Markets sponsored by

Markets News

Markets

Market Close

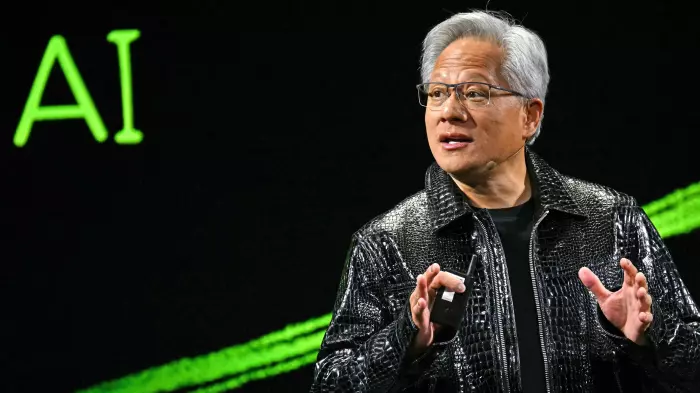

Nvidia earnings boost markets, NZ sharemarket closes up

The S&P/NZX 50 Index closed up 0.84% or 112.502 points.

Tom Raynel

20 Nov 2025

Markets

AFT forges ahead with China iron injectable deal

Oldest iron products in Aussie are booming, while new iron injectable gets China boost.

Rebecca Stevenson

20 Nov 2025

Markets

Meridian says hydro is key to energy security and affordability

Meridian says it has learnt lessons from winter 2024.

Ian Llewellyn

20 Nov 2025

Infrastructure

Goodman Property looks to full-year earnings growth

The REIT lifts interim profit, as well as per-unit earnings and net tangible assets.

Andy Macdonald

20 Nov 2025

Markets

Turners accelerates profit, diversification delivers

Auto group says it's on track for 32 cents per share full year dividend.

Rebecca Stevenson

20 Nov 2025

Primary Sector

The a2 Milk Company ups revenue guidance

Its annual meeting is in Auckland on Thursday.

Riley Kennedy

20 Nov 2025

Markets

My Food Bag reports slight revenue increase

The meal kit company says its gross margin is lower at 48.5%.

Staff reporters

20 Nov 2025

Markets

Air NZ backs mission-critical startup OneReg

Airline's support boosts regulatory compliance startup's global ambitions.

Pattrick Smellie

20 Nov 2025

Primary Sector

Napier Port takes a big bite as Hawke’s Bay bears fruit

Its full-year results were released on Wednesday.

Riley Kennedy

20 Nov 2025

Markets

Hidden gems for investors outside tech darlings

AI may be getting all the attention but leaves opportunity for investors, experts say.

Rebecca Stevenson

20 Nov 2025

Your company has a subscription

Team

To join your company account for BusinessDesk and enjoy full access, enter your email and we’ll send you details