Rod Duke, the driving force behind Briscoe Group, has clearly shown that industry expertise, innovative strategies and excellent execution are key ingredients for superior long-term sharemarket returns.

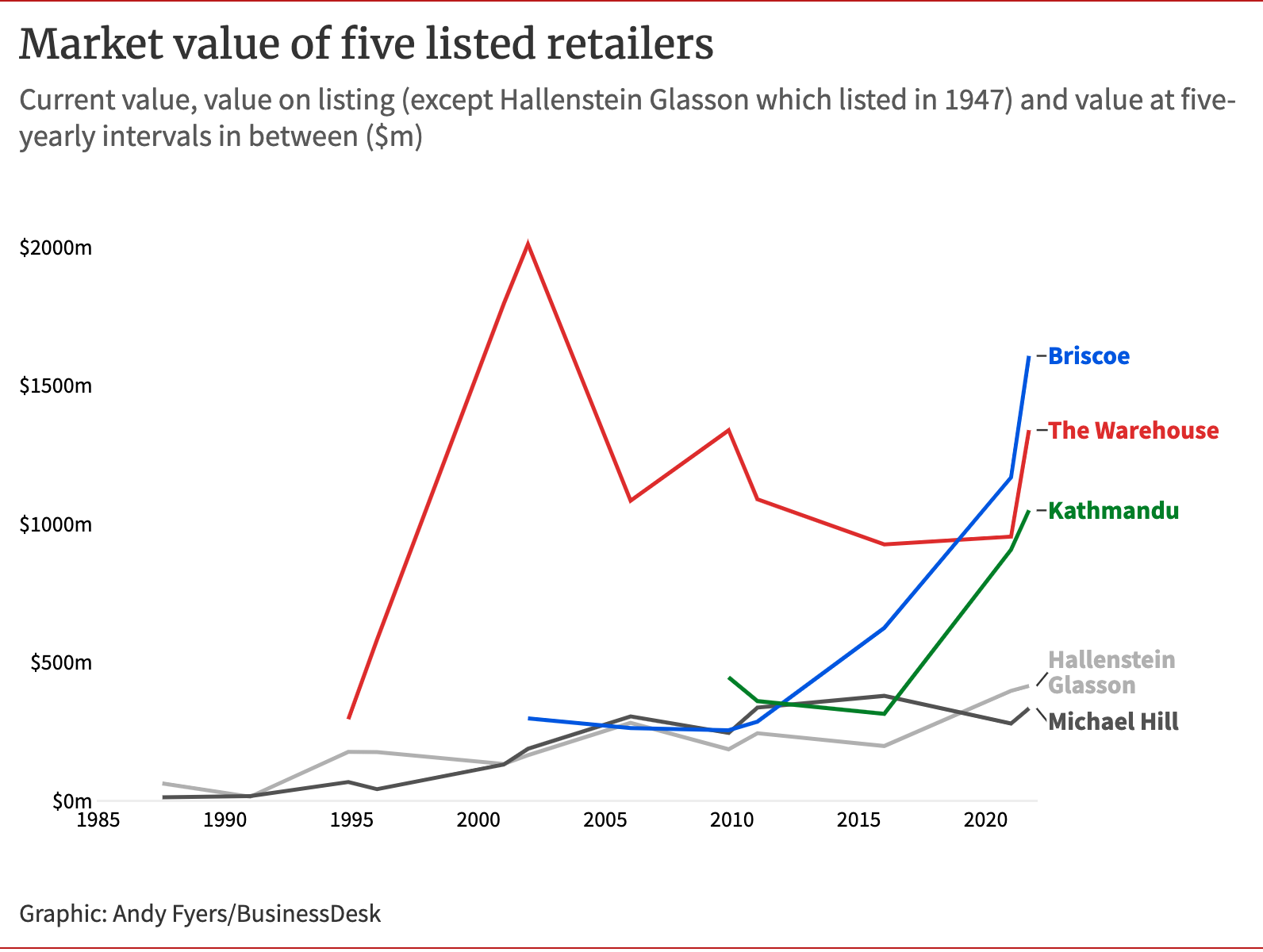

When Briscoe was listed in December 2001, it had an IPO value of just $210 million. This was slightly ahead of the market values of Michael Hill and Hallenstein Glasson at the time, but 90% below Stephen Tindall’s The Warehouse, which was worth $2.01 billion in late 2001.

Briscoe is now the most valuable NZX retailer, well ahead of The Warehouse, and of Kathmandu which listed in November 2009. Meanwhile, Hallenstein Glasson and Michael Hill are now a long way behind.

Duke’s 77.1% Briscoe shareholding is worth $1.22b and he has received almost $0.5b in dividends – mostly tax-free – since Briscoe listed almost 20 years ago.

This $1.7b plus return has been generated from an initial investment of just $2.

Who is Rod Duke?

Duke was born in Adelaide and had extensive experience in the Australian retail industry and was managing director of Norman Ross before coming to Auckland.

Norman Ross was started by Gerry Harvey and Ian Norman in 1961. Alan Bond acquired the company in 1982 and quickly sacked Harvey and Ross.

The two retailers went on to establish the hugely successful Harvey Norman.

Duke made a smart decision to leave Norman Ross in 1988, and cross the Tasman because Noman Ross went bust in 1992.

Duke was enticed to New Zealand by Hagemeyer, the Dutch-based international company, which had control of Briscoe since 1977. Duke’s mission was to return the NZ retailer to profitability and prepare it for sale.

In November 1989, Briscoe Group was re-incorporated, with 100 shares issued to Hagemeyer at $1 each.

In January 1990, 99 of these 100 shares were transferred to the RA Duke Trust for just $1 and in July 2001, the remaining share was acquired by Duke’s trust for $1.

So, Duke now owned 100% of Briscoe at an initial cost of just $2. Shortly before floating the company on the NZ stock exchange in December 2001, the 100 shares held by Duke were split into 170,000,000 Briscoe shares.

Sinead Boucher’s purchase of Stuff for $1 is another example of an overseas owner selling its shareholding to an NZ chief executive for a nominal sum.

IPO

Briscoe issued an initial public offering (IPO) prospectus in November 2001 for the sale of 40 new million shares at $1.00 each.

In addition, Duke had agreed to reduce his holding from 170 million to 157.5 million shares through the sale of 2.0 million shares to two Briscoe executives and 5.25 million shares each to Gerry Harvey and Harvey Norman Holdings.

These transactions connected Duke back to his Australian retail roots, and Harvey agreed to join Briscoe's board.

This link was also important because Gerry Harvey and Harvey Norman Holdings controlled the ASX listed Rebel Sport, and Briscoe had a franchise agreement with the Australian company which was due to expire in March 2003.

The $40m of new equity was to be used this way:

- $10m for the expansion of Rebel Sports from 11 to 21 outlets.

- $9m to partly fund a dividend payment to RA Duke Trust.

- $3m to modernise the 28 Briscoe Homeware stores.

- $18m for unidentified expenditure.

The IPO was an enormous success, with demand far exceeding supply.

Briscoe listed on the NZX on December 14, 2001, with its shares closing at $1.41 compared with their $1.00 issue price. A total of 7.23 million shares, representing 18.1% of the shares sold to the public, were traded on day one.

Performance

The company reported net earnings after tax of $17.5m for the January 2002 year, compared with the prospectus forecast of $15.1m, and $23.6m for the January 2003 year, compared with the prospectus forecast of $17.7m.

Briscoe’s earnings performance has continued to impress, except for a sharp decline in its January 2009 year profit because of the negative impact of the global financial crisis (GFC) on retail spending.

The company reported net earnings of $73.2m for the January 2021 year, and its January 2022 year result should be well in excess of the January 2021 year figures, because the company reported a 69.6% increase in net profit for the six months to July 2021.

Briscoe has performed extremely well for several reasons:

- Rod Duke learned his trade in the competitive Australian retail sector and has adopted several successful Australian strategies on this side of the Tasman.

- Briscoe uses a vendor refills system, where suppliers are responsible for maintaining stock levels within its stores. This reduces the company’s working capital requirements and gives Briscoe a huge advantage over smaller competitors.

- The group has aggressive advertising and promotion strategies, with suppliers paying up to 50% of the company’s advertising under advertising rebate schemes.

- Duke anticipates what shoppers are going to buy before they know themselves, and he nudges them towards his offerings with aggressive advertising and promotional campaigns.

- He has also been fortunate that New Zealanders have put a huge emphasis on their homes, particularly during the covid-19 lockdowns, and have been spending an increasing proportion of their incomes on household items.

Other retailers

The following table shows the key performance figures for the five listed NZX retailers.

| Listed NZX retailers | ||||

|---|---|---|---|---|

| Revenue ($m) | Gross margin | EBIT margin | Online sales |

Briscoe | 702 | 43.8% | 16.5% | 18.8% |

Hallenstein | 288 | 58.8% | 13.6% | 21.9% |

Kathmandu | 802 | 58.3% | 5.7% | 15.7% |

Michael Hill | 492 | 60.6% | 2.9% | 5.0% |

The Warehouse | 3,173 | 32.6% | 3.7% | 11.4% |

Briscoe has 88 stores, Hallenstein Glasson 114, Kathmandu 325, Michael Hill 290 and The Warehouse 257 stores.

Briscoe’s gross margin – the difference between its revenue and direct cost of goods sold – is lower than three of the other four retailers, but its ebit margin is higher.

This partly reflects the strategy of having some suppliers responsible for stock held in Briscoe stores, and for additional costs, particularly advertising and promotion.

The company’s advertising rebate schemes can give a real boost to its ebit margin.

It's worth noting that the giant US homeware company, The Home Depot, has an ebit margin of 9.2%, compared with Briscoe’s 16.5%.

Ebit margins, which are a major performance indicator, have changed over the past decade:

- Briscoe’s ebit margin has risen from 7.8% in its January 2011 year to 16.5% in the latest year.

- Hallenstein Glasson’s margin has remained static at 13.6%.

- Kathmandu’s margin has plunged from 19.7% to 5.7%.

- Michael Hill’s margin has declined from 8.2% to 2.9%.

- The Warehouse’s margin has fallen from 7.4% to 3.7%.

Rod Duke is clearly the king of the NZX listed retail sector for long-term strategy, execution and sharemarket performance.

Kathmandu

Between 2015 and 2019, Briscoe bought 48.0 million Kathmandu shares, now representing 6.77% of the activewear company, for $87.85m.

This has arguably been Duke’s only mistake because these shares are now worth less — $70.1m.

Nevertheless, Duke has been a major NZ business success story, even though he hasn’t gone down the same path as most companies.

Notably, Rosanne Meo has been chairman since the company listed nearly two decades ago, and there are no lawyers and accountants on its board.

In light of Briscoe’s huge success, it is disappointing that the company has only 4,048 shareholders compared with 5,003 shortly after it listed in December 2001.

Unfortunately, too few investors have taken part in Briscoe’s success, even though the demand for its IPO shares far exceeded the supply.

Disclosure of interests; Brian Gaynor is non-executive director of Content Limited, the publisher of BusinessDesk, and of Milford Asset Management.