The role of physical cash in an increasingly digital society is declining.

While the Reserve Bank of New Zealand (RBNZ) noted a bump in cash withdrawals during covid-19, less than 10% of the money in circulation is in the form of cash.

On the other hand, feedback from New Zealanders shows the most vulnerable in society still rely on cash, which is becoming increasingly hard to access as banks disappear from towns and suburbs around NZ.

To solve this, there’s an opportunity to innovate faster around ways to give all New Zealanders better access to finance without leaving people behind. Many industries have already demonstrated that technology improves transparency, security and accountability while also delivering an enhanced customer experience.

By contrast, the banknote is increasingly looking like an obsolete method of payment. The RBNZ recently signalled it will be working to reduce our reliance on cash without doing away with it entirely. This is to support those without access to the internet and traditional banking.

Digital risk

However, when every other sector is already moving ahead in digital innovation, we risk falling behind countries overseas that are innovating faster in digital payments.

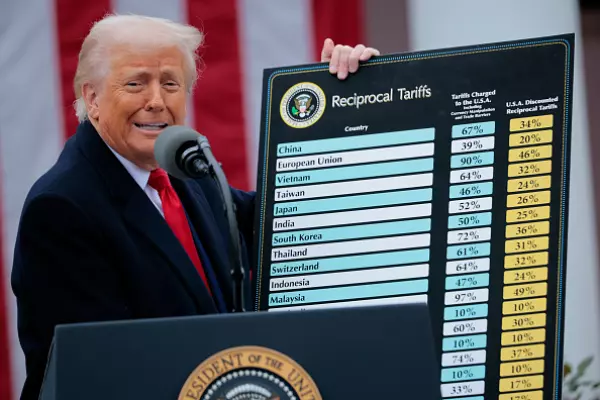

China and Sweden have already started innovating with their own central bank digital currencies, and more are expected to follow suit. It seems inevitable that we’ll start to see countries going entirely cashless.

Is there a way we can reconcile the innovation vs accessibility issues and keep up with global trends while actually making finance better for underserved communities? And what’s the benefit of a cashless society in any case?

Consider a bottle of milk. A person buys a bottle of milk with a $5 note. It turns out the milk is contaminated, and the person becomes ill.

They report their illness to health authorities who investigate. Using the barcode on the bottle, authorities can trace the milk back along its supply chain to the supplier, the transporter, the farm and even the very cows that produced the milk. Simple innovations have enabled the dairy industry to reduce health risks, improve the quality of their product, increase transparency, awareness and accountability.

Now consider the journey of the $5 note that purchased the bottle of milk. What do we know about that? Firstly, we don’t know who its current or previous owner was, we cannot be certain it purchased the bottle of milk and it’s unlikely we will know anything about its future journey including who its future owners might be. Physical cash has no barcode, exchanges of value are anonymous, there is no ledger to record purchases. Notes have serial numbers, but they are solely used to identify counterfeits and maintain the quality of their physical condition.

Cash is corrupt?

In a world of digital innovation, physical cash seems like an anomaly past its use-by date. In addition, cash is the predominant method of exchange for money laundering, terrorism financing, drug dealing and human trafficking among other illicit activities, precisely because it leaves no trace.

There is also the problem of undeclared cash payments ‘under the table’. Removing cash entirely would establish a ledger of digital transactions, capturing transactions that were previously undetectable.

This not only helps regulators fight crime, but it also increases tax revenues without the need to increase taxes, enabling more of everyone’s taxes to be spent on the things that improve our society.

A digital currency also offers better personal security than carrying around cash in your wallet. As we reduce NZ’s reliance on cash, it’s a perfect time to look at how we can make the whole financial system better for those people who don’t meet the usual criteria for a bank account, such as a fixed address.

More than half of the world’s population does not have access to the full services of the traditional banking system. Half of those people don’t use banks at all.

They are therefore forced to use cash or go to unsecured sources of finance, exposing them to greater risk. A digital wallet doesn’t require the same fixed terms and conditions.

Could digital banking hubs similar to the rural banking hubs the government is introducing also help meet the needs of those without the internet?

Really smart banking

Solving the digital access issue and reducing reliance on cash would also help us take the next step, towards extending financial access to more New Zealanders.

Alongside the steps the RBNZ is making, including monitoring overseas digital currencies, it would be great to see innovation opened up via the adoption of open or smart banking in NZ.

This would enable fintechs to share access to financial platforms and provide more customised services in line with what New Zealanders are demanding.

If innovators could provide financial services that met their values in other ways, such as offsetting carbon credits to reflect environmental concerns or enabling iwi to borrow under a collective identity rather than as individuals (which they cannot currently do), a digital finance system would be much more attractive.

Furthermore, it would enable innovation around payments and terms that the current system isn’t set up for, creating much more flexibility for those who fall outside the traditional banking system.

Another reason often given for keeping physical cash is that it protects users’ rights to privacy. However, legislation is increasingly ensuring digital information matches the real world, protecting our privacy in the digital sphere.

The new Privacy Act introduced in December 2020 gives people assurance their personal information cannot be used or stored in ways they don’t consent to.

Privacy concerns have also not halted the huge shift towards digital platforms during lockdown and beyond – instead, what digital platforms can do is build compliance into the system, so approvals are automatic and don’t have to go through as many hands.

We were the first country in the world to introduce an independent central bank.

While our cash-based system is under review, why not consider how else NZ could lead on increasing access to finance?

The writing is already on the wall for notes and coins, so let’s look at how we can ease the transition for those who often fall through the cracks by opening up digital innovation.