The NZX appears to still be trading despite its website crashing briefly for the fifth day in what appears to be another wave of cyber attacks.

The exchange operator announced the market would open this morning with new defence from Akamai Technologies and a backup plan to release market announcements in the event of another attack.

The NZX said it had agreed with the Financial Markets Authority for “contingency arrangements for the release of, and access to, market announcements” designed to allow trading to continue if website was offline. The details of this alternate plan have not been made public.

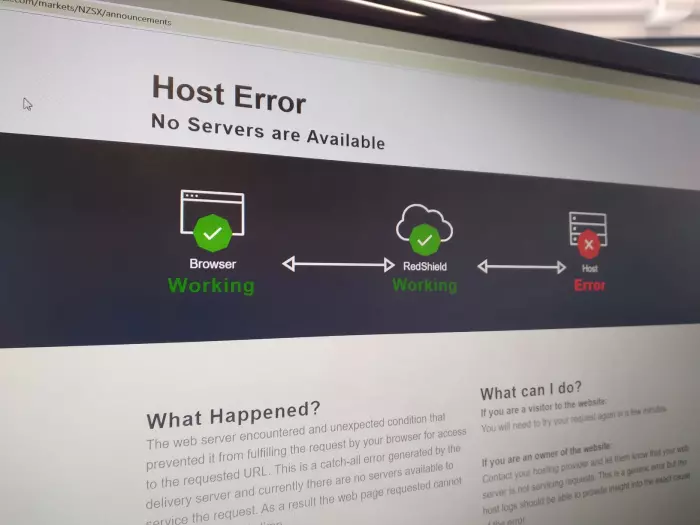

Trading opened as normal today, with the S&P/NZX 50 Index recently down 0.2 percent at 12,070.11. NZX's website crashed at about 10.15am, and while it has returned intermittently, it was down at the time of publication. Refinitiv data shows trading is continuing.

Last week, a string of cyber attacks took the NZX’s market announcement system offline for four consecutive days, disrupting 13 hours of trading and triggering intervention from the Government Communications Security Bureau.

“NZX has been advised by independent cyber specialists that the attacks last week are among the largest, most well-resourced and sophisticated they have ever seen in New Zealand,” the NZX said.

While the NZX and the GCSB have been unwilling to comment on what has motivated the attack, the US Federal Bureau of Investigation’s cyber division released an advisory which warned cyber criminals using the name 'Fancy Bear' had threatened thousands of institutions “across the globe” with distributed denial of service attacks if a ransom was not paid.

The FBI said most were never attacked but “several prominent institutions” did report the group followed through with attacks that affected operations.

Andrew Little, the minister responsible for the GCSB, told BusinessDesk on Friday that work would continue through the weekend, with the real test to come on Monday when trading opens at 10am.

Trading is expected to be heavier than usual today as the MSCI Equity Indices completes its quarterly index review and updates its portfolios.