The founder of a fintech startup that recently announced a collaboration with Sharesies says it’s lonely being Māori in the tech sector.

Adrien Smith (Ngāpuhi), co-founder and chief product officer of BlinkPay, said he built a fintech that works within the open banking space. He spent nearly 15 years working in the United Kingdom banking sector and transformed the Barclays and Lloyds Banking Group.

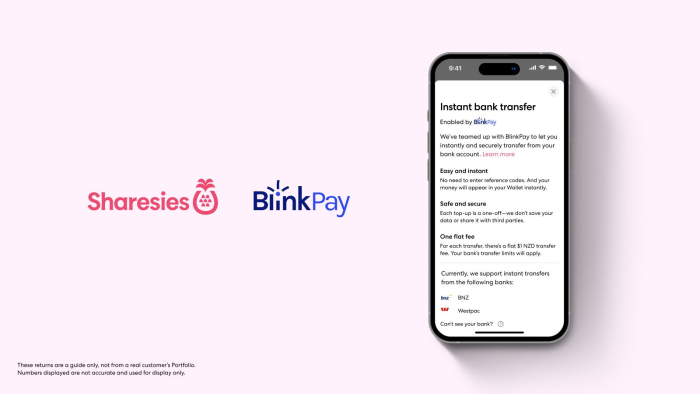

BlinkPay provides a secure way for trusted apps to interact with banks. The apps access a client’s financial information, such as account balances and transactions, using application programming interfaces (API).

Open banking has been widely debated in New Zealand, with the government pushing through changes a couple of years ago, which means open banking is set to become a tool more widely available to the public next year.

Smith has supported bringing open banking to NZ, working with Payments NZ to advise on the implementation in May.

Cultural distinctiveness

He said as a Māori business, his cultural distinctiveness sets BlinkPay apart from others. It is led by Māori values and the whakatauki (proverb) ‘he aha te mea nui o te ao? He tangata he tangata he tangata’ (What is the most important thing in the world? It is the people, it is the people, it is the people) was important to BlinkPay.

A commonly cited number is that Māori only represent 4% of the tech industry, he said.

“If this is true, then there is an argument to be made that more should be in the tech industry, and one of the challenges of having such low representation is that oftentimes you can feel quite lonely in your chosen industry.”

Smith wanted to see more Māori in tech, but there were pathways such as Ko Māui Hangarau, which is an annual summit to encourage youth to engage in the tech sector.

The programme is primarily sponsored by the Ministry of Education.

“A challenge for rangatahi Māori (Māori youth) is it is hard to see how you might succeed in something if there are few role models that you can see and identify with."

Many of the programmes “rise and fall” based on the level of financial support for them, he said.

Smith said the work with Sharesies is exciting for his business as it will empower investors to use the open banking capabilities he has developed.

It simplifies the transaction and makes it faster without the need for a card, he said, adding that he wanted to give the million-plus Sharesies users a taste of what could possibly be their first experience of open banking capabilities.

“For many Kiwis, open banking sounds like a vague concept, and we’re changing that up with this partnership.”

Sharesies built a new payment capability into its app, and Smith said BlinkPay then connected that payment capability to participating banks and back again. Currently, only the Bank of NZ (BNZ) and Westpac are compatible with BlinkPay, aside from Sharesies.

“And the really cool part is it provides a tangible example of the promise of open banking for Aotearoa," Smith said.

Although the banks in NZ have been slow to adopt open banking, he said some banks have moved quicker than others, "BNZ being chief amongst them".

Reality of open banking

However, there was a cost involved for Sharesies investors.

BlinkPay charges $0.40 per successful transaction, and Sharesies adds an additional $0.60 to make up the $1 successful transaction fee.

“It’s our hope that as Sharesies customers start to interact with this new payment capability, they will start to see what open banking looks like in reality, and then maybe we shift the conversation from trying to explain it to showing New Zealanders what it can do, and what the benefits are.”

Costings provided show card and mobile pay fees were 18c each plus 2.65%. Therefore, any amounts exceeding $31 would be cheaper with the new system.

A person topping up $20 would only pay $0.71 if using a credit card or mobile pay option.

But if someone used a credit card, Apple or Google Pay, a top-up of $100 would cost $1.83 more.

Brooke Roberts, Sharesies co-founder and co-CEO, said BlinkPay’s strength in providing security to Sharesies investors was a major reason why it chose to partner with the Māori fintech.

“That’s why we’ve teamed up with BlinkPay, doing the mahi with a local fintech player so that over half a million users on our platform can access open banking capabilities.

“We take protecting our investors’ data very seriously, and so knowing that Blinkpay doesn’t handle or retain any payments or data and offers our investors peace of mind when it comes to making their instant transfers.”