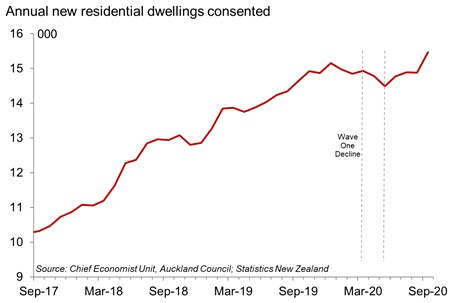

Auckland Council says the city will now need 'only' 15,000 new homes to fill its current housing backlog, 25 percent less than it forecast a mere few weeks ago.

In a note to councillors this week following the release of the latest dwelling consent numbers for September, Auckland Council chief economist David Norman said while the city still had a housing shortfall, the new level of building consents, combined with more accurate population data, meant the city probably needed another 15,000 homes to catch up.

This compares with earlier estimates of a shortfall of 20,000 houses in the council's end of year report.

The report noted the 2016 unitary plan had identified 15,000 additional hectares for urban growth, largely through ‘urban intensification’ by allowing more townhouses, apartments and other attached dwellings.

The council is also cracking on with getting new dwelling consents signed off, with the 1,734 new approvals in September taking the annual total to a record 15,470.

Even in the context of the plan for more intensive builds, Norman said the latest numbers had included an “unusually large number of apartments”, with about 56 percent of all new dwelling consents either townhouses or apartments as opposed to stand-alone homes, though this was "consistent with development patterns in recent months."

He said the surge in house prices, prompted by low interest rates, the removal of loan-to-valuation ratio restrictions and the "perceived relative safety of owning a home", will tend to have a stimulatory impact on development activity.

"But, it's safe to say that no one anticipated house selling and development markets would shrug off the covid blues as quickly or spectacularly as this."

Strong sales

Meanwhile, the city’s biggest realtor, Barfoot and Thompson, reported the strongest residential sale numbers last month for four years, with an average price of $1.05 million across 1,319 sales.

Managing director Peter Thompson said it reflected people's confidence in the medium term future of the city's property prices.

The positive sales environment, he said, was bolstered by a combination of new listings, which at 2,119 for the month were the highest in any month for more than 3 years and low interest mortgage finance being readily available, leading to "fierce competition developing among buyers."

This resulted in the average price in October in Auckland increasing by 4.8 percent on September and the median price climbing 4 percent, to $967,000. Annualised, that reflects an average price increase of 11.3 percent and median price climb of 14.4 percent.

While there is strong interest in property from first home buyers and investors, Thompson said the "vast majority of homes continue to be bought by existing property owners who are moving forward with their lifestyle decisions in terms of their housing ambitions."

“For existing homeowners the financial gap between their present and next home is manageable and they are taking advantage of low interest rates to transition to the next stage of their lives."

Costs

But at those levels, and taking into account the current average Auckland household income of $141,913, versus $114,669 for the rest of the country, the house price to income ratio in the city is about 7.6 times, versus 6.4 nationally, according to Infometrics numbers.

Still, that ignores interest rates. Kelvin Davidson, senior economist with Corelogic, said when you look at mortgage servicing levels, Auckland is currently at 37 percent of household income required to service debt. While higher than the national 32 percent, that figure is "still way below Auckland's peak of 51 percent in 2016."

There is also no doubt investors are making an impact on the market, with the latest analysis by economist Tony Alexander noting a net 59 percent of real estate agents are seeing a proliferation of investors at their open homes, well up from the 16 percent seen immediately post lockdown in June.

'Fear of missing out' is also an emerging theme with a clear majority of buyers, brokers say. Auctions are also the order of the day, with almost half of agents surveyed seeing a spike in that as a preferred sales option.

Davidson sounds a word of warning: "With values rising, affordability will tend to deteriorate again from here, and even after the improvement since 2016, Auckland is still less affordable than the rest of the country."