Corporate cash donations to charity fell by more than 40% between 2018-20, according to a new report.

The drop-off cannot be attributed just to covid, however, since these tax-deductible donations fell by over 30% in 2019 compared to the 10-year high of $143 million in 2018, according to Treasury statistics.

This number is known to fluctuate and it does not include other types of giving, such as in-kind donations or volunteer hours.

The corporate support report, compiled by wealth management firm JBWere, estimates that non-cash contributions constitute the bulk of corporate philanthropy, in terms of value, but that much of this goes unrecorded in many firms’ public accounts.

For example, many companies work with charities under non-commercial sponsorship arrangements, which is tallied as a marketing deduction rather than a donation deduction.

But even with non-cash contributions included, the report estimates that total corporate giving, from 2018-20, will have dropped by 26%.

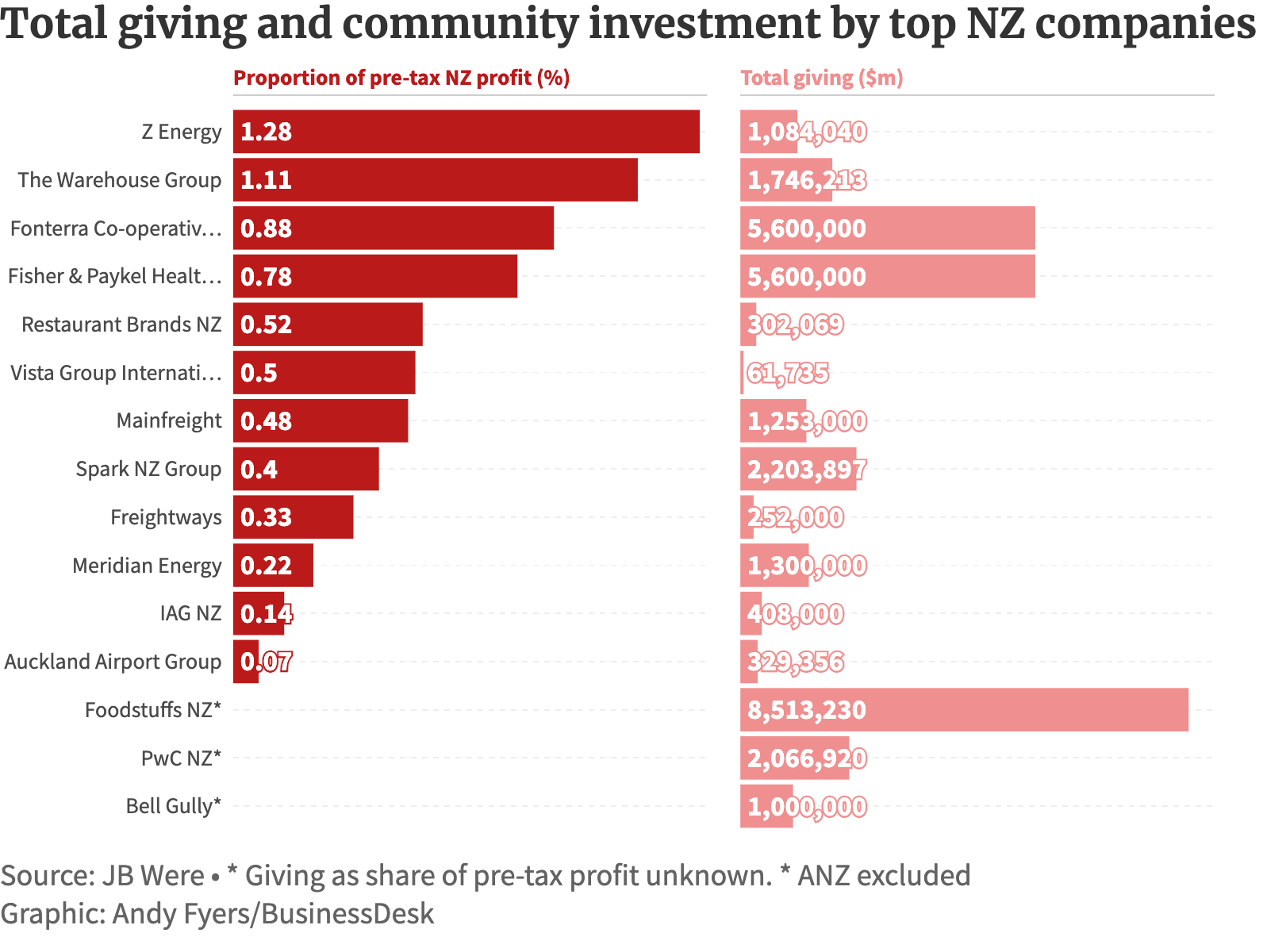

The authors cite a global aspirational standard of companies giving out the equivalent of 1% of their pre-tax profit to charitable causes.

New Zealand falls well short of this.

Pre-tax profit for NZ enterprises for the year 2019/20 was $77.4 billion, according to Stats NZ, meaning 1% would equal $774m.

Yet cash donations, according to the Inland Revenue Department (IRD), over the two years of 2019 and 2020 averaged just $92m, equivalent to 0.12% of annual pre-tax profits.

Even when non-cash donations are incorporated, raising the total of business giving to an estimated $460m, this is only equivalent to 59% of the 1% target.

And corporate giving constitutes a small fraction of total philanthropy in NZ. In 2018, it made up 15% of the $3.8b given nationally. The report’s authors estimate that in 2020, this will drop to 11%.

Profile pictures

The study took a sample of 15 NZ businesses across a variety of sectors, that publicly disclosed their level of giving.

Just two firms, The Warehouse Group and Z Energy, surpassed the 1% level of charitable giving in their most recent annual returns.

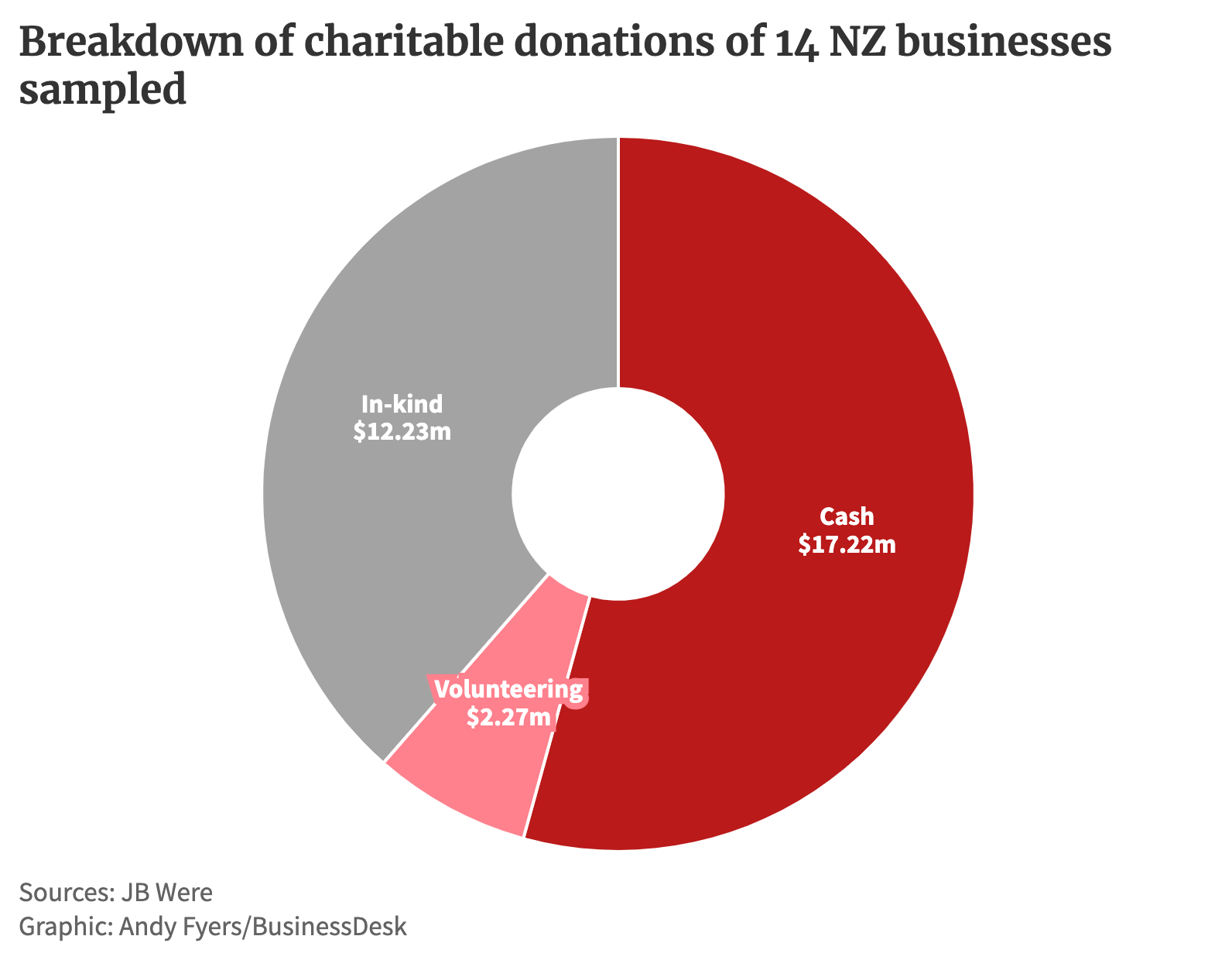

Of the companies sampled, excluding ANZ, since its giving couldn’t be separated from Australian causes, cash donations represented 54% of corporate giving, with in-kind contributions making up 39% and the monetary value of volunteering hours representing 7%.

This varies significantly from company to company.

Seven of the fifteen’s recorded contributions were entirely in cash, while others, such as Bell Gully (100%), PwC (93%), The Warehouse Group (71%), Fisher & Paykel (89%), were made up primarily from in-kind donations or volunteering.

Law firm Bell Gully has a dedicated pro bono programme with a committee of four partners and two senior associates. Its annual target for its volunteer programme is the equivalent of $1m. Last year, staff contributed 2,167 pro-bono hours.

The report also found some alignment between a firm's sector and the preference to support certain causes.

“Utilities sector may have a predisposition to environment and conversations cause areas; professional services and technology towards education; healthcare towards health; consumer staples, consumer discretionary, and financial services towards community development and support,” it said.

The lack of uniformity in the reporting of giving and community investment meant the report’s authors were reluctant to draw too many statistical comparisons.

Nonetheless, it is notable that Auckland Airport Group distributed just 0.07% of its pre-tax profits – the lowest proportion of the sampled groups.

Payroll giving, which was launched in NZ in 2010, has seen a steady increase in users, up 67% from 9,000 to 15,000 between 2015-20.

The mechanism, which allows employees to have regular donations to charities deducted from salary and a tax credit automatically applied, was used to donate just less than $7m in 2020 – an average annual donation of $457 per employee.

“Unless companies more actively promote the concept and senior management lead discussions, the amounts given will not reach the potential possible through this platform, admirable that it is,” the report noted.

Trust in us

Surveys of the public, both in NZ and globally, have recorded an upward trend in trust in business.

Globally, according to the Edelman Trust Barometer, business passed into a net positive ethical score in 2021 to +5 and then again to +14 in 2022.

And a national survey found that, in 2022, New Zealanders trusted business (61%) more than NGOs (57%) and government (57%).

At the same time, 52% worry that business leaders “are purposely trying to mislead people by saying things they know are false or gross exaggeration”.

“Today’s expectations of CEOs are not just to run a business successfully, but to be visible on societal issues that affect their employees, customers, and communities where they operate,” said Adelle Keely, chief executive at Acumen Republic, which ran the survey.

The JBWere report also noted that the impact of covid on overall NZ philanthropy was not as severe as initially feared.

“We have previously estimated that due to covid disruptions, total giving in 2020 was the same as 2019 at $3.8 billion (where there would normally be a 4.5% growth) and that total giving would fall in 2021.

It said until further sector-wide research was done, it would be hard to be definitive, but recent follow-up analysis suggested the overall loss in giving over the last two to three years, compared to where it would have been, has not been as marked.

“Relatively steady levels of grants from Lottery Grants Board, community trusts and private philanthropy have helped to cushion the fall in donations and grants fall from the public and community gaming trusts,” it said.