Bob Campbell, MW talks to Marcus Atkinson, head of fine and rare wines at Webb’s auction house in Auckland, about buying wine for investment, not drinking.

Let's get straight to the point, is wine a good investment?

“Yes, particularly during times when the sharemarket is fairly volatile, as it is right now.”

What advice would you give to potential wine investors?

“Buy wines that you don’t want to drink, so you are not tempted to sample before you sell. On the other hand, some investors choose wines that they would like to drink in case their bottles do not rise in value. In fact, most investors choose a mix of both. They buy wines to drink and wines to hold and resell. Investment wines should be stored in a temperature-controlled environment to maximise resale value.

“High-quality wines are more likely to gain in value and are ultimately easier to sell. Money makes money. Choose glamour brands such as Te Mata Coleraine, Stonyridge Larose, Bell Hill, Puriri Hills, Dry River, Ata Rangi and Felton Road. Champagne is a safe bet if it’s vintage dated and from a well-respected house. Bordeaux reds from a good vintage with high scores from critics such as Robert Parker or Jancis Robinson are obvious targets for savvy investors. Fortified wines are not a big thing in this country, although they can be purchased relatively cheaply here compared to larger wine markets. Check the wine’s fill level – it’s an indication of how well the wine’s been stored. Wines in original wooden cases help to authenticate the wine and reduce the risk of forgery.”

Do you encounter many forged wines?

“None yet, although we’re always on the lookout for forgeries. For that reason we open wooden cases to check the contents. I did once find a second layer of lesser wines under the correct top layer.”

I asked Atkinson how he’d coped during the covid-19 lockdown. “The wine department was the only division of Webb’s to be recognised as an essential service and therefore the only one to remain open.”

He adds that business was down, as expected, but he was fully employed picking and packing lots. During lockdown, he also introduced a ‘Buy Now’ facility, which is continuing.

“Online auctions are gaining massively in popularity and are showing a higher result against reserve prices than traditional live auctions,” he says.

Wines under the hammer

Wine auctions are fun. I have yet to peruse a wine-auction catalogue without seriously considering making a bid (or two). I have purchased wines for investment but in every case have chosen to drink the wine before I could send it off to be auctioned.

I bought a case of Penfolds 1997 RWT Shiraz, when it was released, for around $80 a bottle because it was billed as a “lieutenant to Grange” and was the very first vintage. If I had any left it would now be worth around $200 a bottle. I don’t. But I do have the memory.

Bob's Top Picks

Investment wine

Ata Rangi 2017 Pinot Noir, Martinborough $75

One of the country’s best examples of pinot noir, which has demonstrated an ability to age magnificently. Best of all, this iconic label is underpriced. Supple, accessible wine with plum, dark berry, spice/anise, dried herb/savoury and spicy oak flavours. Buy before they put the price up.

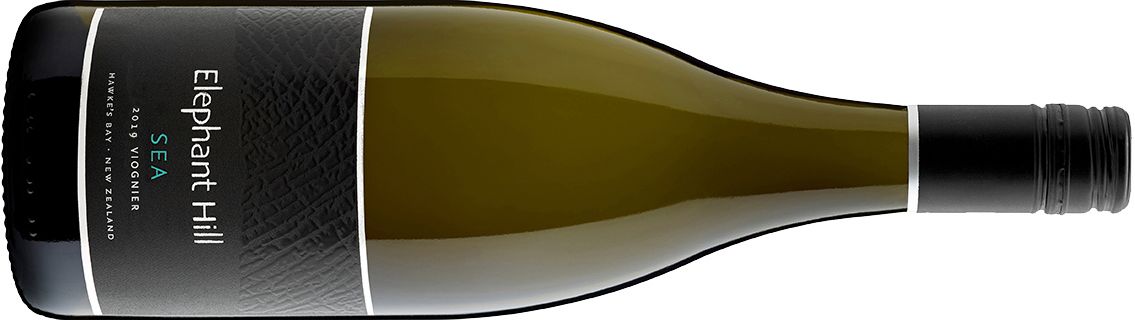

Weekend Wines

Top white

Elephant Hill 2019 Sea Viognier, Hawke’s Bay $34

From a coastal vineyard at Te Awanga. It may be the power of suggestion but I swear I can smell the briny scent of the sea in every glass. Sixty percent barrel fermented. Left on the lees for seven months. This is a delicious viognier with ripe pear, apricot and honeysuckle flavours. Just drink it.

Top red

Grasshopper Rock 2018 Pinot Noir, Central Otago $40

From Central Otago’s hottest vintage on record, this delicious wine may be a peep into the future. Fruity and accessible pinot noir with ripe cherry, plum and raspberry flavours laced with spice and supported by French oak. Lovely purity and energy. Drink it or keep it – your choice.