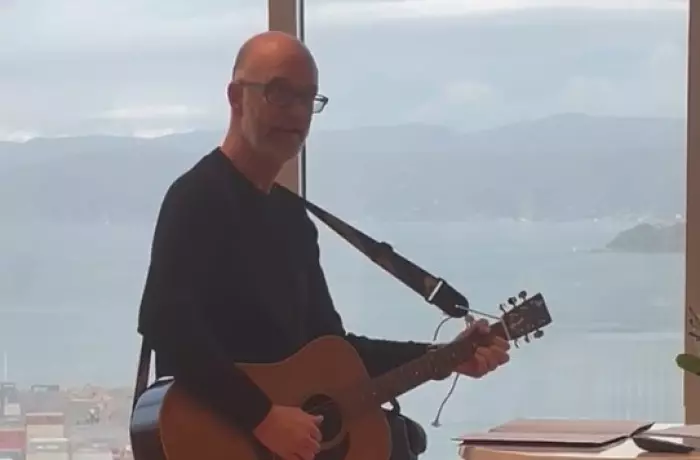

Takeovers Code: the Musical

Every 21st birthday party is improved by a singalong, as demonstrated at a function in Wellington this week to celebrate 21 years since the creation of the Takeovers Code.

With just four hours to prepare, multi-talented Law Commissioner Geof Shirtcliffe whipped out his guitar and came up with what threatens to become an instant classic in the investment banking community.

As Shirtcliffe explained, there’s nothing quite like a tune you can hum along with to guide a busy lawyer through any thicket of legal complexity.

Entitled ‘The Fundamental Rule’, Shirtcliffe’s rendition recalls his early career experience as principal code drafter for the first chair of the Takeovers Panel, the legendary (and contrary to the original version of this item, very much alive) John (Collingwood) King.

Aficionados should watch Geof’s excellent performance in the video above but, for those short of time, the chorus is really as much as you need to know about the operation of the code, sung to pretty much any campfire melody:

“No holding or control increase past 20%,

Whether by yourself, or together with your friends,

Except under Rule 7.

But though Rule 7’s pretty cool….

Nothing kicks arse, like the Fundamental Rule.”

Takeovers Panel chair Carl Blanchard showed a steady hand as videographer. OTM thanks both Blanchard and Shirtcliffe for being great sports and letting us republish this tribute.

Salmon-wrangler no more – outgoing NZ King Salmon CEO Grant Rosewarne in happier times. (Image: NZME)

Salmon-wrangler no more – outgoing NZ King Salmon CEO Grant Rosewarne in happier times. (Image: NZME)

Salmon king seeks new gig

There will be no more swimming upstream against opposition to ocean salmon farming for NZ King Salmon’s former CEO Grant Rosewarne, who left without warning this week after 13 years at the helm.

The Australian with a strong background in high-value brand creation was a bold thinker – he once took a delegation to look at fish farming in Norway – and was never scared of a pithy quote.

There were ministers who wished he’d be more polite, but Rosewarne was easily frustrated at how difficult aquaculture is in New Zealand, particularly when it produces higher value protein than pastoral farming, using tiny amounts of space.

Particularly galling must be that NZ King Salmon is within an ace of getting its long-sought resource consent to farm fish in the colder, deeper waters of Cook Strait. There it hopes to overcome the growing problem of excess salmon deaths in its shallower Marlborough Sounds fish farms – a direct impact of climate change that has devastated the company’s earnings and forced recapitalisation.

A decision on the Cook Strait project, dubbed Blue Endeavour, is due for release some time this month, just as Rosewarne walks out the door, having taken years longer than expected.

It’s not 100% clear whether he was pushed or fell, but signs of shareholder disgruntlement could be discerned at this year’s annual meeting where, without explanation, Rosewarne was not reappointed as a director.

Local tall man Bernard Hickey blocking out the sun on the telly. (Image: TVNZ)

Local tall man Bernard Hickey blocking out the sun on the telly. (Image: TVNZ)Orr cuts Hickey down to size

For the first time in our collective memory, Reserve Bank governor Adrian Orr yielded the podium to his deputy, Christian Hawkesby, at the press conference after the central bank released its latest financial stability report.

The press conference was a week after Orr had addressed the Institute of Finance Professionals New Zealand and left the stage without taking questions.

Perhaps the governor is taking a circumspect approach during the process currently under way to determine whether or not he will be reappointed next year.

Finance minister Grant Robertson has confirmed the issue is live, while National party leader Christopher Luxon has suggested Orr’s term should be extended for a year to prevent any unnecessary financial market uncertainty caused by the transition coinciding with an election year.

Not that Orr remained silent through the press conference – that certainly would have been highly unusual.

He took one question from a woman seated behind long-time Reserve Bank media conference stalwart Bernard Hickey. Orr made it clear he was having difficulty seeing the woman through Hickey’s head.

“Sorry, Bernard. Tall people to the back, please,” Orr quipped.

Ever obliging, Hickey ducked down to desk level to afford the governor direct line of sight to his interrogator.

Tiny land parcels land big cheques for Bryan Mogridge and Mark Wheeler. (Images: Clearspan Property)

Tiny land parcels land big cheques for Bryan Mogridge and Mark Wheeler. (Images: Clearspan Property)Another payday for cell site owners

Few will have heard of Clearspan Property, a privately-held company that has been quietly snaffling up land under cellphone towers the length and breadth of New Zealand since 2007.

However, the company has just delivered a healthy payday for ubiquitous business figure Bryan Mogridge and less well-known Mark Wheeler, who are listed as 20.3% and 78.12% shareholders respectively.

According to Companies Office filings, NYSE-listed American Tower Corp has just paid $50 million for Clearspan’s assets. That equates, prior to any costs, to $39m for Wheeler and $10.15m for Mogridge, who is chair of aged-care provider Bupa, a director of Mainfreight and executive chairman of Nelson fish oil extracts company Seadragon, a few roles that barely scratch the surface of his involvements.

A search of Mogridge’s name brings up 11 pages of results on the Companies Office website.

Clearspan was born out of a vision by the late Leigh Davis, a former Fay Richwhite staffer (and occasional poet) and CEO of Jump Capital, to buy land under cellphone towers and handle the land leases with carriers or third parties directly.

The company owned some 150 of the 4,000 or so such mobile sites around the country when it was challenged in court by Spark in 2018 over whether it was dodging Resource Management Act obligations to get resource consents.

“With some deft legal footwork, Clearspan is achieving a de facto subdivision of land where towers are sited while avoiding the legal definition of a ‘subdivision’ as defined in the Resource Management Act,” said a blog on the case.

For its part, Boston-based American Tower is one of the world’s largest real-estate investment trusts, owning 223,000 communications sites – 43,000 properties in the US and Canada, and around 180,000 properties internationally.

Selling mobile phone sites and tech is big business these days.

Spark sold 70% of its cell phone towers in July to the Ontario Teachers’ Pension Plan Board, while Vodafone announced a sale in July of its mobile towers for $1.7b to funds that were managed or advised by global investors InfraRed Capital Partners and Northleaf Capital Partners.

James "a bit frustrated" Shaw heads to Egypt in the coming days. (Image: BusinessDesk)

James "a bit frustrated" Shaw heads to Egypt in the coming days. (Image: BusinessDesk)Climate change, court action and convenience

Politicians, officials, activists and many, many more will be gathering in the Egyptian Red Sea resort of Sharm el-Sheikh next week for the COP27 climate-change gathering.

Some countries will be travelling to the yearly meeting with new gifts, in the form of more ambitious emissions-reduction targets. NZ will be among those that will not.

Under the Paris Agreement, all countries agreed to ratchet up their pledges in an effort to limit global warming to 1.5°C compared with pre-industrial levels.

Climate-change minister James Shaw has said he is a “bit frustrated” that this country’s pledge will remain unchanged.

The reason – he is awaiting the verdict of the court action taken by the Lawyers for Climate Action group. The lawyers took a case to the high court in February arguing that the carbon budgets proposed by the Climate Change Commission were inconsistent with climate law and international commitments.

Eight months after the case was heard, a judgment has yet to emerge.

Shaw reckons it will have major implications for domestic policy, as well as the country’s international climate pledge.

“I have held off until I know the lay of the land with that,” Shaw told Stuff.

This may well be true, but if not making decisions on climate-change policy because they are under legal challenge is to become the precedent, then the government may find things grind to a halt in what will become an increasingly litigious area.

The less charitable might think the real reason for not upping the ambition is that current policy settings and progress on reductions will be well short of NZ’s current pledge.

Increasing the pledge will only increase the deficit that must be made up by spending possibly billions of dollars on overseas carbon credits – a difficult thing to explain in an election year.