Equity trading on the NZX has skyrocketed as first-time investors have taken to app-based investing during the pandemic chaos.

Trading on the New Zealand exchange surged in April as investors bought into the crater left behind by the market’s history-making plunge in late March.

The number of equity trades was up more than 360 percent at 1.3 million, with an increase in low-value trades cutting the average on-market trade size in half – to $2,463.

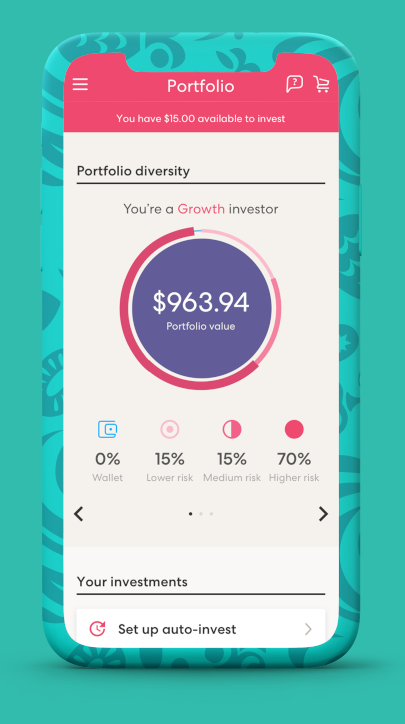

Peter McIntyre, investment adviser at Craigs Investment Partners, said while volumes from retail brokers had been high, the big moves were coming from institutional investors and the advent of pocket-trading platforms like Sharesies.

Pent up demand had been building as new investors have been waiting for the bull market to pull back before buying in, he said.

“We’ve seen the likes of Sharesies platforms say they have been inundated with new accounts and you can see it in the share trades going across your screen with single-digit share numbers,” McIntyre said.

Global phenomenon

“That's quite encouraging from the industry’s point of view – you potentially have a lot of young people getting involved and able to ‘pocket trade’ off their phones.”

Leighton Roberts, co-founder and acting chief-executive of Sharesies, said there was a retail trading phenomenon occurring around the world, as more people were accessing share markets through app-based trading platforms.

Roberts said 50,000 new customers have joined Sharesies in the last two months, with almost three-quarters new to trading.

Despite the platform not existing a year ago, the platform has almost 150,000 customers and makes up roughly 23 percent of all cash trades on the exchange.

“People are coming in, eyes wide open, knowing we haven’t seen the end of the volatility yet,” Roberts said. “But probably some time in this period will be the best time to invest in the next 10 years and people are aware of that to some extent.”

Although the 1987 stock market crash scared a generation away from equity markets, the recent crash has enticed a new generation to buy in.

Having listed companies making front-page news had acted as a catalyst for people stuck at home concerned about their financial future to invest, he said.

Breakdown review

NZX’s first-quarter revenue rose 18 percent this year, as a four-fold increase in trading volumes created market records.

The sheer volume of trades created breakdowns in the exchange’s clearing and settlement system, causing frustration with stockbrokers. Accounting firm EY has been appointed to complete an independent review and get the problems under control.

New retail investors have been driving much of this drastic increase in trading, with app-based platforms allowing them to access the share market with much smaller transactions – the average trade on Sharesies is between $500 and $600.

Roberts said the easier access to the market was helping to boost liquidity.

“Markets are supposed to behave as liquid environments and the NZX hasn’t for some time,” he said.

“I think it bodes well for New Zealand’s capital markets and companies because there are going to be a lot of companies looking for shareholder support and now there are another 150,000 educated New Zealanders who can help that down the track.”

McIntyre said while new investors trading through apps was “significant,” it was institutional traders buying and selling big-name companies like Auckland International Airport and A2 Milk that were the biggest drivers of volumes.

“Definitely those pocket-trade platforms have been a contributor but so have institutional fund flows; a lot of that turnover trade volume has been on sell days as well,” he said.