Aotearoa New Zealand's startup and venture capital scene has a bit of a problem, with some investors taking too much equity for their money, leaving founders with little incentive to put in the effort it takes to grow their businesses.

On top of that, using equity to attract talent is near-impossible when it just lands that talent with a big tax bill the day they start.

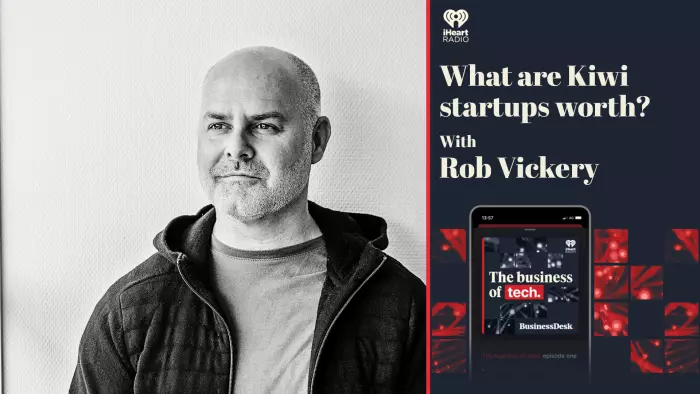

Rob Vickery, founder and managing partner of Hillfarrance Venture Capital, digs into this issue and outlines what he thinks should change to create a stronger and better startup ecosystem in NZ.

We also dig into the untimely death of Sunfed and what it says about the alternative meats industry, the wild story of Unity and Wētā Digital, and the huge success of Canva.

Subscribe on iHeart Radio or wherever you get podcasts.

Reading list

In the episode

- Realistic or undervalued? Putting a fair value on our startups - BusinessDesk

- Hillfarrance Village News

- My Net Worth: Rob Vickery, founder of Hillfarrance Ventures - BusinessDesk

- Unrealistic investors are frustrating the future of food - The Press

- Wētā Digital deal ‘bananas’: $2.2 billion deal described as terrible for Unity - New Zealand Herald

- Blackbird nets $800m payday from Canva share sale - Australian Financial Review

From around the web

- Oxford shuts down institute run by Elon Musk-backed philosopher - The Guardian

- It’s time to retire the term “user” - MIT Technology Review

- The myth of the mobile millionaire - The Atlantic