Fisher & Paykel Healthcare shares hit a two-year low as the breathing mask manufacturer said its annual revenue will fall by as much as 15%.

Shares of New Zealand’s biggest listed company fell as low as $25.34 – a drop of 9.2% – and were at $25.87, down 7.3% in early Wednesday afternoon trading on the NZX.

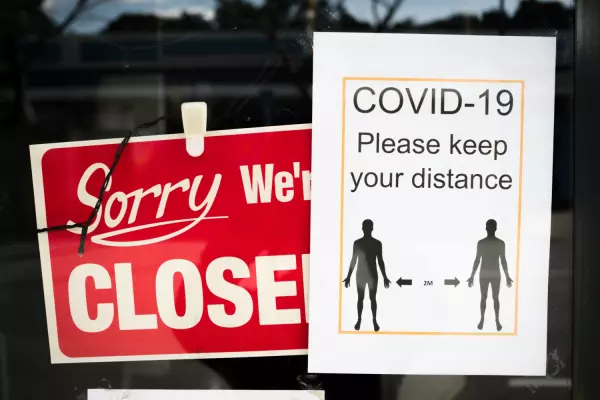

The company today said its annual revenue will be between $1.66 billion and $1.7b in the year ending March 31, down from the $1.97b reported a year earlier when the covid-19 pandemic provided a tailwind that at one point propelled its market value above $20b.

Craigs Investment Partners head of private wealth research Mark Lister said the forecast “sounded significant” but wasn’t a “showstopper” given investors already knew the manufacturer was never going to repeat last year’s result.

“Relative to last year, this year is looking like it's down 27%, but compared to where analysts' expectations were, it's only down by about 5%,” Lister said, referring to F&P Healthcare’s earnings outlook.

“It's completely unfair really, to compare the steady state of the business to this abnormally strong period,” he said.

“It's an outstanding long-term business with lots of long-term growth drivers that are still well and truly in place – I’m not losing any sleep over it.”

The company beat expectations in its first-half result, which analysts had predicted would start showing the impact of slowing demand, and it had previously warned them that sales could continue to decline as people adapted to a post-covid world.

F&P Healthcare’s steep decline weighed on the wider market, with the S&P/NZX 50 Index down almost 1% in early afternoon trading.

Today’s guidance is based on the NZ dollar remaining at its current rate, which at 69.52 US cents is higher than F&P Healthcare was projecting in its November first-half report. About half the manufacturer’s sales are in US dollars.

Craigs investment adviser Peter McIntyre said the revenue guidance provided a good steer on where F&P Healthcare’s profits were heading into the March 2023 year.

“The implication for the market is more about what this means for 2023 numbers,” he said.

“In the Northern Hemisphere, the flu season has been mild, which historically has been a key indicator of earnings for F&P Healthcare.”

McIntyre said lower respiratory interventions and hospital rates also contributed to lower revenue.

“They're still investing for the future, but they're well off their peak, which was in August 2020,” he said.

“But the market has always been prepared for this omicron cross surge of revenue to start to dissipate somewhat,” he said. “And I think this is probably what F&P Healthcare is going through now.”