Covid has made supply chain transparency a priority for companies internationally and driven a surge in business for a local track and trace tech startup.

Rfider has signed up a personal protective equipment (PPE) business, as well as food industry customers in New Zealand and the US as demand for traceability of goods has risen due to the pandemic.

The software-as-a-service product helps companies track shipments’ movement through the supply chain as items with attached QR codes are scanned and logged during transit.

The software, called Digital Concierge, is now integrated with IBM Food Trust, a global platform for the food industry acting as a shared record.

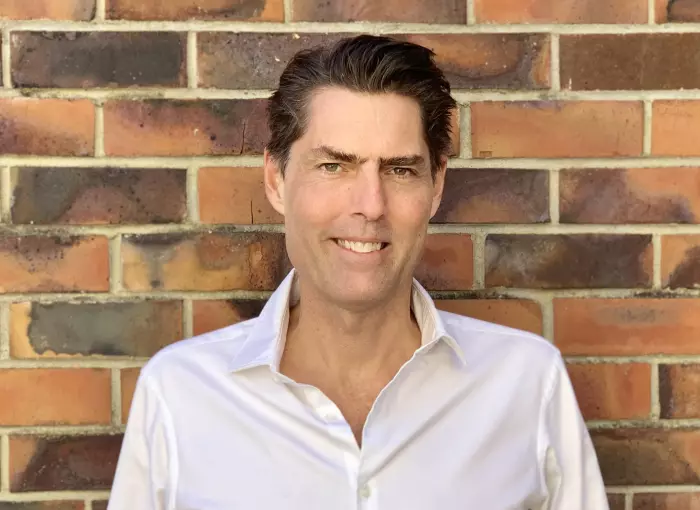

Rfider chief executive officer (CEO) John Pennington said the company’s software is helping to drive supply chain efficiency while satisfying the rocketing demand for food safety transparency in a covid-19 world.

“We’re very privileged and lucky in New Zealand that we have a food supply chain, which is relatively safe,” he told BusinessDesk.

“But that's not the reality for most of the world. So, it's a tremendous opportunity for us to help businesses that at the moment compete and win on transparency."

However, he believes safety transparency will become mainstream for all types of businesses if they want to compete.

Rfider has eight full-time employees working out of its Newmarket headquarters in Auckland, and recently completed a capital raise for an undisclosed sum having previously received a $150,154 grant from Callaghan Innovation.

Former Pushpay chair Bruce Gordon is the company chair. Companies Office records show Gordon has a 16% stake, Calev Investments with 14.2%, and Stephen Tindall’s K1W1 with 9.4%.

Pennington said Rfider was five years ahead of the market when it was founded in 2017, but he wouldn’t name some recent customer sign-ups citing commercial sensitivity.

Coffee is a cornerstone market, with global supplier Mercanta and Colombian exporter Mastercol customers. The software allows scanners to log quality assurance metrics as well as simple transit information.

Most of Rfider’s business is overseas but Steel & Tube and Taupō-based Zealandia Honey are on the books.

The CEO said Rfider's customers use supply chain transparency as a differentiator and price driver, but the company had often needed to convince people that transparency and traceability were necessary.

Covid changed that.

“We are getting more inbound requests about the platform and the services we provide. I think it's been a point in time for people to actually stop and think about the safety of their products.”

Another driver is Australia’s Ag2030 goals that include supply chain transparency in its guidelines.

Pennington said some customers were finding it too costly or complicated to join platform’s like IBM Food Trust and preferred Rfider, so the company had created an integration process its customers can use to join IBM’s larger global ecosystem.

He said Rfider asked customers why they were choosing its product as a standalone solution rather than something like Food Trust.

“Smaller providers don't have necessarily the technical resource, or resources in general, to be able to collect all the information they need.”

“With this [IBM deal], it's an opportunity to help supermarkets source from other suppliers that they wouldn't do today, and also for those businesses to have a different or a new channel to market.”

Beyond food

While ‘track and trace’ is normally terminology associated with tracking covid exposure in humans, Rfider also works with a Singaporean company that produces test kits, and the PPE business, to ensure hygienic transit.

“Whether it’s a lettuce or a covid test, they’re kind of one and the same. We are able to uniquely identify them, we’re able to wrap services around them, and we allow supply chain participants to do things or interact with those devices and with those products in different ways, but it’s all built on the same platform.”

Customers can use Rfider’s tech solely within their organisation but it also supports cross-organisation use. This means it can be used in tandem with existing systems to help create a clearer line of traceability on product movement without requiring every point in the chain to use the same software.

The company is also partnering with Marseilles-based carbon tracking business Searoutes to offer companies the tools to track and trace their carbon emissions.

Pennington said Rfider’s subscription based pricing model is a differentiator.

“We charge when there’s actually usage. When there’s value being created, we charge, so we have event based pricing which is different to traditional providers.”