CHATHAM ANNOUNCES NON-BROKERED PRIVATE PLACEMENT

OFFER

Fri, Jun 13 2025 12:01 pm

NEWS RELEASE 25-011 June 12, 2025

NOT FOR DISTRIBUTION TO U.S. NEWSWIRE SERVICES OR FOR DISSEMINATION IN THE UNITED STATES

CHATHAM ANNOUNCES NON-BROKERED PRIVATE PLACEMENT

WELLINGTON New Zealand - Chatham Rock Phosphate Limited (TSXV: “NZP”, NZX: “CRP” and “3GRE” (Frankfurt) or the “Company”) is pleased to announce a non-brokered private placement consisting of up to 3,500,000 units (“Units”) at a price of CAD$0.05 per Unit (NZD$0.06 or AUD$0.057) for aggregate gross proceeds of up to CAD$175,000, NZD$210,000 or AUD$199,500 (the “Offering”).

Each Unit will consist of one common share of the Company and one common share purchase warrant (a “Warrant”). Each Warrant will be exercisable for one common share of the Company at a price of $0.10 for two years from the date of issuance. In the event that the common shares of the Company trade on the TSX Venture Exchange (the “Exchange”) at a closing price of greater than CAD$0.15 per common share for a period of 20 consecutive trading days at any time after four months and one day after the closing date of the Offering, the Company may accelerate the expiry date of the Warrants by giving notice to the holders thereof by way of a news release and in such case the Warrants will expire on the 30th day after the date of dissemination of such news release.

The closing date will be on such later date as the Company may determine and is subject to the receipt of all necessary approvals, including the approval of the Exchange. The Units to be issued under the Offering will be subject to a hold period under applicable Canadian securities laws until four months and one day after the closing of the Offering.

It is anticipated that certain directors, officers and other insiders of the Company will acquire Units under the Offering. Such participation will be considered to be “related party transactions” within the meaning of Exchange Policy 5.9 (“Policy 5.9”) and Multilateral Instrument 61-101 Protection of Minority Security Holders in Special Transactions (“MI 61-101”) adopted in Policy 5.9. The Company intends to rely on the exemptions from the formal valuation and minority shareholder approval requirements of MI 61-101 contained in sections 5.5(a) and 5.7(1)(a) of MI 61-101 in respect of related party participation in the Offering as neither the fair market value (as determined under MI 61-101) of the subject matter of, nor the fair market value of the consideration for, the transaction, insofar as it involves the related parties, is expected to exceed 25% of the Company’s market capitalization (as determined under MI 61-101).

The Company intends to use the net proceeds from the Offering for general working capital.

The securities described in this news release have not been, and will not be, registered under the United States Securities Act of 1933, as amended (the “U.S. Securities Act”), or any applicable securities laws of any state of the United States, and may not be offered or sold within the United States or to, or for the account or benefit of, U.S. persons (as such term is defined in Regulation S under the U.S. Securities Act) or persons in the United States unless registered under the U.S. Securities Act and any other applicable securities laws of the United States or an exemption from such registration requirements is available. This news release does not constitute an offer to sell or a solicitation of an offer to buy any of these securities within any jurisdiction, including the United States.

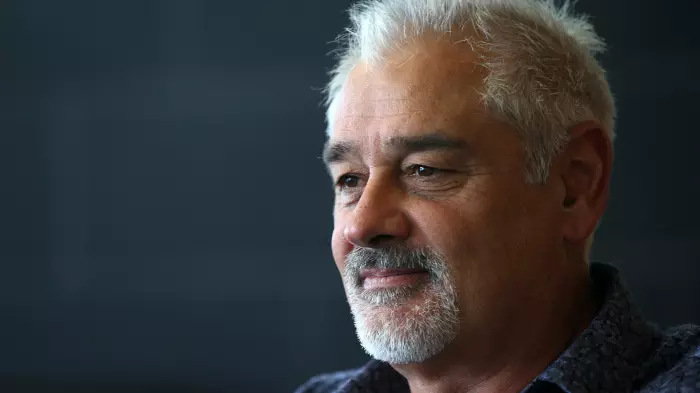

Chris Castle

President and Chief Executive Officer

Chatham Rock Phosphate Limited

64 21 55 81 85 or [email protected]

Statements about the Company’s future expectations and all other statements in this press release other than historical facts are “forward looking statements”. Such forward-looking statements are based on numerous assumptions, and involve known and unknown risks, uncertainties and other factors, including risks inherent in mineral exploration and development, which may cause the actual results, performance, or achievements of the Company to be materially different from any projected future results, performance, or achievements expressed or implied by such forward-looking statements.

Neither the TSX Venture Exchange, its Regulation Service Provider (as that term is defined under the policies of the TSX Venture Exchange), or New Zealand Exchange Limited has in any way passed upon the merits of the above described transaction, and has neither approved nor disapproved of the contents of this press release.