A lack of gas could cause energy shortages again next winter while ensuring investment in existing reserves is essential to ongoing energy security, the gas sector regulator has warned.

The Gas Industry Company (GIC) has advised energy minister Megan Woods that pressure on gas supply could ease around 2024.

However, it will require negotiations with major suppliers and users (most notably Methanex) to ensure there is the investment required to keep the gas flowing to meet New Zealand’s energy needs.

The report on gas market settings lays out a work programme to balance the transition away from gas, while still giving confidence to the sector to spend $200 million a year to develop existing gas reserves.

GIC said to do this will require “sufficient petrochemical/industrial demand remaining to support the required investment in gas development and production”.

This would be needed to ensure there was enough gas to “support electricity generation until no longer required (the current assumption is that this will be until 2030, given the government’s 100% renewable electricity target, but with some leeway to extend if required)”.

Gas would also be required to supply users who need to keep operating in NZ and have no suitable alternative energy supply, or until an alternative becomes achievable. This would include commercial, residential and agricultural operations, albeit at reduced volumes over time.

The transition away from gas will also mean “users exiting as their businesses become less viable, partly due to availability and cost of suitable energy”.

it said in the immediate future, supply of natural gas will likely be tight next winter and possibly into 2023, but investment is occurring.

"With industry coordination and continued investment and good risk management across the energy sector, gas supply should be able to be managed to meet demand in the short to medium term.”

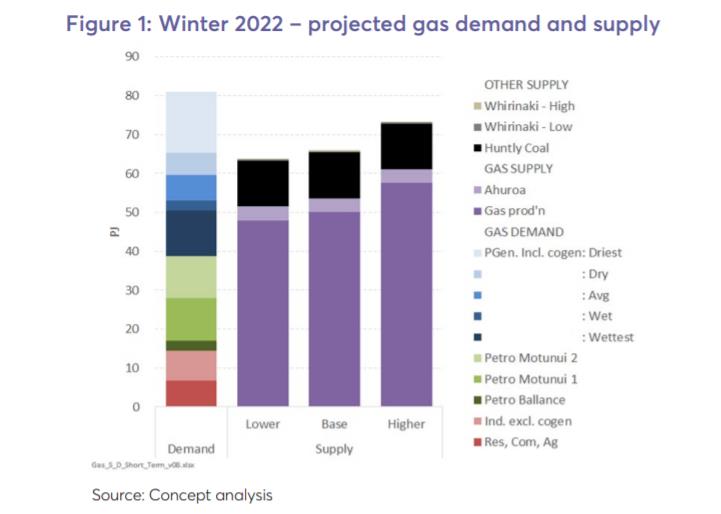

Modelling by Concept Consulting shows the potential for an energy gap similar to that experienced in late 2020/early 2021. The severity of this will be largely dependent on how much rain falls in the hydro lakes, how much gas suppliers managed to eke out of fields and whether large gas users, such as Methanex, will be willing to cut production again if its contracted gas is needed.

The need for stable and long-running agreements with major gas producers and users is emphasised by the GIC.

Its work programme said: “A critical early step will be Gas Industry Co facilitating discussions between relevant stakeholders (e.g. Methanex, Genesis, MBIE, consenting authorities, the Electricity Authority) to develop a specific understanding of the factors that will drive petrochemical businesses’ decisions about whether to remain operating in NZ as they transition to more efficient and greener production, given their critical role.”

The GIC warned this investment was by no means certain. It does not mention the ban on new offshore oil and gas exploration permits, the 100% renewable electricity target or other signals that gas has no long term future in the country.

However, the regulator notes: “We have heard that there is a higher risk hurdle for capital investment in gas production and development in NZ than has previously been the case. While investment is happening now, future capital investment is at risk and a higher risk premium is being attached to any investment to compensate.

“We consider that this leads to a real risk that insufficient investment will be committed to ensure that gas reserves and contingent resources will come to market and that security of supply for both electricity generation and major users could therefore be compromised during the transition to 2030 and beyond.”

Methanex assumption

The study assumes Methanex will stay in the country. This in turn gives gas suppliers confidence to invest in production and then agreements are reached around managing supply and demand to meet NZ’s wider energy needs.

The GIC said there are insufficient commercial arrangements for gas supply dedicated in advance for electricity security of supply during sustained dry periods.

“In 2021, participants have had to rely on last-minute contracting when it appeared a ‘dry winter’ was looming, creating unplanned demand diversion from gas users who are unable to absorb the reductions in their operations and resulting in poor overall outcomes for NZ.”

It said the much-discussed “ten years of gas in the ground” can only be recovered, delivered and eventually consumed if the ongoing investment is made. This would require on average $200m a year in investment across the Taranaki fields.

“Gas demand and supply in the period from 2025 to 2030 will be strongly influenced by decisions that are being made now. Whether gas is available for all users depends on producers’ willingness to invest in supply-side assets.”

This would need pre-contracted demand for gas because of the large financial and lengthy-time commitments involved.

“There is more confidence that tight conditions will ease by 2024, provided investment in development and production continues. This is especially in light of recent successful investments in production, and an expectation that planned work programmes at all major NZ gas fields will see more gas being brought to market. In addition, committed new renewable electricity generation projects are expected to be on stream, reducing thermal generation demand for gas.”

To get through the transition period, “it will be important to develop a universal (cross-government) understanding of the factors that will drive petrochemical businesses’ decisions about whether to remain operating in NZ, so they can play their critical role in supporting and enabling the transition”.