New Zealand should follow Australia and establish a freight council to ensure government agencies are considering industry perspectives, a sector advocate says.

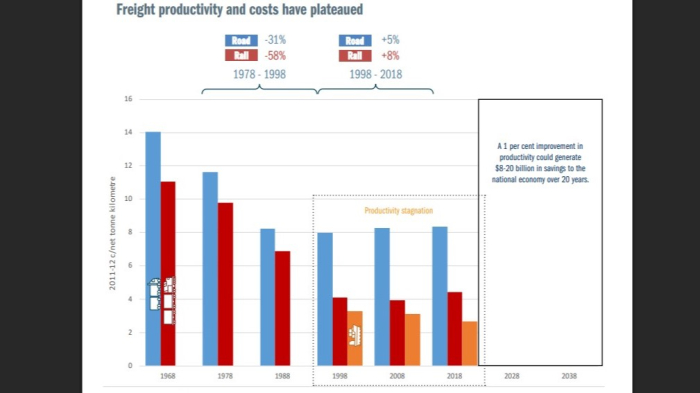

In 2019, Australia published its National Freight and Supply Chain Strategy – a succinct document setting out key issues (stagnant productivity and costs, for example) and the actions needed to accommodate an expected 35% increase, or 270 billion tonnes more freight by 2040.

A review, action, and implementation plan, along with the establishment of a five-person Freight Industry Reference Panel, have been followed up on the strategy.

The panel, which is made up of industry experts, is meant to monitor the strategy and provide feedback and advice to officials and ministers on issues affecting the supply chain.

Contrasting strategies

National Road Carriers chief executive Justin Tighe-Umbers said NZ should have something similar – he called it a freight council – to provide multimodal feedback to ministers and officials.

“At the moment, what we do here is we just plan in isolation,” he said, meaning there wasn’t adequate understanding of how different freight modes like road, rail, and coastal shipping interacted with each other.

The Ministry of Transport set up an industry reference group when it was developing the Aotearoa NZ Freight and Supply Chain Strategy.

As BusinessDesk reported, work on aspects of the strategy, including the development of an action plan and updating the Freight Demand Study, which was last done in 2019 using data from 2017 and 2018, has stalled.

“Seven years is a long time between drinks in terms of a study,” Tighe-Umbers said, referring to the decision by the ministry not to update the Freight Demand Study.

“The issue that we have is that freight productivity is not being measured by the government or government agencies, and targets are not being set for improving it.”

The Australian example

As with the NZ strategy, the Australian version identified a need for better freight location and performance data, including establishing indicators and performance benchmarking.

Australia now has a National Freight Data Hub that brings together various data sources, allowing users to look at metrics like freight volume by mode, transit times by key routes, and the price to move a tonne of freight per kilometre (a useful measure of freight task productivity).

Part of the Australian strategy that was published in 2019. (Image: Screenshot)

Tighe-Umbers said infrastructure owners and investors benefited from this data-rich approach, as it allowed them to target scarce capital towards the most productive new investments and interventions.

“If you’re not measuring it, you’re not improving it,” he said. “That’s just where we are in NZ at the moment. We’re a country where a huge amount of income relies on physical goods exports, so we’re missing a big opportunity here to do the same.”

Data sharing pilot

NRC is multimodal but largely represents trucking operators.

Tighe-Umbers estimated that around 60% of the heavy vehicle fleet was now fitted with telematics devices, meaning operators had access to electronic data about their fleets.

This represented a huge opportunity, he said, to aggregate data across operators and provide a better picture of freight movements and roading conditions.

However, the trucking industry was highly competitive, so operators could be wary of sharing their data without assurances about how it would be used.

Tighe-Umbers said Australia had already cracked this, with Transport Certification Australia (TCA) providing a neutral “Switzerland-like” database that managed data-sharing between transport operators, telematics providers and the regulator. The data sits outside of government, and is accessible to them only under terms agreed by the transport operator.

“They've started giving road freight operators benefits such as increases in permitted loads, in return for shared telemetry data,” he said.

Tighe-Umbers described the approach as a win-win: operators benefited from improved productivity, and the regulator got better visibility of how the roading network was being used at a macro level, allowing for more targeted investments.

NRC co-ordinated a successful trial here last year, with some transport operators providing voluntary telemetry data into a TCA database, which housed NZ road network GIS information from NZTA and local councils.

“It demonstrated the concept can readily be developed here in New Zealand,” Tighe-Umber said. “And given the current limited availability of road-freight data, this has created a lot of interest within government as it plans infrastructure and supply chain for the future.”

Move at pace

Seeking to establish a partnership with the sector to support mutual data sharing was one of the recommendations in the NZ Freight and Supply Chain Strategy.

The strategy also recommended a review of the regulatory system to enable the uptake of more zero-emission heavy vehicles.

In response to an Official Information Act request from BusinessDesk, the ministry said it and NZTA were continuing to investigate regulatory barriers.

This year, the director of land transport at NZTA granted an exemption allowing class 1 driver licence holders to drive electric variants of existing diesel trucks exceeding 6,000 kilograms.

Electric trucks are heavier due to the weight of their batteries.

Tighe-Umbers said NZ was a receiver of technology trends, and zero-emission trucks coming out of Europe and Asia were getting heavier.

“We’ve got to get a whole lot faster and smarter in this space in terms of getting approvals,” he said.

Tighe-Umbers spoke with BusinessDesk as part of the Blue Highway series on the NZ supply chain.

In 2017/18, trucks, trains, ships, and planes moved about 280 million tonnes of freight around NZ, with the vast majority going by road.

Tighe-Umbers said there was a tendency, particularly in urban settings, for motorists to view trucks as an inconvenience.

“I think there needs to be better recognition that, actually, that’s our supply chain. It’s the lifeblood of the whole economy.”

Read more in the series here.