Ray White New Zealand last month sold 2,256 houses valued at $1.9 billion, an increase of 86.5 percent from December 2019.

That capped a year in which the country’s second-largest real estate firm – which transacts about 21 percent of NZ’s residential sales - increased overall sales by 42 percent to $13.55 billion through its 182 offices.

That was up from $9.53 billion in 2019, led by a 61 percent increase in Auckland volumes and double-digit increases across the board.

It was a similar story for Auckland's Barfoot & Thompson, which reported its strongest December sales period ever, selling a record 1,479 properties for a combined $1.6 billion, at a median value per house of just over $1 million.

Frenzied bidding in auction rooms also saw some big ticket sales through the month, notably a lifestyle 5-bedroom home on Briar Lane, Whitford which changed hands at $5.07 million, a 5-bedroom Upland Rd property in Remuera (pictured above) which attracted a purchase price of $4.85 million and a 375sqm, 4-bedroom double storey in Seatoun Heights, Wellington, which went for $3.33 million.

Barfoot & Thompson managing director Peter Thompson said the December numbers were more than double the sales figures for the December average of the past five years, though there were still “a large number of yet-to-be-completed and conditional sales in the pipeline.”

While that bodes well for a strong start to the year, he said the market was also starting the year “desperately short of properties for sale.”

13-year low

That is supported by just-released data from listing site realestate.co.nz, which shows that national inventory is at its lowest in 13 years.

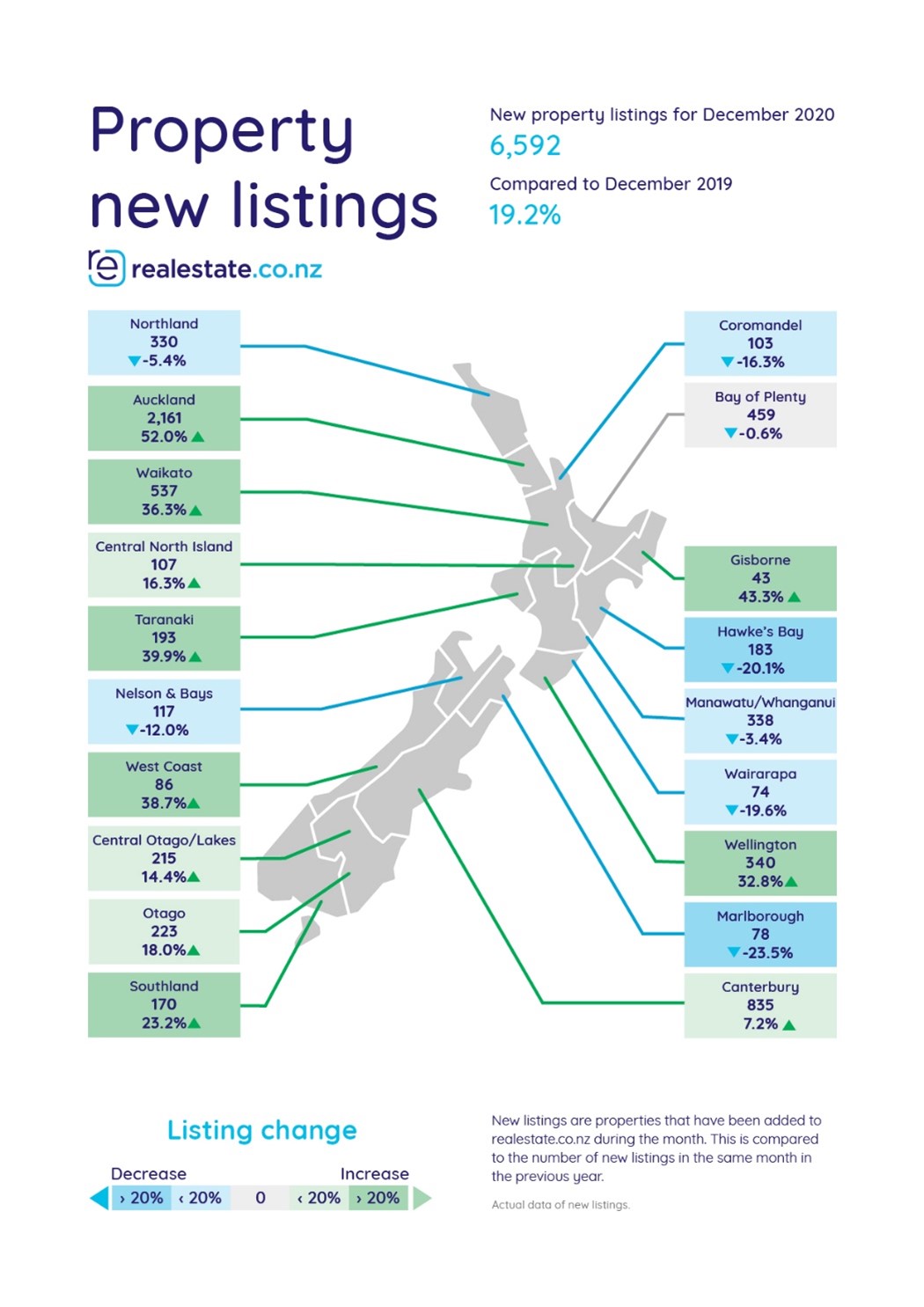

And that’s despite a 19 percent increase in listings last month – largely driven by a 52 percent year-on-year increase in houses listed in the Auckland market and reflecting the sheer pace of sales for the month.

Realestate.co.nz general manager of marketing, Vanessa Taylor, said while it was promising to see pockets of new listings come onto the market, “buyers in regional NZ are still faced with little choice.”

Taylor said that scenario had created a “significant mismatch in supply and demand” that are likely to continue to drive strong prices during the coming months.

Such competition has already seen the national seasonally adjusted average asking price move to $799,190 in December. That is 13.6 percent, or $95,410, higher than the prior December’s $703,780.

Taylor noted that that jump was influenced by several high-end and large lifestyle properties that came onto the market in the central North Island during the month. But she said the combined number of listings had still plunged to 12,932 homes, down 29.1 percent from 18,230 listings in December 2019.

Listings drying up

Declines were acute by the year-end in Wairarapa, where listings fell 58.5 percent from 205 to 85, and in Coromandel, which saw only 219 homes registered for sale, a 50 percent year-on-year drop from 441.

Canterbury, meanwhile, saw 1,020 fewer listings, down from 2,786 last December to 1,766 homes available for sale last month.

Only three regions - Auckland, Gisborne and Central Otago - avoided hitting rock bottom stock levels last month, which Taylor said would "continue to prove challenging for buyers at the beginning of 2021."

That trend has seen national inventory levels, based on the number of weeks expected to clear available stock, drop to about eight weeks from the long-term average of 28 weeks, according to realestate.co.nz. The smaller the number of weeks it would take for all existing stock to sell out, the more it implies either that the market is short of stock, running hot, or both.

The tightest inventory levels, at four weeks, are in the Wellington area, while the Bay of Plenty, Manawatu/Whanganui, Wairarapa and Nelson came in at five weeks.

The highest level of inventory, at 17 weeks, remains in Northland, though that is against a long-term average of 84 weeks, while the Coromandel, at 14 weeks, is down from its longer-term average level of 121 weeks.