A new NFT company co-founded by Dan Carter says it is more sustainably minded than other digital art marketplaces.

The All Blacks legend has an 11% stake in Glorious Digital, a New Zealand business set to launch an app in October selling digital art as non-fungible tokens (NFTs).

NFTs are digital tokens that are hosted, bought, and sold on blockchains, the centralised cloud systems designed for financial assets and cryptocurrencies such as bitcoin or Ethereum.

An NFT can be anything, including a GIF, a photo, or the digital cats CryptoKitties, which pioneered the concept.

The market has blown up.

Artist Beeple sold a single NFT for US$69 million, Jack Dorsey sold his first tweet for US$3m, and rockers Kings of Leon sold their latest album as a US$50 NFT (other normal formats were available).

Other artists flat-out reject the artistic value of NFTs in the first place.

Glorious’s NFTs will be digital video artworks, often sold with exclusive assets.

“They might come with tickets or backstage passes if you're an artist, or a kicking session with Dan Carter,” Glorious co-founder and chief executive Tim Harper told BusinessDesk.

Mining for cryptocurrency and minting NFTs often requires an incredible amount of energy to perform the computation required for a blockchain to function.

“Now that NFTs have sort of taken off, there’s obviously this need to create more NFT-specific blockchains, which are a lot more energy efficient.”

NFTs are largely traded on the energy hungry Ethereum blockchain. At the time of writing, it is estimated the Ethereum blockchain has similar annual power consumption to the Czech Republic and a comparable carbon footprint to Denmark.

Such blockchains often use a ‘proof of work’ mechanism in the absence of a third party such as a bank to oversee transactions.

Proof of work requires people and their computers to solve puzzles that expend a huge amount of computing and energy resources to allow decentralised blockchains to validate account balances and financial transactions.

In February, it was reported that bitcoin, the first cryptocurrency, has a carbon footprint similar to NZ, with electricity generated to run its computing processes producing 36.95 megatons of carbon dioxide every year.

Harper said that Glorious NFTs will reside on a ‘proof of stake’ blockchain that doesn’t require physical mining to create the energy required to perform the computations needed for validation.

“Instead of people competing, what it does is randomly chooses different participants, and gets them to effectively crack the blocks,” Alex Sims, associate professor of commercial law at the University of Auckland, told BusinessDesk of the proof of stake method.

“It requires randomisation rather than just brute force.”

By selecting random validators, it is hoped proof of stake blockchains will not incentivise huge energy consumption in the same way proof of work blockchains do.

Keen to be green

Glorious co-founder Scott McLiver introduced Tim to Dan Carter and Murray Thom, Harper’s creative partner, over Zoom after this year’s February lockdown and the business idea was born.

Harper said they agreed Glorious should assure its artists the company is thinking progressively about sustainability.

“Our NFTs have very low energy impact, so it's sort of comparable to making an Instagram post or sending an email.”

Glorious’s proprietary platform is being built for the company by Auckland software company Sylo, which builds platforms on CENNZnet, an NZ-built public blockchain created by tech venture company Centrality.

This chain of collaboration continues to Sylo’s co-founder Dorian Johannink, who is one of Glorious’s two company directors.

This bespoke approach is similar to the NBA’s phenomenally popular NFT platform Top Shot where short videos are traded like basketball cards.

Top Shot packs are held on Flow, a blockchain designed specifically for apps, games, and digital assets. Many of Top Shot’s customers purchase NFTs using a credit card and don’t hold any cryptocurrency, removing a confusing barrier to wider adoption.

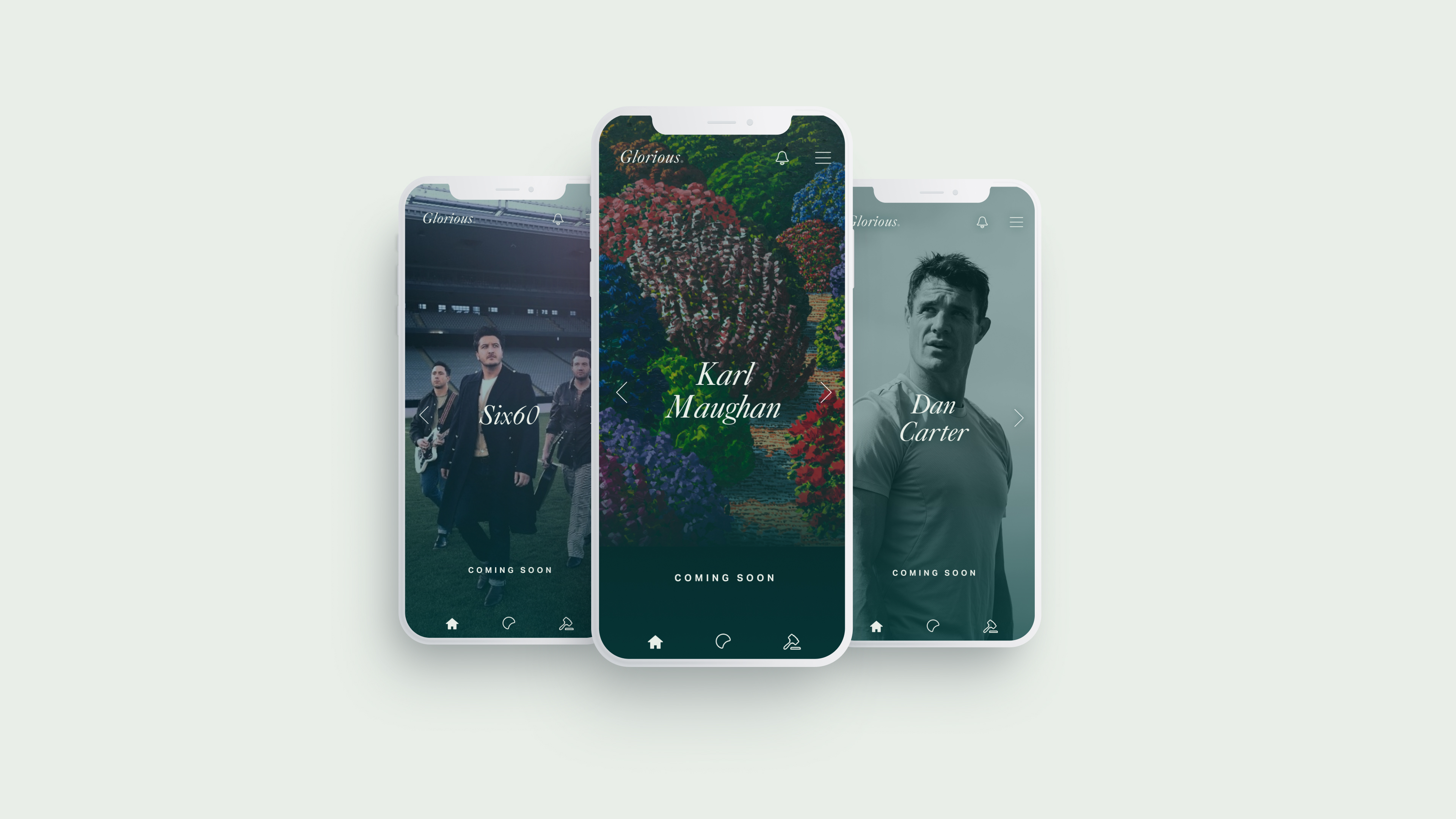

Glorious hand picks artists to collaborate with. (Image: Supplied)

Glorious hand picks artists to collaborate with. (Image: Supplied)The only cryptocurrency Glorious will allow people to trade in at launch is ether (ETH). Thanks to ongoing market fluctuation, 1 ether is currently worth NZ$4,626, up from about NZ$260 in January 2020.

“Because Ethereum is the main currency that people are using, they can use that to buy our NFTs, but our NFTs won’t belong on the Ethereum blockchain. They’ll live on the CENNZnet blockchain, which is this greener blockchain,” Harper said.

“So, in terms of the energy transaction that takes place it's all on CENNZnet, so that's why it's greener.”

Sims is less certain.

“Using Ethereum to purchase NFTs on Glorious’s platform does mean that the transaction to buy the NFT itself will mean a reasonably large environmental footprint although this is still better than the NFTs being on Ethereum themselves,” she said.

She said people buying NFTs on platforms like Glorious will not normally be doing the mining for the cryptocurrency themselves but buying it from ether exchanges. Glorious and other businesses in NZ may struggle to convince banks and credit card companies to engage with an NFT marketplace.

Harper said Glorious is likely to partner with an unnamed third party to allow people to interact end-to-end on its platform, akin to Top Shot, but at launch it will not be possible.

Stars and asterisks

Glorious has already signed up many collaborators including Six60, Neil Finn, Heather Straka, and co-founder Carter himself. More local and international artists are to be announced in the coming months.

The company is acting as a collaborator with its hand-picked artists, often hooking them up with producers to create new video art or to digitise their existing works. No prices have yet been revealed.

Unlike popular global open NFT marketplaces such as OpenSea, Foundation, Rarible, or Nifty Gateway, where anyone can upload and sell an NFT, Glorious positions itself as a gallery service.

“Like anything in life, we all appreciate a good curator when they come along, whether it's a menu at a restaurant or a department store that does all the hard work and just brings incredible quality,” Harper said.

Because of this, Glorious will take a fixed 30% commission on first sales, the same percentage fee Apple takes from app developers for purchases made within iOS apps. It is also akin to the fees charged by traditional art galleries and auction houses, which often fluctuate according to the art’s sale price.

Public NFT marketplaces commonly take between 2% and 5%.

“What differentiates Glorious from other entity marketplaces is the singular focus on creating work that is enduring,” Harper said.

Glorious chief executive Tim Harper. (Image: Supplied)

Glorious chief executive Tim Harper. (Image: Supplied)“We're sort of firmly positioning ourselves at the premium end of the NFT market mostly because we wholeheartedly believe in these kind of masterpiece NFTs, these magnificent works of art. They’re the ones that will endure, not the cash-grab NFTs that are currently flooding the market.”

Unlike regular digital files, NFTs can be one-of-a-kind thanks to their unique imprinting on a blockchain, proving provenance. This created scarcity mirrors the traditional art market and directly affects fluctuations in valuation.

The blockchain keeps track of NFT ownership and can also facilitate royalty payments for both artist and curator. If an artwork originally sold by Glorious is sold on, the artist will receive 7% of the total and Glorious 3%.

“It’s so brand new that everybody is probably going to be the most flexible in this space,” Harper said when asked if Glorious’s percentages were usual.

The business has enlisted the services of Michael Heron QC, former solicitor general of NZ, to ensure it is able to comply with local regulation. He is the second of the company’s two directors and has a 9% stake.

“We sort of thought, well, wouldn't it be great if the seller could keep more? And wouldn't it be great if the majority of that went to the artist?” Harper said.

“I think there's probably room for flexibility in that going forward. It's always a dialogue with the artist, but I think for now, the 7% [for the artist] feels, you know, it feels about right.

“We are being really transparent, because that's what the blockchain is.”

A new way

The global OpenSea platform is where Auckland-based photographer Ben Campbell is hosting his first NFT collection.

“This is a completely separate way of selling,” he told BusinessDesk.

“It's a good opportunity to get my work out to a different set of collectors … obviously with the Internet being worldwide.

“The royalty factor is quite a nice one to have.”

Campbell set up his OpenSea collection himself. OpenSea takes a 2.5% commission on sales and lets people program their NFTs so that each subsequent resale transaction includes a royalty payment of up to 10% back to the creator.

If he wanted to work with Glorious, he’d have to be invited and accept the 30% initial commission and ongoing royalty split.

Having worked in the music industry, Harper said he was familiar with how hard it is for artists to make money in the modern entertainment industry.

“One of the most difficult things for artists has always been, how do I make money off work as my brand grows, you know, as my star ascends?”

Harper said Glorious encourages scarcity but ultimately it is up to the artist whether they sell one unique piece or produce a limited run, akin to screen prints.

“Our goal is to try and get them as much as we can off that first initial sale, whereas a lot of other NFT success projects around the world, they’ve given away the NFT and they’ve become valuable over time,” Harper said.

Unlike Top Shot, Glorious is ensuring its NFTs can be sold on outside of its bespoke platform. Harper hopes this will help the company reach a wider market.

“We didn't want to just be sort of a local niche Kiwi market, but we wanted to be something global and big.”

He said Glorious wants to partner with Christie’s and Sotheby’s to sell high value works to buyers who won’t be getting onto the blockchain anytime soon.

“The talent we have here [in NZ] is extraordinary in the art scene, and to be able to sort of create this international platform that promotes and gets Kiwi artists out there, that gets me really excited.”