New Zealand King Salmon's shares rose today after a revised earnings guidance as the local market edged up in anticipation of the earnings season, which kicks off on Monday.

The S&P/NZX 50 index rose 60 points, or 0.5%, to 12,178.76. Turnover was $131.4 million.

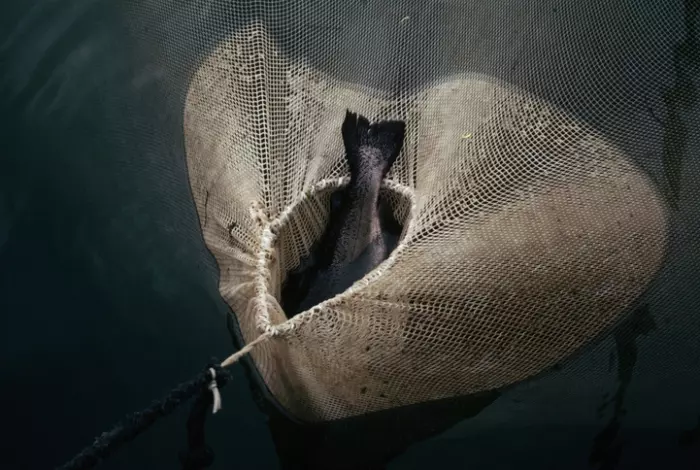

A better-than-expected end to its production season saw NZ King Salmon revise its earnings guidance today and in turn saw its share price bounce.

The listed salmon farmer provided a trading update this morning, which said the salmon harvest at its Ruakaka farm, in the Queen Charlotte Sound, had outperformed expectations.

Instead of expecting a loss of earnings before interest, tax, depreciation and amortisation (Ebitda) of between $8m and $12m, the company revised the loss to be between $3m and $5m.

NZ King Salmon ended the day up 9.5% to 23 cents.

Energy retailer Contact Energy, the first big company to report its earnings next week, was up 0.8% to $7.78 today.

Fellow energy retailer Manawa Energy fell 1.6% to $5.51, along with Meridian Energy, down 0.09% to $5.39. Genesis Energy edged up 0.7% to $2.87 and Vector rose 1.2% to $4.30.

Logistics company Mainfreight lifted 0.5% to $75 today after falling 3% yesterday.

Devon Funds’ Greg Smith said Mainfreight had been a “huge covid beneficiary” that had been helped by closed borders and a surge in freight rates.

“These tailwinds have dissipated significantly,” he said.

“A question now for the company is the extent to which it can increase prices to offset inflationary pressures.”

Forsyth Barr analysts Andy Bowley and Paul Koraua wrote in a report today that Mainfreight had announced an “uncharacteristically, albeit partly anticipated, subdued trading update”.

“This stellar earnings growth momentum may have (temporarily) come to an end, but the growth option remains."

Forsyth Barr now expects Mainfreight’s profit before tax for the year ending March to be $585.9m, a fall of almost 4% from their previous $609m forecast.

Rival logistics company Freightways also rose, by 1.9%, to $9.60.

Precinct Properties jumped 5.6% to $1.32 and turned over $4.3m over the day.

Fonterra Shareholders' Fund units edged down 0.3% to $3.22, A2 Milk was up 0.3% to $7.50 and Synlait rose 0.6% to $3.48.

ASB economist Nat Keall wrote in a commodities weekly report this afternoon that dairy prices had a “decent comeback” at this week’s global dairy trade auction, which had been boosted by stronger demand out of China.

He said it was positive for ASB’s $8.65 per kgMS farmgate milk-price forecast for the present season, but was more pessimistic on the outlook for the global economy this year.

“Our CBA [Commonwealth Bank of Australia] colleagues expect recessions among many of the world’s major economies.”

The NZ dollar was trading at 63.27 US cents at 3pm in Wellington today, up slightly from 63.09 US cents at the same time on Wednesday.