“Under-valued, under-appreciated, underpaid, tired, used and fearful of what lies ahead for our profession,” is how Rachel Roth, a senior scientist at Asia Pacific Healthcare Group (APHG), feels.

During covid, Roth and her colleagues worked around the clock, doing labour-intensive PCR testing, which involves data entry, unbagging, stickering tubes, uncapping samples and then transferring them using small droppers.

“After months of this, stress levels were high and injuries were regularly occurring,” the Wellington-based scientist added. “Covid has had a profound effect on our lab.

“During this time, health and safety was not really top priority, despite being overwhelmed with samples. Micro-breaks and stretching will not suffice when you just don’t have the capacity to test what is coming in."

In October 2021, APHG gave $300 Prezzy Cards to all employees to thank them for their work over the period.

For the 12 months to December 2021, APHG paid its owners – a Canadian pension fund and NZ Super – a $40 million dividend.

At APHG, workers were not given the same benefits as DHB-owned labs in relation to covid leave, with head of human resources Linda Hart telling unions it was its right to do so as a private business.

Roth said six of her team left after the covid experience. The NZ Institute of Medical Laboratory Science (NZIMLS) estimates 5% of the entire lab-testing workforce left after covid.

APHG also returned share capital to its owners, although the amount is not clear from financial statements. Profit after tax for the period was $40.35m.

“A $40m payout to shareholders shows what a good position it is in, due in no small part to the money it made over covid. Pity the financial gain does not flow on to the people actually providing the service,” Roth said.

But APHG head of business development Trevor English told BusinessDesk he thought the pandemic was well-handled.

“I don’t think too many people have too much to grizzle about in that space. We don’t get it 100% right for 100% of people but I think you’ll find DHB labs had it as bad if not the same as us."

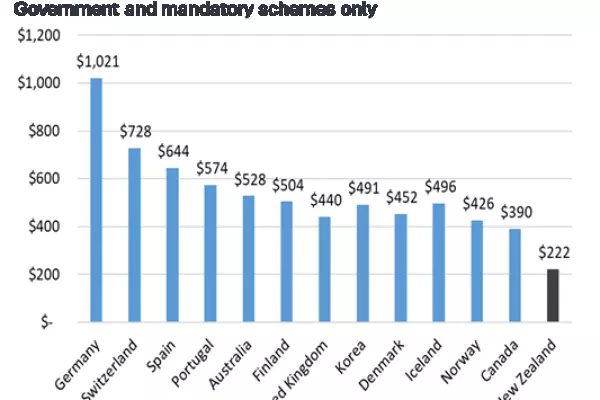

Roth is one of 3,660 regulated workers across the motu who help undertake 200,000 lab tests nationwide a day, funded by about $800m per year allocated for public diagnostic services.

The NZIMLS estimates an extra $250-300m was allocated for testing during the pandemic.

APHG has 25 laboratories and 125 testing centres nationwide – including Labtests and Southern Community Laboratories (SCL). It operates 75% of the community testing market, meaning referrals from GPs as opposed to hospitals.

Health minister Andrew Little notes pathology is one sector “that’s done very well with covid".

“I’d be disappointed if their pay and conditions haven’t improved somewhat during those times because they’ve generated huge amounts of revenue from all the testing.”

Financial benefits

Part of APHG’s revenue boost came from a controversial saliva testing contract awarded by the government in May 2021. The auditor-general was heavily critical of the process to award what it described as a $50m contract.

English said the process was “a bit ugly” but added that “there were some numbers being bandied about for what it was worth, but the ministry figures were a bit dodgy, or a lot dodgy on the volumes".

He wouldn’t say how much the contract was worth but said while the government might have set aside $50m for it, APHG only received “a fraction” of that.

Asked about the payout to shareholders, English said: “We are a commercial business, and we need to do that.

"I think we do invest a lot in the business... it’s not as obvious as we’d like it to be.”

The $40m dividend is the first under new owners the Ontario Teacher’s Pension Plan (OTPP) and NZ Super Fund. The company did not pay a dividend in 2020 but paid $55m in both 2018 and 2019 to its previous owner, Australian-listed Healthscope.

Private market

APHG is not the only privately held provider of laboratory services.

The second-largest lab services provider in NZ is Pathlab.

It is owned by pathologists and does not report publicly. However, figures obtained under the Official Information Act show it has a Waikato DHB contract worth $108.1m over five years, or $21.62m per year, and a 17-year Bay of Plenty contract worth $28 million, or $1.64m per year. It also has a smaller Lakes contract but the details of that were unavailable at press time.

The third-largest player in NZ is ASX-listed Sonic Healthcare, which is headquartered in Palmerston North with 250 staff based in three public hospitals.

The locally filed accounts show the company generated $30.7m in revenue in the 12 months ended June 30, 2021, up 15% over five years.

Profit was up from $3m to $4m over the same period, while the company has paid between $4-7m in dividends back to its parent each year since 2017.

The company did not see a dramatic increase in revenue or profit due to covid. In fact, revenue fell from $32.9m to $30.6m while profit dropped from $5m to $4m.

Medlab chief executive Cynric Temple-Camp said the laboratory business was already a “lean and responsive” business and cost efficiencies could only really be made by improving the technology used to deliver results.

Despite being the third-biggest pathology provider in the market, Sonic Healthcare has said it does not wish to grow in NZ.

How we got here – a short history

APHG’s virtual monopoly is thanks to its previous owner’s big appetite for expansion.

Healthscope – which also purchased radiology firms – started by purchasing 11 labs across Otago, Canterbury, Hawke’s Bay and Lakes District in 2007.

It would then make acquisitions across the country, including the major Auckland provider Labtests and SCL Southland.

By 2012, Sonic Healthcare said it had taken a “battering” in recent years as it failed with tenders for DHBs in Auckland, Hawke’s Bay, Canterbury and the southern South Island.

At that point, it decided to sell its Christchurch business to APHG, after its lab was ruined in the Canterbury earthquake and it lost the Canterbury DHB contract. It told the Commerce Commission it wasn’t going to tender for the Nelson Marlborough or South Canterbury DHB contracts in 2016 and would make staff redundant if it didn’t sell to APHG.

Expansion plans

According to NZ Super and Ontario Teachers' Pension Plan Board’s application to the Overseas Investment Office to buy the network of labs, APHG had suffered from being a smaller business unit inside the larger hospital company Healthscope and didn’t have capital available to grow.

The consortium, which also included investment fund Te Pūia Tāpapa, paid $550m for the company.

OTPP and NZ Super Fund said the target had “ambitions to grow” and “develop tangential service offerings".

English said APHG would soon rebrand, and that the company was looking at innovations.

For example, it had just rolled out patient booking in the South Island, enabling people to book appointments for samples online. It has also introduced NZ’s first non-invasive prenatal testing technology that uses whole-genome sequencing, enabling screening for rare diseases.

It also bought rival testing firm Rako Science, for an undisclosed sum.

Despite this, representatives for lab workers' unions say they want more reinvestment into the workforce.

NZ Institute of Medical Laboratory Science president Terry Taylor is eyeing the change to the centralised Te Whatu Ora as a way to get better conditions into contracts.

“Professional development funding disparities can be fixed overnight with a mandate that a percentage of the current operational laboratory contracts must be ring-fenced for solely external professional development activities," he said.

"Any internal funding should come from the laboratory provider."

Roth said the message she wants to get across is that "it is time for APHG to make their staff, not their shareholders, a priority".