StraitNZ Holdings, the owner of the Bluebridge Cook Strait ferries, boosted net profits by 64% to $17.1 million for the 12 months to March 2022 in the wake of operational problems at KiwiRail's Interislander – its only competitor.

Revenues were up 27% at a record $208.2m from $168.1m for the comparable period.

Like the Interislander, Bluebridge plies the Wellington to Picton crossing. It owns the Dutch-built MV Straitsman and Italian-built Strait Feronia vessels, with a combined capacity for 360 vehicles and 700 passengers, as well as truck drivers and crew.

StraitNZ is owned by Morgan Stanley's North Haven Infrastructure Partners, after being sold by CPE Capital Holdings (CPEC) on March 31 for about $500m.

Unreliability issues

CPEC private equity firm bought Strait Shipping and Freight Lines from founder Jim Barker about four years ago, combining it with freight forwarding firm Streamline and creating StraitNZ.

The infrastructure investor had clearly seen value in buying into the freight and passenger service, given the unreliability issues that have dogged the Interislander service in recent years.

That has seen repeated breakdowns of both its Kaiarahi and Aratere ferries. In response, KiwiRail brought an extra ferry into service, the UK registered Valentine.

Ageing fleet

Valentine, which is a freight-only service, only started regular sailings in January.

Last June, KiwiRail signed a $551m contract to build two rail-enabled, diesel-electric ferries with Korean shipyard Hyundai Mipo Dockyard to replace its ageing fleet. Those ferries are expected to start service in 2025 and 2026.

It will also require fast-track consent for upgrades to the Kaiwharawhara ferry terminal near Wellington, part of a $900m book of upgrades to both Wellington and Picton ferry sites.

But last August, two of the country's transport unions called for a review of KiwiRail's choice of ferries, citing the use of outdated fuel technology and continuing high levels of emissions.

Meanwhile, Interislander's issues are continuing business as usual.

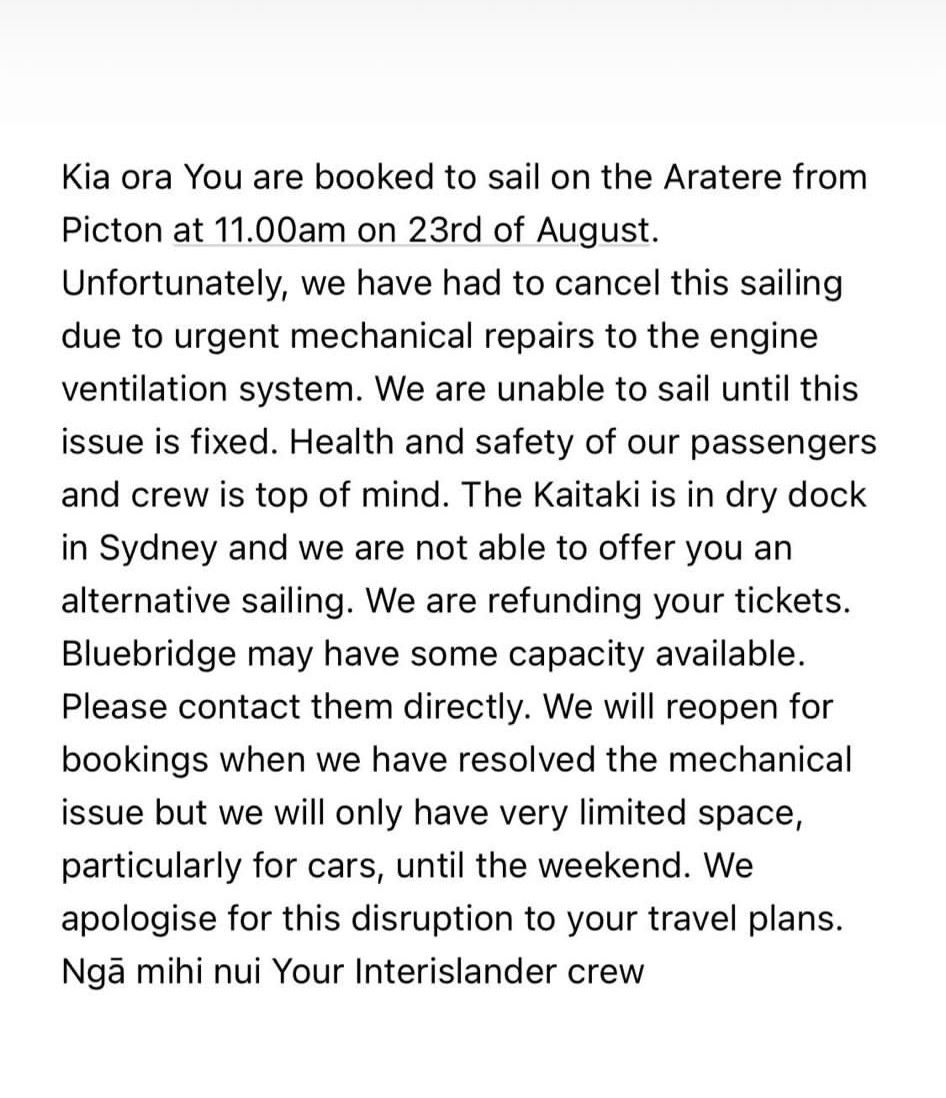

Last week it cancelled sailings of its Aratere ferry as repairs were required on its engine ventilation system.

A leaked Interislander message to a 'former' customer – helping fill up Bluebridge ferries.

A leaked Interislander message to a 'former' customer – helping fill up Bluebridge ferries. In March, then-KiwiRail chief executive David Gordon cited the impacts of covid on international and domestic tourism as well as the costs of keeping its ferries operational as reasons for a disappointing operating surplus of $64.9m for the first half of the year to December 2021.

Its Interislander revenues for the period were down by a fifth for the period to $49.1m.