Mainfreight shares climbed 6.3% to $90.15 in early trading after the company reported an 85% jump in pre-tax profit to $372 million in the first 43 weeks of its March financial year.

The trend of rising freight volumes and supply chain disruptions continued in the period, which saw the group’s air and ocean division leapfrog its transport business as the biggest contributor to earnings, tripling pre-tax profit to $186.7m from $60.6m in the same period a year earlier.

Transport, for its part, boosted pre-tax profit by 31% to $141.7m while warehousing contributed $43.7m, up 36%.

In its latest trading update, the company reported total revenues up a whopping 45% for the 43 weeks of trading, at $4.1 billion – from $2.8b on a comparative basis.

Regionally, the biggest jump came out of Mainfreight’s Asian operations, which saw revenue climb 121% to US$203.3m. The Australian business reported a one-third increase in revenue to A$939.6m while New Zealand’s transport division benefited from the largest 2021 Christmas volumes on record.

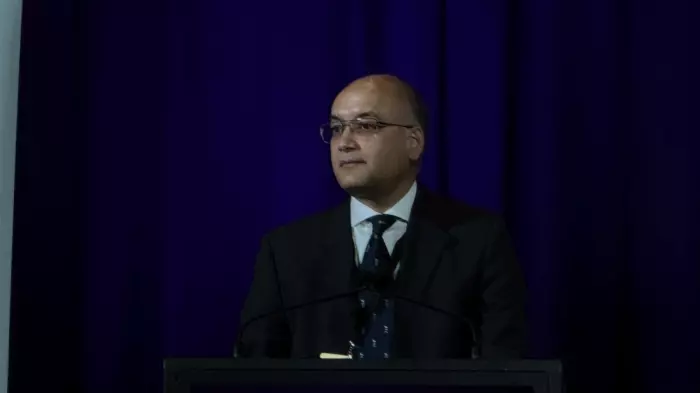

Managing director Don Braid said the results weren’t surprising, reflecting a continuation of increasing freight volumes and trends seen in its first-half results.

Braid said while service levels had been impacted across the Australian, European and American operations by absenteeism related to omicron restrictions, neither the NZ or Asian businesses had been materially impacted to date.

Prepping for covid

In NZ, where the group has had mandatory vaccinations for its team members since Jan 17, he said the company was preparing for heightened absenteeism.

In Asia, air and ocean volumes increased significantly on the back of space constraints with shipping lines. The group expects to open its first Indonesian branch in Jakarta by the middle of this year.

Mainfreight has also recently opened new depots in Dallas and in Pennsylvania in the US and in Toronto, Canada. Braid said the company is also looking for larger sites in Los Angeles and Newark, New Jersey to cope with increasing warehousing demand.

Overall warehousing capacity had already reached 936,153 square metres across the global footprint, with Braid indicating this could increase by another 250,000 sqm over the next two years on the back of new customer gains and larger inventory holdings.

That comes as slower ocean freight services create congested container arrivals into warehouses, he said.

Braid downplayed the year to date, describing it as "satisfactory", and said he expects elevated freight volumes to continue as the year progresses, with managing service levels as a “key priority”.

The group will release its full year financial results for the year to March on May 26.