and feed conversion ratios. They also know business and trade, how to manage suppliers and employees, income and expenses. Farmers are good with their hands, drive tractors, operate machinery, and fix fences. They do it all with a strong work ethic, often rising before dawn and finishing after sunset.

Craigs Investment Partners Investment Adviser Andrew McLean.

Craigs Investment Partners Investment Adviser Andrew McLean.

Raised rural himself, Palmerston North-based McLean knows all too well what it takes: “Dad’s still farming – it’s a challenging business often with a low cash return, but sometimes quite substantial wealth is released when the farm is sold, and swinging from managing an overdraft to a big sum in the bank can be frightening.”

He says planning for that day should start as early as possible because with any cash influx soon comes the realisation that money in the bank itself can become a liability, steadily eroded over time by inflation and the cost of living.

“Good investment strategies start with planning and an eye on the future, something farmers already do very well. But, given the long cycles involved, we like engaging with farmers long before they’re ready to sell – and initial introductions into the Craigs family don’t cost anything.”

While it is a big leap forward from that point to a ‘sold’ sign, McLean says getting started with the notion of a diversified portfolio doesn’t take money, it just takes an interest and a willingness to think about the future.

“Starting small right now with a few hundred dollars every month is the best way to learn,” he advises. “This allows for building a relationship with your adviser, too – and that relationship is a crucial component of how and where we add value at Craigs. We’ve seen many farmers looking to diversify beyond the farm gate while still working the land; that’s an excellent way of preparing for the future.”

Everyone’s goals and situations are different and successful financial advice depends on a clear understanding of multiple variables, McLean says. Some are financial, like investment vehicles, risk appetite and investment opportunities, while others are filial.

“Appreciating the family situation is important. Farms often pass from one generation to another, occasionally with some capital taken out at succession. In many instances, there are family members among whom the land or proceeds must be divided.”

There are potential sensitivities around succession, particularly when siblings are involved. For this reason, McLean again stresses the necessity for planning from the earliest possible opportunity. “If there’s a clear plan, and everyone is on board, there shouldn’t be any surprises and unpleasant situations and family disagreements can be avoided.”

At the outset, McLean says he looks to establish settings around three basic goals. The first is protecting capital against inflation and the cost of living. “You want to have similar or better wealth 10 years down the line,” he notes.

The second, related to the first, is generating income sufficient to maintain a consistent standard of living; the third is capital growth. “That third one is really the cherry on top – but these three objectives are generally common to every client, although each client’s situation has a slightly different view of the importance of each one. After that, we start looking at aspects like liquidity, the extent of diversification, specific investments, and so on.”

On diversification, he says that this sometimes includes some ‘hands-on’ investing from the individuals involved – like commercial or residential rental property. “Of course, we’re happy to help as much or as little as anyone is comfortable with, and that kind of external allocation can complement what we do.”

Working predominantly with the rural community in which he grew up is a rewarding experience, McLean notes. “This is very much a people business. Over two decades I’ve had many of the same clients, and they’re people who I probably would have formed personal relationships with outside of work.

“That really contributes to the value we create at Craigs; the better we know our clients, the more mutual respect there is, the better we understand their investment goals and strategies, and the better we can work together to achieve our clients’ goals. Again, while selling the farm is a major life event for our clients, our involvement and relationships with them often start long before.”

For more information: craigsip.com/how-we-help

Andrew McLean is an investment adviser at Craigs Investment Partners. His disclosure statement is available on request and free of charge. This information is general in nature and should not be regarded as specific investment advice. Craigs Investment Partners do not accept liability for the results of any actions taken or not taken upon the basis of this information, or for any negligent mis-statements, errors or omissions. Those acting upon this information and any recommendations do so entirely at their own risk. Craigs Investment Partners did not take into account the investment objectives, financial situation or particular needs of any particular person in the preparation of this information. This information does not constitute a representation that any investment strategy or recommendation is suitable to your individual circumstances or otherwise constitutes a personal recommendation. Craigs Investment Partners recommend seeking advice from a licenced financial adviser about your financial situation and goals before acquiring any financial products or making any investment decision. To talk to one of Craigs Investment Partners’ financial advisers, please call 0800 272 442. The Craigs Investment Partners Limited Financial Advice Provider Disclosure Statement can be viewed at craigsip.com/tcs. Visit craigsip.com.