ANZ Bank expects house price inflation to flatten and then cool on the back of a 17.1 percent inflationary jump in 2020, as bank lending is reined in and the central bank acts to curb “irrational exuberance.”

The bank, which holds about 31 percent of all residential mortgages in New Zealand, has stuck to its guns following last month’s comments that the market is unsustainable at current levels, with monthly house price rises of 3 percent in the context of zero income growth “just not adding up.”

Property economist Liz Kendall believes some buyers are “very stretched.”

She said first-home buyers in particular were taking on high debt-to-income ratios, leaving them vulnerable if income prospects were to change — even if very low interest rates are making repayments easy.

Kendall cited anecdotal evidence some parents were taking on more financial risk by tapping into housing equity or taking on debt to help their children, but she said “at some point affordability and credit constraints will start to weigh, especially with the economic outlook expected to be challenging.”

The longer the party goes on, “the more financial vulnerabilities increase and the greater the risk of a correction.”

ANZ economists have "pencilled in" a wobble in the market on the back of those affordability and credit constraints, as weak migration and income strains bite.

The covid environment will also play a part, the bank said, with the “path to eventual normality in front of us” with vaccines being rolled out globally.

While NZ is an outperformer economically – reflecting the success of our health response – the virus remains “an ever-present threat” with prospective bumps along the way to widespread inoculation, the bank said.

An affordability divide

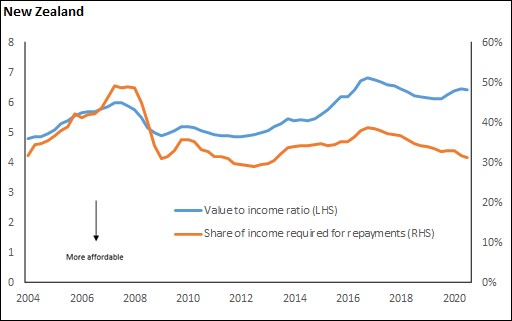

Kelvin Davidson, senior property economist with CoreLogic, said while there were pockets where housing price inflation had priced buyers out of the market, New Zealand’s value-to-income ratio was still below past peaks.

Corelogic's value-to-income rating — a measure of the average household income versus the average house price — is at 6.4 data to December 2020 showed, compared to a long-term average of about 5.5 and a high of 6.8 in late 2016.

Davis said mortgage servicing numbers, or mortgage payments as a percentage of average gross household income, were "pretty much" as favourable as ever at about 31 percent at December 2020.

And while house prices were an emotive issue, most of that related to the “affordability divide” between those already in houses and those scrambling to save a deposit.

CoreLogic estimates the deposit saving period is now pushing nine-years, versus the long-term average of under 7.5 years.

ANZ’s Kendall points out it isn’t just home ownership that is out of reach. She said rents are expensive too, and have risen faster than incomes in recent years.

Not responsive enough

Kendall said these issues relate to housing supply not adapting to changes in demand, financial conditions and price.

“In recent decades, lower interest rates and increased credit availability have contributed to rising house prices, but the potency of these effects is directly linked to the fact that supply has not been responsive to changing trends.

“Reflecting these supply issues, we have an infrastructure deficit and a significant existing housing shortage, which we estimate could be anywhere in the realm of 60,000 to 120,000 homes.”

Looking forward, she expects demand to continue outstripping supply, a scenario “baked into” today’s house prices.

Source: Corelogic