Global beauty company Lush operates in New Zealand and 47 other countries, yet despite the huge importance it places on marketing, it has removed itself from Facebook, Instagram, TikTok and Snapchat.

It’s a risky move, given the millions of followers it had on Instagram and Facebook, especially. “We already know there is potential damage of £10m in sales and we need to be able to gain that back,” Jack Constantine, chief digital officer and product inventor at Lush, told the BBC.

He said the decision was sparked by social media’s effect on emotional and mental health. “We would not ask customers to meet us down a dark and dangerous alleyway … Social media is beginning to feel like a place no one should be encouraged to go to.”

Another luxury giant reassessing its relationship with social media is Bottega Veneta. Last year, the Italian brand deleted its Instagram, Twitter and Facebook feeds, waving ciao to more than 2.5 million followers. In China, one of its biggest markets, it also deleted its Weibo account, which had 270,000 followers.

Bottega Veneta is part of Kering Group, which has annual revenue of almost US$15 billion and a portfolio of luxury brands that includes Gucci, Saint Laurent, Balenciaga, Alexander McQueen, Brioni, Boucheron jewellery and Girard-Perregaux timepieces.

At a time when many brands rely on social media to drive e-commerce, the move caused such a flap that Kering's chairman and chief executive officer, François-Henri Pinault, felt moved to explain. “Bottega Veneta is not disappearing from social networks — it’s merely using them differently,” he said.

Rather than having the brand speak for itself, he explained, it would rely on ambassadors and fans to drive conversations online. The plan is to focus on curated events and other digital initiatives, sparking word-of-mouth and coverage by independent style-makers such as the @newbottega Instagram account.

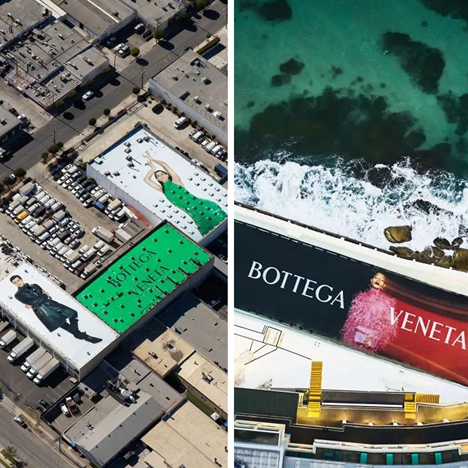

Throughout 2021 and into 2022, Bottega Veneta staged a series of digitally screened public art installations in cities ranging from Los Angeles and Sydney to London and Beijing. Most recently, the brand kicked off its Chinese New Year shopping campaign by taking over part of the Great Wall of China with an enormous digitally screened public art installation in auspicious bright green and tangerine orange. Both are often used in Bottega Veneta designs, and they’re also considered lucky colours in Asia.

Bottega Veneta also launched an online boutique – decorated in green and tangerine – on WeChat. This platform is like a cross between Facebook, an e-commerce site and Instagram, and it’s the only brand-run social media Bottega Veneta still uses.

The Bottega Veneta digital art installations in Los Angeles and Sydney. Photo: Bottega Veneta.

The Bottega Veneta digital art installations in Los Angeles and Sydney. Photo: Bottega Veneta.

Reach v results

“Withdrawing from social media is a strategic move for Bottega Veneta, to position them away from other brands. By withdrawing from some popular platforms, the brand becomes more rare and exclusive, and therefore more coveted,” says Chris Wilkinson, managing director of First Retail, which works with clients and malls in New Zealand and Australia on retail strategies.

He says some brands don’t want everyone talking about them. They just want the “right” people. This means social media’s greatest strength – its mass appeal – can also be its greatest weakness.

Nick Licence, director of ad tech at marketing consultancy krunch.co in Auckland, says if a brand decides its audience “isn't showing up and engaging in social media, or the environment doesn't lend itself to the creativity it wants to be known for, then it probably makes sense to shift investment. From Bottega's perspective, that seems to be the case.”

There’s also the question of reach v results. Popular platforms such as Facebook reach a lot of people, but do they deliver sales results?

Licence says yes. “Social media marketing can drive leads and sales. But the most successful campaigns integrate across multiple touchpoints and allow consumers to convert where they feel most comfortable. Website, data-inspired creative, a fluid customer experience …social is just a part of it.”

This means many luxury brands are exploring alternative ways to influence customers, well away from the scrum of social media. Gucci and Moncler release their own downloadable playlists on Spotify.

Dior has commissioned feature-length documentaries about perfume and fashion. The most recent premiered at the 2020 Tribeca Film Festival. You can rent or buy it on Apple TV, Amazon Prime Video, and Google Play.

Brands are also exploring collaborations in the metaverse, where they can use augmented-reality, motion-capture and facial-recognition technology to create curated, immersive worlds. Dior partnered the metaverse avatar platform and game app Ready Player Me for a recent fragrance launch. Players created an avatar and saw it come to life in dreamy environments inspired by fragrances, like a rose garden. They could also order the Dior fragrance in the game and get it delivered in real life.

Edgy fashion brand Balenciaga went further and collaborated with the video game Fortnite, which has 350 million players around the globe. The fashion house released a collection of limited-edition virtual clothes for characters to wear in-game and to order in real life. The project got so much buzz that Balenciaga’s autumn/winter 2020 collection was released on the Afterworld video game.

Morality or marketing?

While Bottega and other luxury brands worry social media is not exclusive enough, Lush worries it’s not inclusive enough.

Anyone who has tried quitting social media knows it’s hard. Lush has tried it before, closing several British social media accounts in the past, only to find itself “back on the channels, despite the best intentions”, as the company explained. It said it had to go back onto Facebook to service customers during coronavirus lockdowns.

But now, Lush says it’s definitely off the most popular platforms for a year, to highlight the potentially serious effects of social media on mental health, especially in young women and girls.

Lush is famous for handmade fresh cosmetics, which include its bestselling fizzing bath bomb and solid shampoo bars. Calling itself a “beauty company with a campaigning heart”, it is active in social causes, championing LGBTQ+ inclusion, and donating almost $400,000 a year to groups “working to regenerate environmental and social systems”.

“Most customers at Lush are young women,” says Wilkinson. “They’re heavy users of Instagram, but they’ve also been having conversations online about how social media can be toxic for mental health, body confidence and self-image. So Lush’s move shows their customers, ‘We hear your concerns. And we’re on your side.’

“But Lush customers are very connected digitally, so the company is not leaving all social media; it’s just leaving some platforms that their customers associate with negative things.”

Lush plans to keep Twitter for customer feedback, stay active in Reddit discussion groups, repurpose more “positive content” onto YouTube and Pinterest, and ramp up on app development. Its latest figures show some 30% of its total sales are now online or made via the Lush app, which was developed by its in-house digital innovation team.

Facebook dominates in New Zealand

But not every business has the resources to develop apps or manage multiple social media platforms. In New Zealand, Facebook still dominates social media spend. And you can see why, given that 83% of the population still uses it regularly.

“Many of our clients are entirely reliant on social media for their marketing, particularly in the hospitality space, as well as health and wellness practitioners like physiotherapists or personal trainers. Any interruption to Facebook can be devastating,” says Jef Kay, director of Easy Social Media in Auckland.

He adds: “There’s not really a realistic alternative to Facebook for many [small to medium-sized] brands. Google Ads and EDMs [electronic direct mail-outs] can be effective, but they don’t have the reach.”

Licence agrees that Facebook and YouTube deliver reach, but he suggests exploring alternatives. “The challenge for marketers is to eke out value from every last dollar of the budget. It’s worth understanding the different ways your audiences engage on different social platforms.”

Social media platforms are also retooling to be more attractive to advertisers. To rival YouTube and Facebook, Pinterest recently introduced idea pins, which let users create long-lasting, multi-page, saveable video content. And YouTube just announced plans to disable the Unlike button. It says that’s to reduce online bullying, but it will also appeal to advertisers hoping to reach the 87% of New Zealanders who use YouTube regularly.

TikTok has also transitioned from teen video gimmick to a real marketing channel with more than a billion active users. In New Zealand alone, TikTok has 1.3 million monthly users. What’s more, 30% of them use only TikTok – they don’t have accounts on Instagram, Facebook or other social networking sites.

When it comes to Lush, Jack Constantine says the move away from social media won’t have much impact on the company’s digital marketing budgets. Instead of paid social media, the plan is to focus on creating “positive” content with influencers and Lush’s own in-house creators, then reusing it on several platforms.

It has not deleted its Facebook, Instagram, TikTok and Snapchat accounts, but it’s signed off with a post that encourages followers to “stop scrolling and be somewhere else instead”.

If more brands follow this plan, what will that mean for marketing on social media? Most importantly, will this ultimately help to make social media a safer space?