Covid-19 accelerated New Zealand’s uptake of e-commerce, changed consumer behaviour and forced small businesses to move online, according to retail sector experts and data.

The first ten months of 2020 saw online shopping spend in NZ grow by more than 25 percent according to NZ Post’s eCommerce Spotlight report.

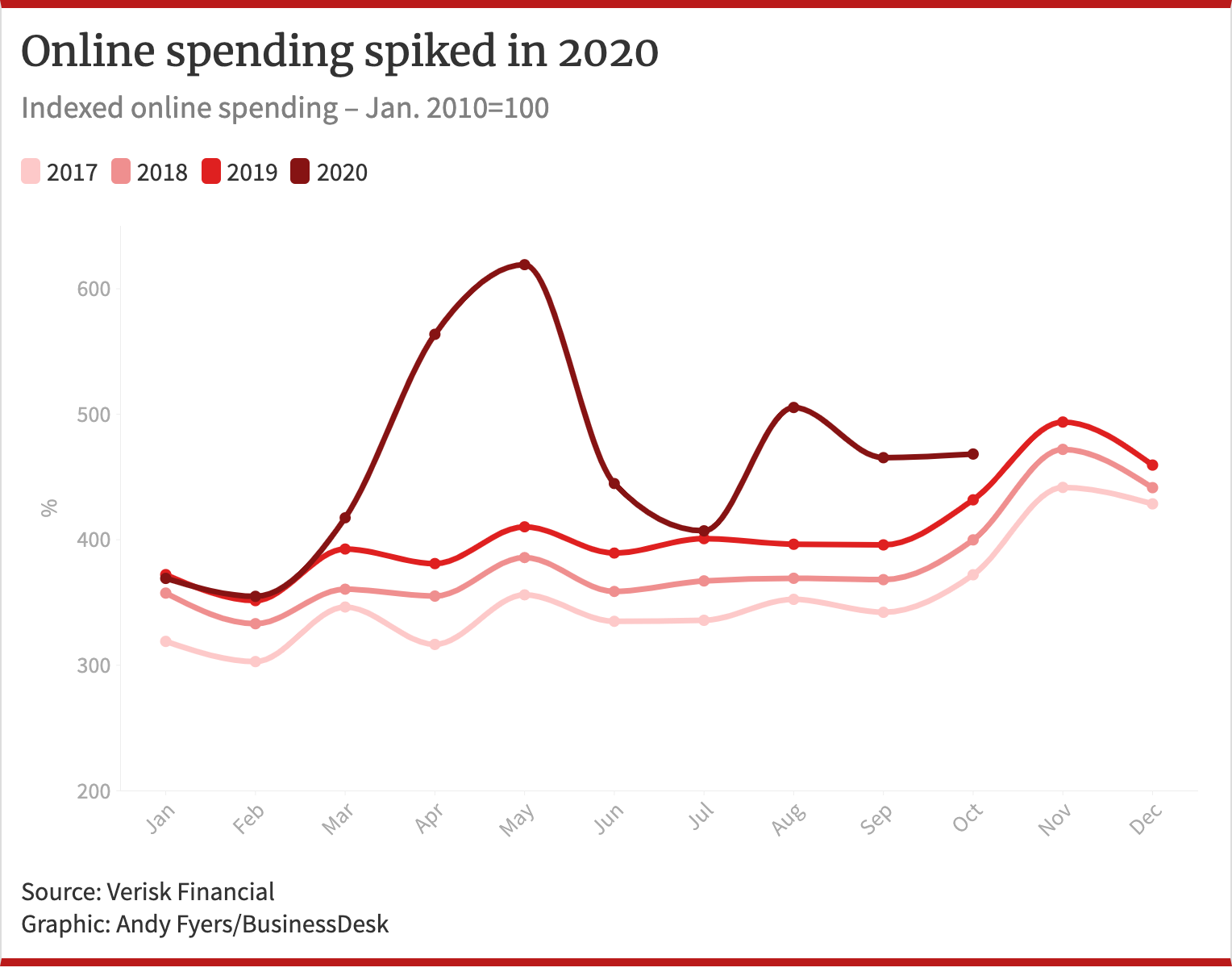

Data from consumer industry group Marketview (see figure 1) shows NZ's online spending spiked in March to May when the country went into lockdown, with a second spike in August coinciding with Auckland’s lockdown.

“Back in April and May when all the shops were closed, we saw online spending roughly double. It went from about nine percent of all retail spending being online to closer to 20 percent,” said Greg Harford, chief executive of Retail NZ.

He said much of the spike was driven by the stark necessity for New Zealanders to buy groceries online. This convenience persuaded many to continue buying online even after the country’s physical shops reopened.

“Previously NZ was a very poor performer, we had very low penetration of e-commerce,” said Chris Wilkinson, managing director of First Retail Group.

Wilkinson attributed the stronger culture of online shopping in the US and UK to the bygone era of catalogue shopping, which could naturally evolve online, whereas New Zealand never had that kind of mentality or market, he said.

Expected spikes

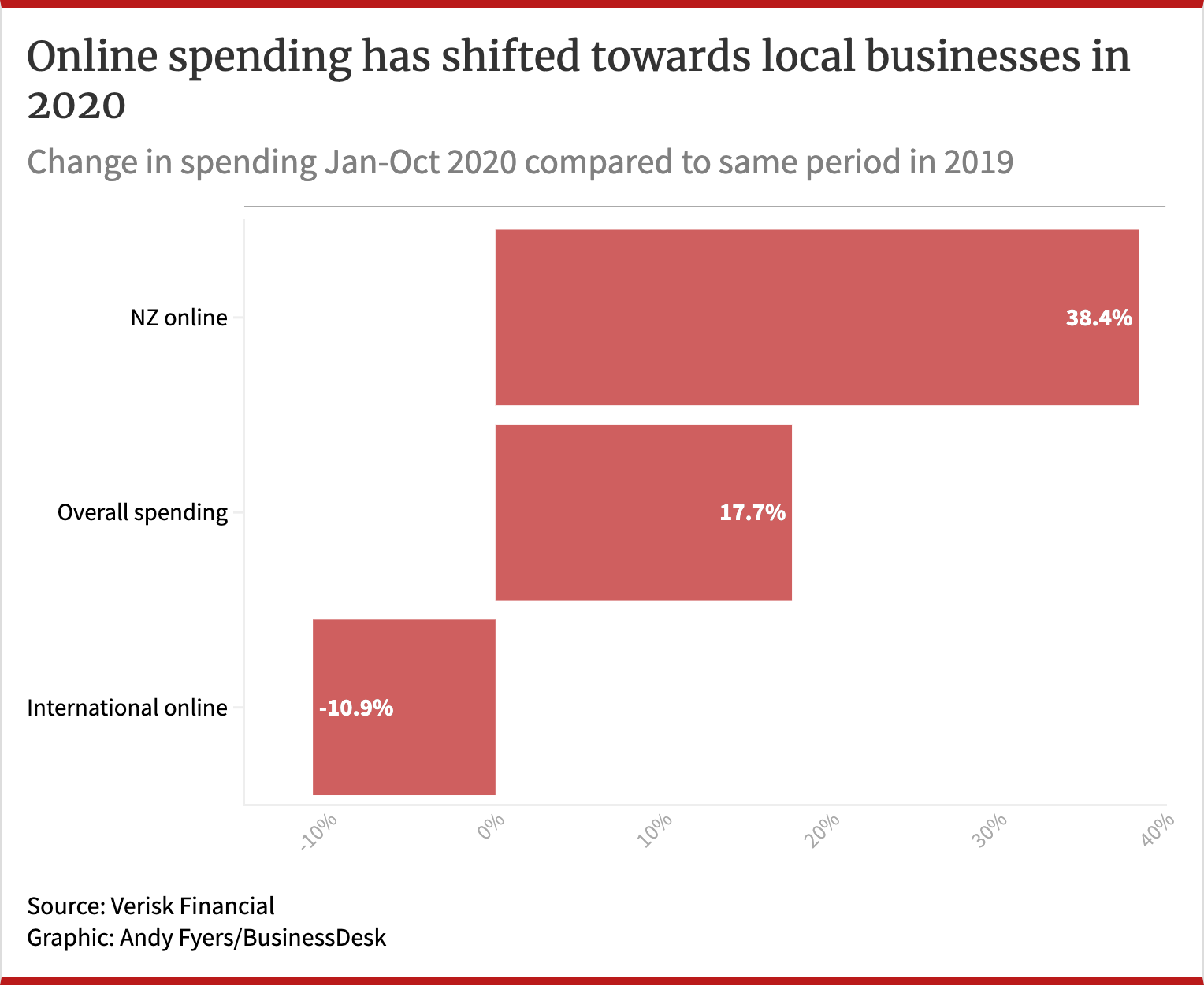

Marketview data compares online spending from January to October with the same period in 2019. It found NZ online spending up 38.4 percent, and spending by New Zealanders in international online stores down 10.9 percent.

Wilkinson attributed the latter decline to changes to GST rules in late 2019 for international retailers importing goods to NZ customers.

“With that threshold being dropped, consumers were increasingly cautious about buying offshore,” he said, which was to the benefit of local retailers.

Local premium clothing brand Edmund Hillary conversely had good online sales overseas according to marketing director Clare Hall-Taylor.

“We saw huge numbers, a huge number of sales to the UK and the US in particular,” she told BusinessDesk in October.

The Marketview data shows overall spending for retail of all types was up 17.7 percent.

NZ Post’s eCommerce Spotlight report, citing card transactional data from Datamine, shows November spending in NZ at “all-time highs” as online-savvy Kiwis flocked to spend up on Singles Day (11/11), Black Friday (27/11), and Cyber Monday (30/11).

“At a massive $5 billion, November’s retail spend was even bigger than the biggest months experienced over lockdown (May, $4.1 billion),” the report states.

This represents a 10 percent increase in online spending for the month of November from 2019, with $282 million spent on Black Friday alone. The month had an average online basket size of $115, 11 percent up from 2019.

Because of previous action taken to prepare for Amazon entering the market, Wilkinson said NZ’s biggest online retailers were generally well equipped for covid, even if they didn’t know they needed to be ready for a pandemic.

“There was this absolute concern that this was ultimately going to happen in NZ,” he said of the Amazon threat.

“That drove retailers across the board, but particularly the larger players, Hallenstein Glasson and Warehouse Group etc., to develop really strong strategies and infrastructure around e-commerce.”

Big biz boom

For the year ended Aug. 2, The Warehouse Group reported a 55.2 percent increase in online sales compared to 2019, with 11.4 percent of all sales online.

Warehouse Group chief customer officer Jonathan Waecker was careful to stress the continuing importance of physical stores in NZ.

“We do everything we can to make sure our online and our in-store experience has the right people in the right places,” he said.

“This year, the difference is that the online experience is even more in demand. So, we've had to move a lot of resource and focus into making sure we can meet the e-commerce demand that's coming through because it's so much higher than it has been in years past.

“The stores matter and they're very important, but we do expect online to be a growing percentage of our sales going forward.”

Hallenstein Glasson posted 46.8 percent growth in online sales for the same period, and 80.1 percent growth for the second six months of the financial year.

Briscoes reported 16.3 percent of its third-quarter sales were online, while Kathmandu Holdings claimed its preparedness allowed it to successfully scale resources to meet the boom in online demand during national lockdown.

Spikes in online spending also proved a catalyst for Mighty Ape as it was acquired in early December by Australian retail giant Kogan.

The strength of the Mighty Ape brand cuts a lonely figure as one of New Zealand’s few online-only retailers, with high customer loyalty. At the time of the deal, Kogan said more than 70 percent of Mighty Ape’s orders in the 12 months to October were from repeat customers.

“It’s a little bit sad to see what really is an iconic Kiwi digital business be gobbled up by an Aussie firm but it will undoubtedly give them greater depth and access to a broader range of products potentially,” Harford said.

Mighty Ape declined to share any e-commerce data, saying it is “commercially sensitive.”

Sales and marketing chief Gracie MacKinlay said overall it saw an accelerated shift to consumer shopping online.

"Post lockdown, our traffic and sales didn't go back to pre-covid levels, which indicates a permanent shift."

Help is at hand

Small businesses had to react as quickly as their larger counterparts, but often with far fewer resources available.

“There is a risk that smaller New Zealand businesses may regard e-commerce channels as having been a necessity that gets them through a crisis, rather than an important tool that will help future-proof their businesses,” said Ben Morgan, managing director at consultant Accenture New Zealand.

“In 2021, we expect businesses to refocus efforts on their e-commerce offerings as a way to attract and retain customers all around New Zealand.”

Chief executive of online shop building platform Storbie, Shane Bartle, agrees. Storbie’s new website builds grew over 113 percent in 2020 as it helped community pharmacies move their stock online.

“One of the challenges of community pharmacies is the business owners are typically very busy on the floor serving customers,” said Bartle, whose team speaks to pharmacies’ suppliers and pull the complex network of products, and accompanying images and descriptions, to a centralised platform.

It’s an example of the kind of help on offer to retail business owners who thought a lack of time and resources prevented them from getting stock online.

“It’s not about e-commerce or instore, it’s about a continuum. Modern consumers don’t necessarily think of the worlds as being separate,” added Bartle, emphasising how small businesses need to appeal to consumers who can act differently from one day to the next.

“Retailers are starting to understand if they don’t cater for the customer in all their different states of mind as they move from one place to another, they force the customer potentially to another retailer when that consumer is wanting to interact in a way they don’t support,” he said.

While big business has relied on brand recognition to attract online shoppers in this strangest of years, the same can’t be said for small businesses.

But Storbie’s collaborative model shows there are efficient ways for business owners to get retail stock online quickly and to the benefit of all parties – consumers included.

Additional reporting by Rebecca Stevenson and Andy Fyers