We presume Larry Page’s preferred search engine is Google. And that Elon Musk drives a Tesla. And that whether he’s going to Martinique or into space, Richard Branson flies Virgin. And that Jeff Bezos shops at Amazon. Well, maybe we can’t be so confident about the last one.

But in general, it is accepted wisdom that it is important for the boss of any company to use what they sell. After all, who should know better just how a product or service is supposed to work, how it is serving its market and what might need to be improved?

The practice is called dogfooding, based on a possibly apocryphal story about the boss of the Kal Kan pet food company in the US, who it was claimed ate a can of his firm’s product at shareholder meetings, although that may have just been his way of keeping meetings short.

The term, possibly because of its slightly louche aura, isn’t widely used here, but the practice is certainly well established.

In the course of preparing this article, I contacted three makers of dog food and asked them about their policies on actual dogfooding. Two did not reply and the third said they would think about making a response. If they did, they apparently thought better of it, because they didn’t get back to me.

I did speak to three other bosses about how they used dogfooding in their work and its benefits.

Chris Quin, CEO, Foodstuffs North Island

“We don’t call it dogfooding,” says Quin, who actually sells quite a lot of dog food through his cooperative’s Pak’nSave, New World and Four Square outlets. “But we do a lot of it.”

Not only does Foodstuffs actively source feedback from its team of 24,000 people representing 30 nationalities, but Quin himself can be found pushing a trolley “probably a couple of times a week, whether it’s because I’ve popped in to pick up a bottle of wine or am on a decent shopping mission”.

Family is another dependable source of feedback. “A funny thing about dogfooding is that when my wife, Sue, says, ‘They were out of this or that,’ and I go, ‘I’ll do something about it,’ I get, ‘Don’t make a fuss! I don’t want them to think I’m spying on them.’ I say: ‘You’re not spying, you are helping.’”

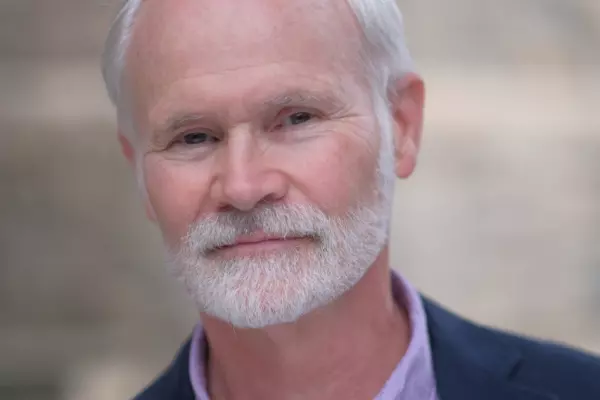

Foodstuffs North Island CEO Chris Quin is a regular 'dogfooder'.

Foodstuffs North Island CEO Chris Quin is a regular 'dogfooder'. Dogfooding homework for the wider Foodstuffs team includes everything from giving feedback on whether the cheese is stretchy enough on the instore deli pizzas to testing the Pak’nSave online shopping app. “The way online works, you look up what is in store and in stock,” says Quin. “We have our own people using those systems.” This also makes it possible to allow for the wide range of digital literacy that customers will have.

Quin can’t imagine it any other way. “If you are part of a brand, then you are all in. You are loyal to it, you shop with it, and you make your choices there. I think loyalty to the brand you are employed by is crucial. Also, you should want to make it the best you can. Don’t walk past spilt milk.” (He means that literally.)

He even finds himself “facing up” aisles if he notices it’s needed – turning products around so they all have their labels facing front and lined up.

His phone is his dogfooding friend: “I’ve never taken so many photos at the supermarket. You see something and think, ‘That is fantastic,’ or ‘That is not what is expected.’ You almost have a to-do list there on your phone.”

As this suggests, Quin’s approach to dogfooding isn’t just about finding out what is wrong. His philosophy could be summed up as: if it’s not broke, tell the person concerned they’re doing a good job.

Nick Crawford, senior client director, The Private Office

Do investment advisers put their money where their clients’ mouths are? They can dish it out, but can they take it? Well, yes. In the case of Nick Crawford, a financial adviser with a boutique wealth management firm in Auckland, one way he practises dogfooding is by having his own independent financial adviser.

“He is an ex-colleague in the UK,” says Crawford. “He and I started working as financial advisers on the same day at the same company. When I have a big financial decision to make, I still talk it through with him.”

He explains that financial planning advice and investment advice are distinct. The advice is what – ideally – provides the money to pay for the plan.

“I am good at advising people what to do in their situations and with their own money, partly because I am completely detached and can look at their situation objectively,” says Crawford, whose firm specialises in advising people who get windfalls, such as Lotto winners, “The reason I have my own adviser is that I think it is impossible for people not to have an emotional attachment to their own money.”

Investment advisor Nick Crawford. Photo: The Private Office.

Investment advisor Nick Crawford. Photo: The Private Office.

Situations where he has sought help include: deciding to make the leap from employee to co-owner of his company; a decision about whether to buy an investment property; and deciding whether to move his retirement savings from the UK to New Zealand.

But when it comes to the ultimate financial dogfooding – deciding where to put the money he has to invest – “I use the same investments we recommend as the vehicle to achieve our financial plans. My portfolio is managed the same way as every client’s. We pay for independent research and funds monitoring. If a researcher came and said this fund should be changed, we would speak to all our clients and make recommendations, and I would receive that recommendation, too.”

There is one important difference between Crawford and many of his clients. He hasn’t won Lotto yet. “Although I would be the perfect person.”

Unfortunately, “I have no control over how the investment markets themselves perform. There is no secret book where advisers know what is going to happen before the public.”

Neil Little, former managing director, Davis Funerals*

It’s a question funeral directors are often asked: do you do the funerals for your own family members? Almost invariably, they do.

“It’s only happened to me twice directly,” says Aucklander Neil Little. “One was my dad in 1992 and the other was my father-in-law.”

Even though he wasn’t doing the main part of the organising, he found himself “thinking about the practicalities and what needed to happen rather than what had happened. I was too young to look after Dad’s, but it’s a tricky thing with our industry. You click into funeral director mode.”

Funerals are really two things: the preparation, which includes embalming, planning a service and any number of other details, and the event itself. “You have to make a decision about how involved you want to be. I did stay away from the preparation. He was embalmed but I didn't do that. Some people do. I would find that very difficult.”

Funeral director Neil Little.

Funeral director Neil Little.

Has he found himself consciously dogfooding at any stage of family funerals?

“The whole experience with Dad definitely altered how I approached things in the future. It changed how I dealt with my father-in-law’s funeral. I was very conscious about trying to be a mourner at that funeral.”

Seeing things from the client’s perspective made all the difference.

“It makes you realise what is important to people in terms of what we do. We can be accused of taking over and doing too much. It made me understand it is best for us to do the admin stuff so the family can do other things. Maybe let them talk to the florist, rather than just having the funeral director order the flowers.”

Little thinks it is important for any funeral director to have had this level of experience with their role. “It’s remarkable that those are the only two very close people I have lost in 30-odd years as a funeral director. It is a completely different experience when you are having that emotional connection.”

*This writer’s brother.