This article has been republished. It was first published in May.

Bank of New Zealand (BNZ) was constantly in the headlines in the late 1980s and early 1990s, mostly for the wrong reasons.

Its profile was particularly high between March 1987, when it listed on the NZX, and Dec 1992, when it delisted following a successful takeover offer by National Australia Bank.

This retrospect covers the early period between March 1987 and Dec 1988, particularly the proposed sale of the crown-controlled bank to Brierley Investments.

BNZ listing

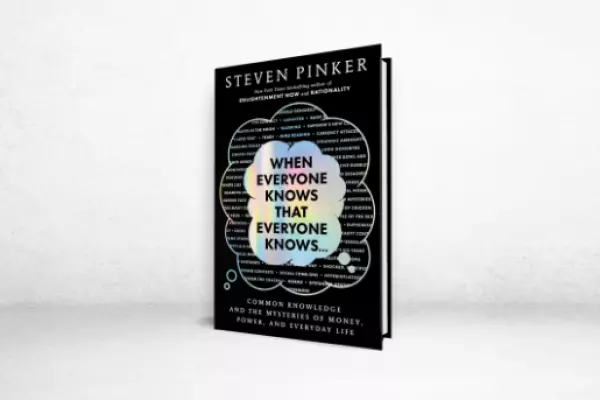

BNZ listed on the NZX on March 31, 1987, following the issue of 13% to the public at $1.75 a share. The crown owned the remaining 87% and the total value of the bank at the IPO price was $1.4 billion.

It was the fifth-largest New Zealand-listed company on its listing day, behind Fletcher Challenge, Brierley Investments, Goodman Fielder and NZ Forest Products.

The BNZ directors at the end of March 1987 were Lewis Ross (chairman), Ron Brierley (deputy chairman), Rob Campbell, Ted Keating, Len Bayliss, Frank Pearson and Pat Morrison.

On April 1, 1987, the day after listing, Ross retired, Brierley became chairman and Campbell deputy chairman. Keating also retired that day, and Susan Lojkine and Peter Leeming joined the board.

From the 1987 BNZ prospectus.

From the 1987 BNZ prospectus.1987 and early 1988

BNZ’s share price stayed above the IPO $1.75 price for the first two days and then began to drift lower.

The company reported a net profit after tax of $148.5 million for the March 1987 year, compared with the prospectus forecast of $145m. Brierley told shareholders at the Wellington annual meeting: “I believe in the longer term, the price of $1.75 will prove to be a very favourable one for original investors. I have no doubt present market levels represent the beginning of an investment success story for many years to come.”

The share price drifted down to $1.53 but then rallied after the bullish annual meeting to reach an all-time high of $1.93 in early Oct 1987.

Meanwhile, BNZ executives continued to talk up their bank to the media. Alan Milne, head of corporate banking in Auckland, told the National Business Review in early Oct that his region represented 70% of BNZ’s corporate business, compared with only 40% a few years before. He was reported as saying: “If you take the major players in the Auckland scene – the Equiticorp, Chases and so on – we’re lead bankers to all of them.”

Milne added that whereas the bank used to type ‘m’ (millions) on its deals, it was increasingly using the letter ‘b’ (billions).

When the market opened on Oct 20, 1987 BNZ shares plummeted 53 cents to $1.30 but closed at $1.50. It finished the 1987 year at $1.35.

BNZ’s public relations approach changed dramatically after the market crash. The bank went silent, having previously gloated about its lending, which included financing Equiticorp’s acquisition of BHP shares and Chase’s purchase of the Myer building in Brisbane.

Claims of client confidentiality and banking ethics were used to avoid answering difficult questions, with chief executive Bob McCay telling the Auckland Sun: “The bank makes very few loans for the purchase of equities. Having said that, we would not know what many of our customers were using that money for.”

McCay continued to be remarkably confident and told a reporter in late Feb 1988 that the BNZ share price – which had fallen below $1 – was “a better bargain every day”.

The following day, he was quoted in an NZX announcement as saying: “Not only has the bank fully provided for all known potential losses but it has a substantial cushion in its general provisions.”

Brierley was also upbeat at the annual meeting held in Wellington on July 27, 1988, telling shareholders that “overall, our exposure is well within the bounds of banking prudence”. The bank was looking at all its exposures, which included a full inquiry into its lending to Energycorp.

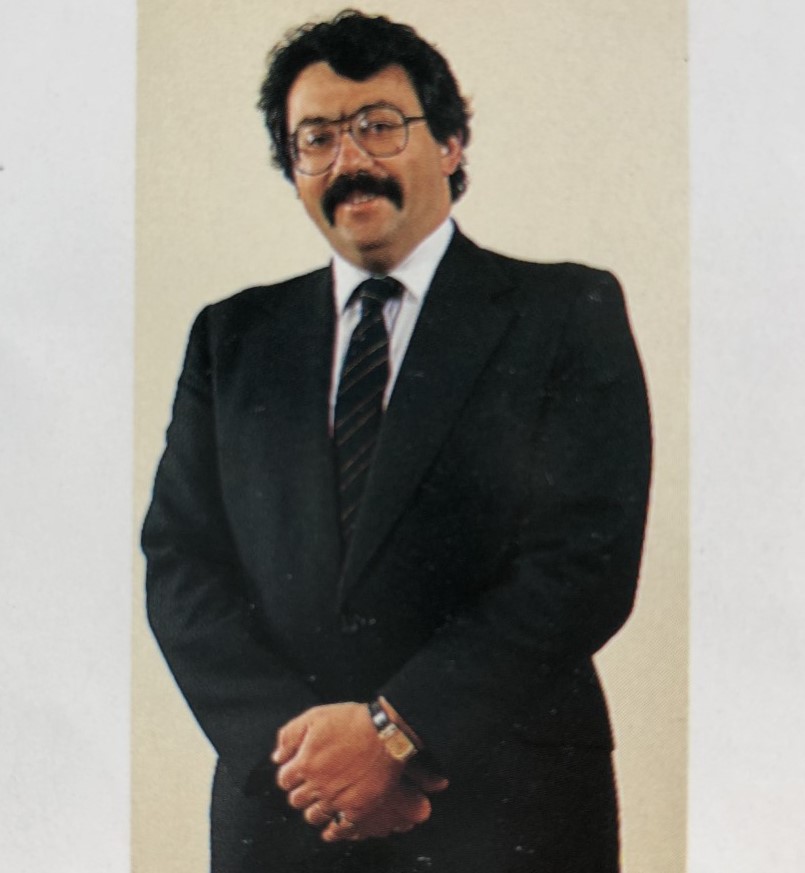

Former BNZ chairman Ron Brierley in 1987.

Former BNZ chairman Ron Brierley in 1987.

Full privatisation

The following day, July 28, 1988, finance minister Roger Douglas announced in his Budget speech that he had “a target for business sales of $2000 million this year” and the full privatisation of BNZ was included in this target.

Douglas wanted to tackle his burgeoning Budget deficit and asset sales would play an important role in this strategy.

Unsurprisingly, there was little interest in the BNZ. The Treasury and its advisers, First Boston, contacted 46 potential buyers around the world. Only 10 submitted a preliminary written expression of interest and only six participated in a one-day due diligence process.

Bidders

There were just two serious bidders, Brierley Investments (BIL) and National Australia Bank (NAB). Ron Brierley temporarily stepped down as chairman of the BNZ and was replaced by Campbell, who had a trade union background and limited corporate board experience.

The BIL offer, which included the formation of a new company called BNZ Corporation, was as follows:

• BNZ Corp would replace BIL as the listed entity.

• BNZ Corp would pay $1.45 a share, or $1011 million, to the crown for its 87% shareholding in the BNZ.

• BNZ Corp would offer the minority BNZ shareholders one BNZ Corp share for every BNZ share, or $1.44 cash.

• BNZ Corp would then make an offer for BIL on the basis of one BNZ Corp share for every BIL share.

Following the successful completion of the deal, BNZ Corporation would own 100% of Brierley Investments and 100% of Bank of New Zealand, which would be run as totally separate organisations.

NAB wanted to do a further six weeks of due diligence and said it would pay the crown 1.3 times the net tangible asset backing after adjusting for further bad debt provisioning. In addition, a portfolio of problem loans would be segregated and managed separately, with losses charged to the crown.

BIL and NAB both assessed that further bad debt write-offs of around $400m-plus would be required.

Neither offer was satisfactory, as NAB was unprepared to make a firm bid and it was totally inappropriate for a highly geared Brierley Investments to own a distressed bank and have access to the confidential information of the bank’s corporate clients.

Former BNZ deputy chairman Rob Campbell in 1987.

Former BNZ deputy chairman Rob Campbell in 1987.

Political turmoil

The Treasury and Douglas had targeted mid-Dec 1988 for the finalisation of the targeted $2000 million in asset sales, with PostBank, Air New Zealand and BNZ up for sale. The problem was that Brierley Investments was also bidding for Air New Zealand with Qantas.

The bitter conflict between Prime Minister David Lange and Douglas, which mainly revolved around a deteriorating economy, the escalating Budget deficit and the asset sales programme, came to a head on Wednesday, Dec 14, 1988, when Lange called a press conference for 1.40pm. Shortly afterwards, Douglas revealed he would hold a press conference at 1.20pm following a meeting with Labour MPs.

The atmosphere in the Beehive was incredibly tense; was this the end of the road for Lange or for Douglas?

At 2.15pm, the Prime Minister told the media that Douglas had resigned and been replaced as finance minister by David Caygill. Caygill had been a strong supporter of Douglas but sided with Lange on this occasion.

On Tuesday, Dec 20, a special cabinet meeting was held to consider the asset sales, with the Treasury recommending the sale of Air New Zealand to the Brierley/Qantas consortium, BNZ to Brierley Investments and PostBank to ANZ Bank (NZ).

The cabinet endorsed the sale of Air New Zealand for $660m and PostBank for $665m but rejected the BNZ proposal.

The following day, the Labour caucus reconfirmed Lange as party leader with the following vote count: Lange 38, Douglas 15, informal 2 and absentee 2. The caucus also confirmed the sale of Air New Zealand and PostBank and those sale agreements were signed that afternoon.

If Douglas and Richard Prebble, the state owned enterprises and associate finance minister sacked by Lange the previous month, had remained in the cabinet, the BNZ would almost certainly have been sold to BIL.

Future prime minister Mike Moore and his wife, Yvonne, sat behind me on a flight from Wellington to Auckland later that day. Moore tapped me on the shoulder and declared that Lange should have supported the sale of the BNZ to BIL.

Moore was totally wrong; the BNZ had serious problems and its sale to Brierley Investments would have been a disaster for the investment company and for the economy.

BNZ’s share price finished the 1988 year at $1.40 but its most controversial period was just ahead.

Disclosure of interests: Brian Gaynor is a non-executive director of Content Limited, the publisher of BusinessDesk, and of Milford Asset Management.

[email protected]